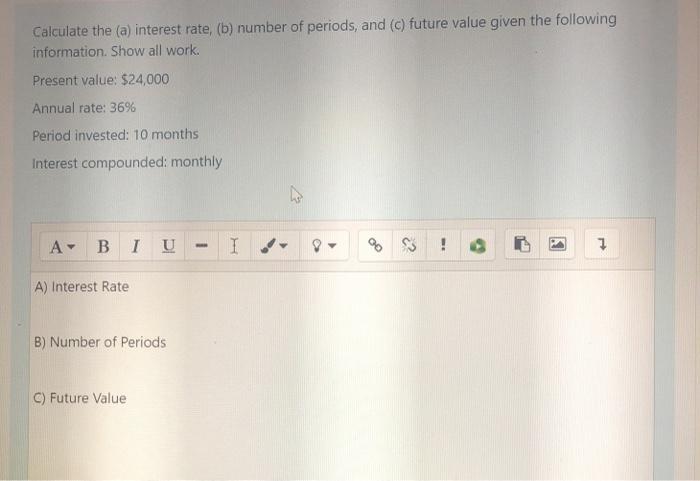

Walt Disney Company plans to make four annual deposits of $6,250 each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at 12% on the fund's balance. Determine how much will be accumulated in the fund on December 31, 2024 after four years, under each of the following situations. Show all work. Situation 1: The first $6,250 annual deposit is made at the end of each of the four years on December 31, 2021, and interest is compounded annually. Situation 2: The first $6,250 annual deposiris made at the beginning of each of the four years on December 31, 2020, and interest is compounded annually. Situation 3: The first $6,250 annual deposit is made at the beginning of each of the four years on December 31, 2020, interest is compounded annually, and interest earned is withdrawn at the end of each year. A B I U I ! Situation 1 Assuming a 12% annual interest rate, determine the present value of a five-period annual annuity of $6,800 under each of the following situations. Show all work. Situation 1: The first payment is received at the end of the first year, and interest is compounded annually. Situation 2: The first payment is received at the beginning of the first year, and interest is compounded annually. A B I U I ! Situation 1 On March 1, 2021, Walt Disney receives $150,000 from a local bank and promises to deliver 95 units of certified 1-oz. gold bars on a future date. The contract states that ownership passes to the bank when Walt Disney delivers the products to a third-party carrier. In addition, Walt Disney has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold bar is $1,520 per unit, and Walt Disney estimates the stand-alone price of the replacement insurance service to be $80 per unit. The third-party carrier picked up the gold bars from Disney on March 30, and delivery to the bank occurred on April 1. Prepare the journal entry for March 1. Show your work. A - BI U I I ! 7 March 1 Walt Disney Company operates a downhill ski area near Lake Tahoe, California. An all-day adult lift ticket can be purchased for $90. Adult customers also can purchase a season pass that entitles the pass holder to ski any day during the season, which typically runs from December 1 through April 30. Walt Disney expects its season pass holders to use their passes equally throughout the season. The company's fiscal year ends on December 31. On November 6, 2021, John Smith purchased a season pass for $475. Prepare the appropriate journal entries that Walt Disney would record on November 6 and December 31. on " 1 U 1 % 7 November 6 December 31 Calculate the (a) interest rate, (b) number of periods, and (c) future value given the following information. Show all work. Present value: $24,000 Annual rate: 36% Period invested: 10 months Interest compounded: monthly ? - A B I U I ! 1 A) Interest Rate B) Number of Periods C) Future Value