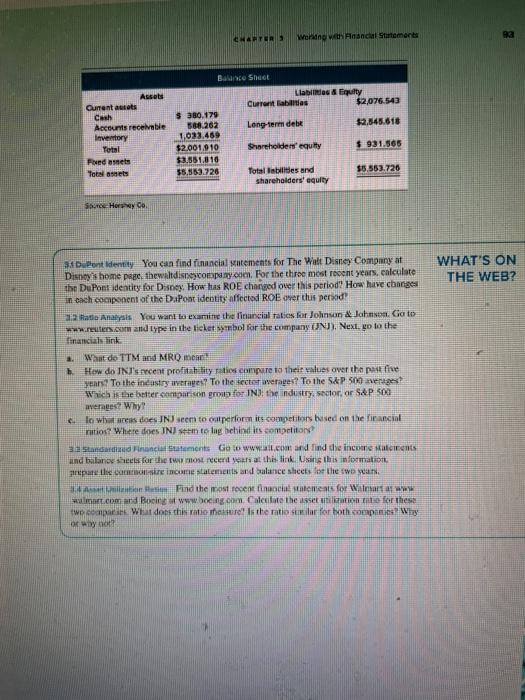

WALTERS Worang warnancial Statements Assets Qurrent autets Cash Accounts receivable Inventory Yotal Fixed assets Torslanets BOSHO Llables & Equity Curabilities $2,076,543 $ 380.179 568.262 Long-term debe $2.545.618 1,033.469 $2.001.910 Shareholder'equity $ 931.565 $3.581.810 $5.863.726 Totalities and $5.553.726 shareholders' equity Sauce Hero WHAT'S ON THE WEB? DuPont identity You can find financial itements for The Walt Disney Company at Disney's home page. thewaldisneycompany.com. For the three most recent years, enlculate the DuPont identity for Disney. How has ROE changed over this period? How have changes in each component of the DaPoat identity affected ROE over this period Ratio Analysis You want to examine the financial aties for Johnson & Johnson. Go to www.reuters.com and type in the ticket symbol for the company N), Next, go to the Tinancials link What do TTM and MRO h. How do INI's recent profitability to compare to their values over the past five sears? To the industry etagesTo the sector averates? To the S&P 500 nengest Which is the better comparison gra for INIthe industry sector or S&P 500 werages? Why? e lowess does INI seem to caterform its competitors based on the ancial ratios? Where does INI seem to lag behind its competitors standarditatements Geo www.oad lind de income atients and balance sheets for the two cents at this link. Using this information prepare the care income statements and balance sheets for the woman e Find the most recent finalements for Wow memand Boeing www.bong.com Caleate the asset milion for these we compat Wat does this ratione is the ratio sila for both copy of wo WALTERS Worang warnancial Statements Assets Qurrent autets Cash Accounts receivable Inventory Yotal Fixed assets Torslanets BOSHO Llables & Equity Curabilities $2,076,543 $ 380.179 568.262 Long-term debe $2.545.618 1,033.469 $2.001.910 Shareholder'equity $ 931.565 $3.581.810 $5.863.726 Totalities and $5.553.726 shareholders' equity Sauce Hero WHAT'S ON THE WEB? DuPont identity You can find financial itements for The Walt Disney Company at Disney's home page. thewaldisneycompany.com. For the three most recent years, enlculate the DuPont identity for Disney. How has ROE changed over this period? How have changes in each component of the DaPoat identity affected ROE over this period Ratio Analysis You want to examine the financial aties for Johnson & Johnson. Go to www.reuters.com and type in the ticket symbol for the company N), Next, go to the Tinancials link What do TTM and MRO h. How do INI's recent profitability to compare to their values over the past five sears? To the industry etagesTo the sector averates? To the S&P 500 nengest Which is the better comparison gra for INIthe industry sector or S&P 500 werages? Why? e lowess does INI seem to caterform its competitors based on the ancial ratios? Where does INI seem to lag behind its competitors standarditatements Geo www.oad lind de income atients and balance sheets for the two cents at this link. Using this information prepare the care income statements and balance sheets for the woman e Find the most recent finalements for Wow memand Boeing www.bong.com Caleate the asset milion for these we compat Wat does this ratione is the ratio sila for both copy of wo