Answered step by step

Verified Expert Solution

Question

1 Approved Answer

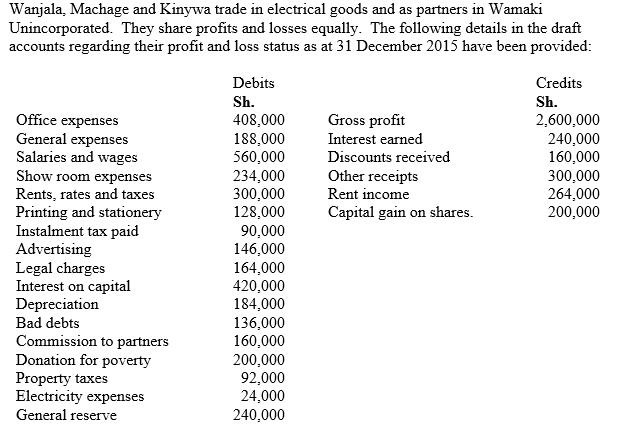

Wanjala, Machage and Kinywa trade in electrical goods and as partners in Wamaki Unincorporated. They share profits and losses equally. The following details in

Wanjala, Machage and Kinywa trade in electrical goods and as partners in Wamaki Unincorporated. They share profits and losses equally. The following details in the draft accounts regarding their profit and loss status as at 31 December 2015 have been provided: Office expenses General expenses Salaries and wages Show room expenses Rents, rates and taxes Printing and stationery Instalment tax paid Advertising Legal charges Interest on capital Depreciation Bad debts Commission to partners Donation for poverty Property taxes Electricity expenses General reserve Debits Sh. 408,000 188,000 560,000 234,000 300,000 128,000 90,000 146,000 164,000 420,000 184,000 136,000 160,000 200,000 92,000 24,000 240,000 Gross profit Interest earned Discounts received Other receipts Rent income Capital gain on shares. Credits Sh. 2,600,000 240,000 160,000 300,000 264,000 200,000 The partners provided additional information as follows: Closing stock had been understated by Sh.30,000 as at 31 December 2015. Wanjala was paid Sh.100,000 as salary (included in salaries and wages) and PAYE Sh.31,000 was paid on it. The firm was fined Sh.30,000 for breach of regulations. This is included in legal charges. Interest on capital was Sh.160,000 to Wanjala, Sh.120,000 to Machage and sh.140,000 to Kinywa. 1. 2. 3. 4. 5. 6. Commission to partners include sh.90,000 to Wanjala and the balance to Kinywa. Capital allowances had been agreed at sh.1,800,000 with the tax authorities. Required: (b) Compute the total income (loss) from the partnership business. Show allocation of profit/loss among partners. How is the profit/loss of each partner to be treated for tax purposes? Specify five matters you are likely to question on the above accounts and state why.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of total income loss from the partnership business Debits Credits Sh Sh Office expenses 408000 Gross profit 2600000 General expenses 188...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started