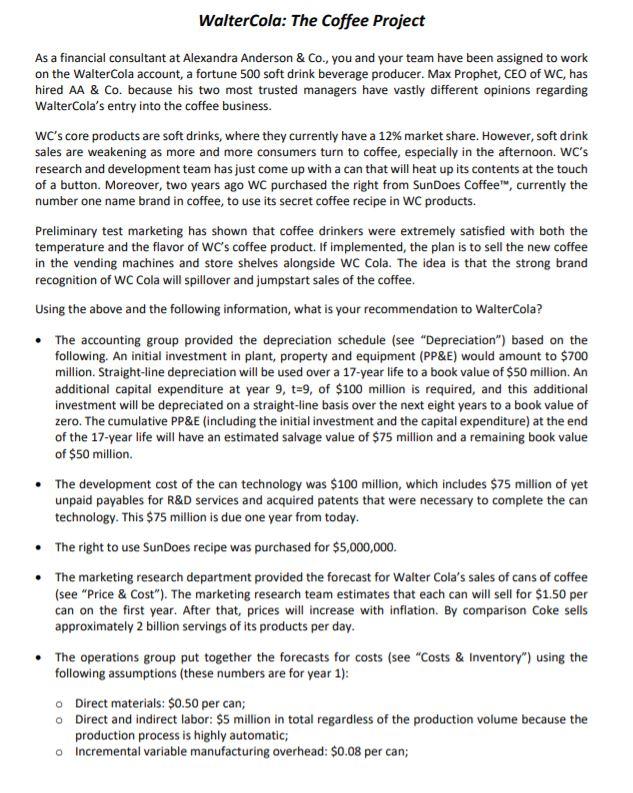

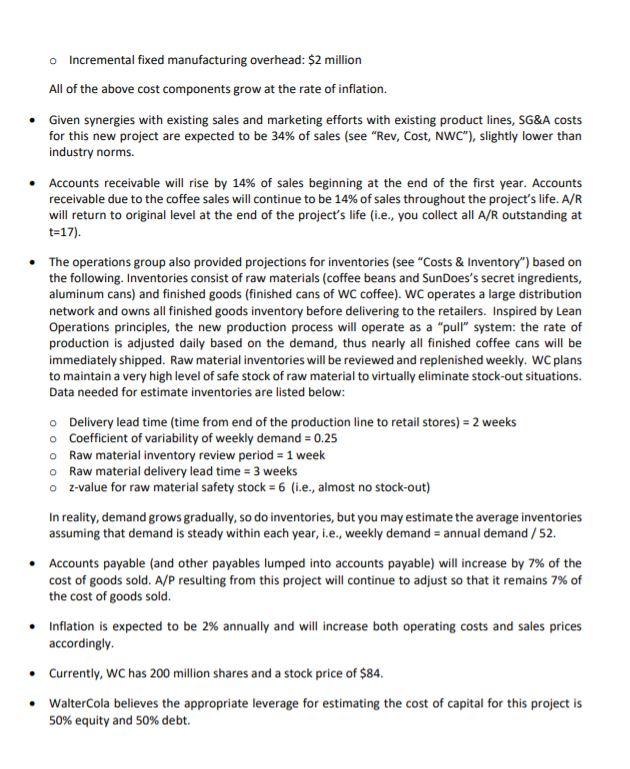

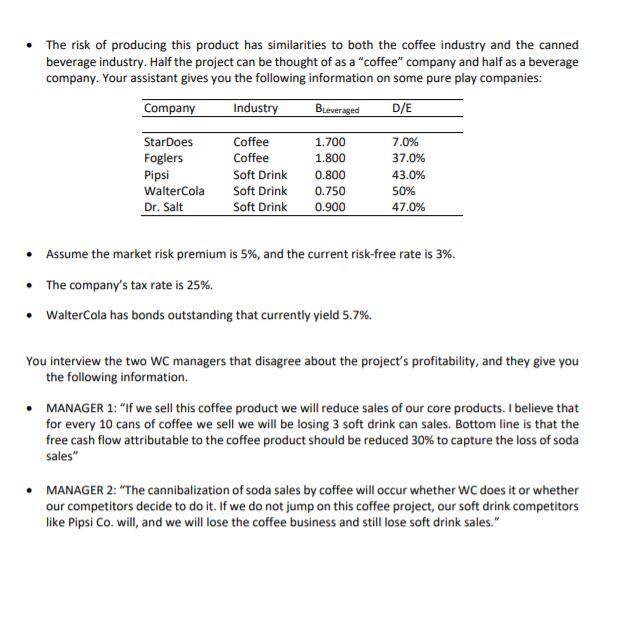

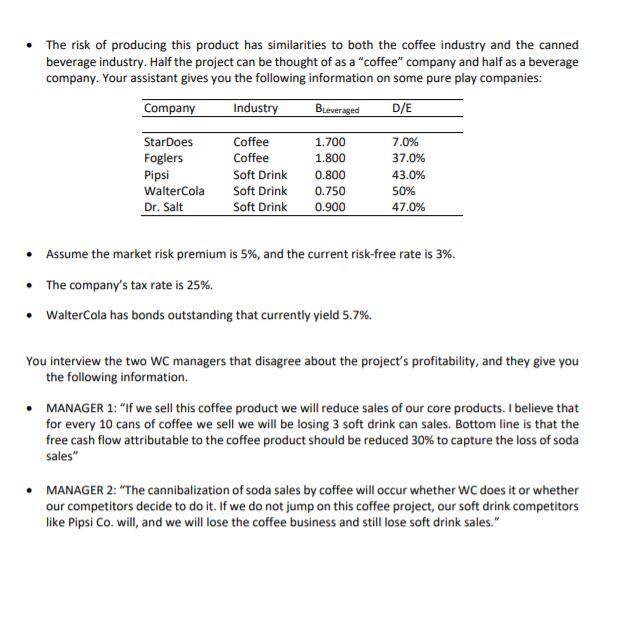

WalterCola: The Coffee Project As a financial consultant at Alexandra Anderson & Co., you and your team have been assigned to work on the WalterCola account, a fortune 500 soft drink beverage producer. Max Prophet, CEO of WC, has hired AA & Co. because his two most trusted managers have vastly different opinions regarding WalterCola's entry into the coffee business. WC's core products are soft drinks, where they currently have a 12% market share. However, soft drink sales are weakening as more and more consumers turn to coffee, especially in the afternoon. WC's research and development team has just come up with a can that will heat up its contents at the touch of a button. Moreover, two years ago WC purchased the right from SunDoes Coffee, currently the number one name brand in coffee, to use its secret coffee recipe in WC products. Preliminary test marketing has shown that coffee drinkers were extremely satisfied with both the temperature and the flavor of WC's coffee product. If implemented, the plan is to sell the new coffee in the vending machines and store shelves alongside WC Cola. The idea is that the strong brand recognition of WC Cola will spillover and jumpstart sales of the coffee. Using the above and the following information, what is your recommendation to WalterCola? The accounting group provided the depreciation schedule (see "Depreciation") based on the following. An initial investment in plant, property and equipment (PP&E) would amount to $700 million. Straight-line depreciation will be used over a 17-year life to a book value of $50 million. An additional capital expenditure at year 9, t=9, of $100 million is required, and this additional investment will be depreciated on a straight-line basis over the next eight years to a book value of zero. The cumulative PP&E (including the initial investment and the capital expenditure) at the end of the 17-year life will have an estimated salvage value of $75 million and a remaining book value of $50 million The development cost of the can technology was $100 million, which includes $75 million of yet unpaid payables for R&D services and acquired patents that were necessary to complete the can technology. This $75 million is due one year from today. The right to use SunDoes recipe was purchased for $5,000,000 The marketing research department provided the forecast for Walter Cola's sales of cans of coffee (see "Price & Cost"). The marketing research team estimates that each can will sell for $1.50 per can on the first year. After that, prices will increase with inflation. By comparison Coke sells approximately 2 billion servings of its products per day. The operations group put together the forecasts for costs (see "Costs & Inventory") using the following assumptions (these numbers are for year 1): O Direct materials: $0.50 per can; Direct and indirect labor: $5 million in total regardless of the production volume because the production process is highly automatic; o Incremental variable manufacturing overhead: $0.08 per can; o Incremental fixed manufacturing overhead: $2 million All of the above cost components grow at the rate of inflation. Given synergies with existing sales and marketing efforts with existing product lines, SG&A costs for this new project are expected to be 34% of sales (see "Rev, Cost, NWC"), slightly lower than industry norms. Accounts receivable will rise by 14% of sales beginning at the end of the first year. Accounts receivable due to the coffee sales will continue to be 14% of sales throughout the project's life. A/R will return to original level at the end of the project's life (i.e., you collect all A/R outstanding at t=17). The operations group also provided projections for inventories (see "Costs & Inventory") based on the following. Inventories consist of raw materials (coffee beans and SunDoes's secret ingredients, aluminum cans) and finished goods (finished cans of WC coffee). WC operates a large distribution network and owns all finished goods inventory before delivering to the retailers. Inspired by Lean Operations principles, the new production process will operate as a "pull" system: the rate of production is adjusted daily based on the demand, thus nearly all finished coffee cans will be immediately shipped. Raw material inventories will be reviewed and replenished weekly. WC plans to maintain a very high level of safe stock of raw material to virtually eliminate stock-out situations. Data needed for estimate inventories are listed below: o Delivery lead time (time from end of the production line to retail stores) = 2 weeks o Coefficient of variability of weekly demand = 0.25 o Raw material inventory review period = 1 week o Raw material delivery lead time = 3 weeks Oz-value for raw material safety stock = 6 (i.e., almost no stock-out) In reality, demand grows gradually, so do inventories, but you may estimate the average inventories assuming that demand is steady within each year, i.e., weekly demand = annual demand/52. Accounts payable (and other payables lumped into accounts payable) will increase by 7% of the cost of goods sold. A/P resulting from this project will continue to adjust so that it remains 7% of the cost of goods sold. Inflation is expected to be 2% annually and will increase both operating costs and sales prices accordingly Currently, WC has 200 million shares and a stock price of $84. WalterCola believes the appropriate leverage for estimating the cost of capital for this project is 50% equity and 50% debt. The risk of producing this product has similarities to both the coffee industry and the canned beverage industry. Half the project can be thought of as a "coffee" company and half as a beverage company. Your assistant gives you the following information on some pure play companies: Company Industry Bleveraged D/E 1.700 1.800 StarDoes Foglers Pipsi WalterCola Dr. Salt Coffee Coffee Soft Drink Soft Drink Soft Drink 0.800 0.750 0.900 7.0% 37.0% 43.0% 50% 47.0% Assume the market risk premium is 5%, and the current risk-free rate is 3%. The company's tax rate is 25%. WalterCola has bonds outstanding that currently yield 5.7%. You interview the two WC managers that disagree about the project's profitability, and they give you the following information. MANAGER 1: "If we sell this coffee product we will reduce sales of our core products. I believe that for every 10 cans of coffee we sell we will be losing 3 soft drink can sales. Bottom line is that the free cash flow attributable to the coffee product should be reduced 30% to capture the loss of soda sales" MANAGER 2: "The cannibalization of soda sales by coffee will occur whether WC does it or whether our competitors decide to do it. If we do not jump on this coffee project, our soft drink competitors like