Question

Walton Modems, Inc. makes modem cards that are used in notebook computers. The company completed the following transactions during 2017. All purchases and sales were

Walton Modems, Inc. makes modem cards that are used in notebook computers. The company completed the following transactions during 2017. All purchases and sales were made with cash.

1) Acquired $840,000 of cash from the owners.

2) Purchased $450,000 of manufacturing equipment. The equipment has a $40,000 salvage value and a four-year useful life. Label the purchase of the equipment as Event 2a and the recognition of depreciation as Event 2b.

3) The company started and completed 7,000 modems. Direct materials purchased and used amounted to $58 per unit.

4) Direct labor costs amounted to $43 per unit.

5) The cost of manufacturing supplies used amounted to $8 per unit.

6) The company paid $68,000 to rent the manufacturing facility.

7) Magnificent sold all 7,000 units at a cash price of $210 per unit. (Hint: It will be necessary to determine the manufacturing costs in order to record the cost of goods sold.)

8) The sales staff was paid a $7 per unit sales commission.

9) Paid $57,000 to purchase equipment for administrative offices. The equipment was expected to have a $4,800 salvage value and a three-year useful life. Label the purchase of the equipment as Event 9a and the recognition of depreciation as Event 9b.

10) Administrative expenses consisting of office rental and salaries amounted to $74,650.

Required

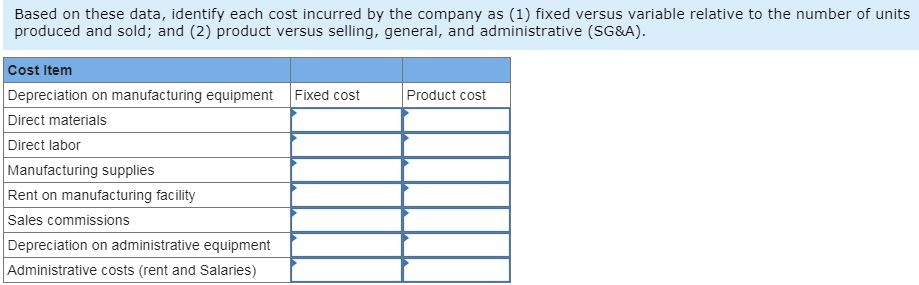

a) Based on these data, identify each cost incurred by the company as (1) fixed versus variable relative to the number of units produced and sold; and (2) product versus selling, general, and administrative (SG&A). The solution for the first item is shown as an example.

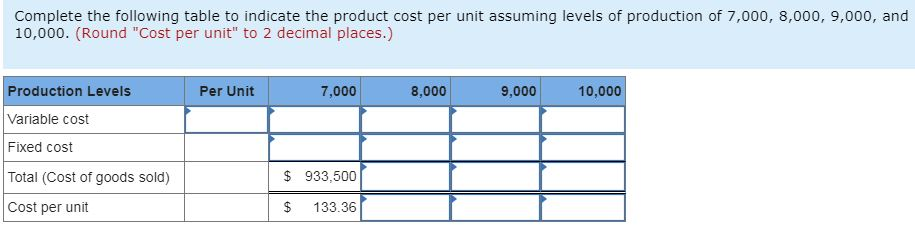

b) Complete the question marks in the following table to indicate the product cost per unit assuming levels of production of 7,000, 8,000, 9,000, and 10,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started