Pipsi Co. will, and we will lose the coffee business and still lose soft drink sales." WalterCola: The Coffee Project As a financial consultant at Alexandra Anderson & Co., you and your team have been assigned to work on the WalterCola account, a fortune 500 soft drink beverage producer. Max Prophet, CEO of WC, has hired AA & Co. because his two most trusted managers have vastly different opinions regarding WalterCola's entry into the coffee business. WC's core products are soft drinks, where they currently have a 12% market share. However, soft drink sales are weakening as more and more consumers turn to coffee, especially in the afternoon. WC's research and development team has just come up with a can that will heat up its contents at the touch of a button. Moreover, two years ago WC purchased the right from SunDoes Coffee, currently the number one name brand in coffee, to use its secret coffee recipe in WC products. Preliminary test marketing has shown that coffee drinkers were extremely satisfied with both the temperature and the flavor of WC's coffee product. If implemented, the plan is to sell the new coffee in the vending machines and store shelves alongside WC Cola. The idea is that the strong brand recognition of WC Cola will spillover and jumpstart sales of the coffee. Using the above and the following information, what is your recommendation to WalterCola? The accounting group provided the depreciation schedule (see "Depreciation") based on the following. An initial investment in plant, property and equipment (PP&E) would amount to $700 million. Straight-line depreciation will be used over a 17-year life to a book value of $50 million. An additional capital expenditure at year 9, t=9, of $100 million is required, and this additional investment will be depreciated on a straight-line basis over the next eight years to a book value of zero. The cumulative PP&E (including the initial investment and the capital expenditure) at the end of the 17-year life will have an estimated salvage value of $75 million and a remaining book value of $50 million The development cost of the can technology was $100 million, which includes $75 million of yet unpaid payables for R&D services and acquired patents that were necessary to complete the can technology. This $75 million is due one year from today. The right to use SunDoes recipe was purchased for $5,000,000 The marketing research department provided the forecast for Walter Cola's sales of cans of coffee (see "Price & Cost"). The marketing research team estimates that each can will sell for $1.50 per can on the first year. After that, prices will increase with inflation. By comparison Coke sells approximately 2 billion servings of its products per day. The operations group put together the forecasts for costs (see "Costs & Inventory") using the following assumptions (these numbers are for year 1): O Direct materials: $0.50 per can; Direct and indirect labor: $5 million in total regardless of the production volume because the production process is highly automatic; o Incremental variable manufacturing overhead: $0.08 per can; o Incremental fixed manufacturing overhead: $2 million All of the above cost components grow at the rate of inflation. Given synergies with existing sales and marketing efforts with existing product lines, SG&A costs for this new project are expected to be 34% of sales (see "Rev, Cost, NWC"), slightly lower than industry norms. Accounts receivable will rise by 14% of sales beginning at the end of the first year. Accounts receivable due to the coffee sales will continue to be 14% of sales throughout the project's life. A/R will return to original level at the end of the project's life (i.e., you collect all A/R outstanding at t=17). The operations group also provided projections for inventories (see "Costs & Inventory") based on the following. Inventories consist of raw materials (coffee beans and SunDoes's secret ingredients, aluminum cans) and finished goods (finished cans of WC coffee). WC operates a large distribution network and owns all finished goods inventory before delivering to the retailers. Inspired by Lean Operations principles, the new production process will operate as a "pull" system: the rate of production is adjusted daily based on the demand, thus nearly all finished coffee cans will be immediately shipped. Raw material inventories will be reviewed and replenished weekly. WC plans to maintain a very high level of safe stock of raw material to virtually eliminate stock-out situations. Data needed for estimate inventories are listed below: o Delivery lead time (time from end of the production line to retail stores) = 2 weeks o Coefficient of variability of weekly demand = 0.25 o Raw material inventory review period = 1 week o Raw material delivery lead time = 3 weeks Oz-value for raw material safety stock = 6 (i.e., almost no stock-out) In reality, demand grows gradually, so do inventories, but you may estimate the average inventories assuming that demand is steady within each year, i.e., weekly demand = annual demand/52. Accounts payable (and other payables lumped into accounts payable) will increase by 7% of the cost of goods sold. A/P resulting from this project will continue to adjust so that it remains 7% of the cost of goods sold. Inflation is expected to be 2% annually and will increase both operating costs and sales prices accordingly Currently, WC has 200 million shares and a stock price of $84. WalterCola believes the appropriate leverage for estimating the cost of capital for this project is 50% equity and 50% debt. The risk of producing this product has similarities to both the coffee industry and the canned beverage industry. Half the project can be thought of as a "coffee" company and half as a beverage company. Your assistant gives you the following information on some pure play companies: Company Industry Bleveraged D/E 1.700 1.800 StarDoes Foglers Pipsi WalterCola Dr. Salt Coffee Coffee Soft Drink Soft Drink Soft Drink 0.800 0.750 0.900 7.0% 37.0% 43.0% 50% 47.0% Assume the market risk premium is 5%, and the current risk-free rate is 3%. The company's tax rate is 25%. WalterCola has bonds outstanding that currently yield 5.7%. You interview the two WC managers that disagree about the project's profitability, and they give you the following information. MANAGER 1: "If we sell this coffee product we will reduce sales of our core products. I believe that for every 10 cans of coffee we sell we will be losing 3 soft drink can sales. Bottom line is that the free cash flow attributable to the coffee product should be reduced 30% to capture the loss of soda sales" MANAGER 2: "The cannibalization of soda sales by coffee will occur whether WC does it or whether our competitors decide to do it. If we do not jump on this coffee project, our soft drink competitors like Pipsi Co. will, and we will lose the coffee business and still lose soft drink sales