Answered step by step

Verified Expert Solution

Question

1 Approved Answer

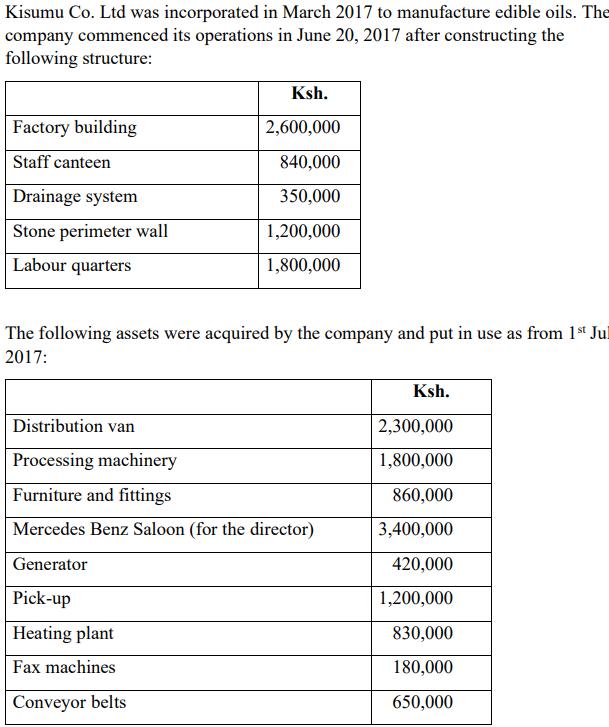

Kisumu Co. Ltd was incorporated in March 2017 to manufacture edible oils. The company commenced its operations in June 20, 2017 after constructing the

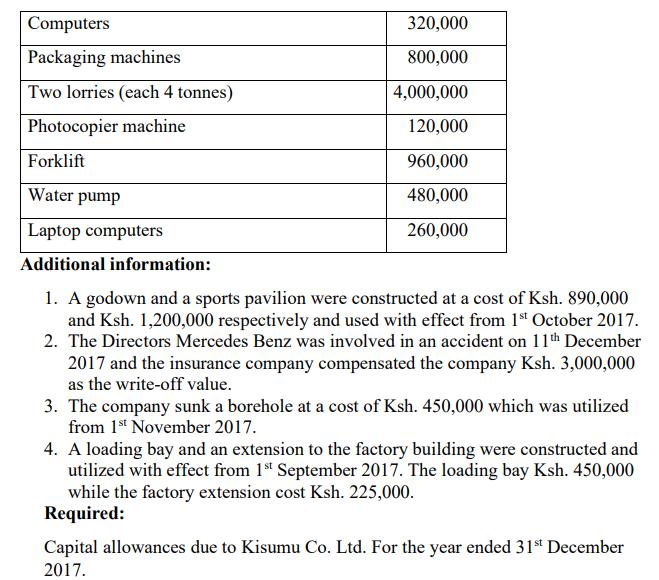

Kisumu Co. Ltd was incorporated in March 2017 to manufacture edible oils. The company commenced its operations in June 20, 2017 after constructing the following structure: Factory building Staff canteen Drainage system Stone perimeter wall Labour quarters Ksh. 2,600,000 840,000 350,000 1,200,000 1,800,000 The following assets were acquired by the company and put in use as from 1st Jul 2017: Distribution van ocessing machinery Furniture and fittings Mercedes Benz Saloon (for the director) Generator Pick-up Heating plant Fax machines Conveyor belts Ksh. 2,300,000 1,800,000 860,000 3,400,000 420,000 1,200,000 830,000 180,000 650,000 Computers Packaging machines Two lorries (each 4 tonnes) Photocopier machine Forklift Water pump Laptop computers Additional information: 320,000 800,000 4,000,000 120,000 960,000 480,000 260,000 1. A godown and a sports pavilion were constructed at a cost of Ksh. 890,000 and Ksh. 1,200,000 respectively and used with effect from 1st October 2017. 2. The Directors Mercedes Benz was involved in an accident on 11th December 2017 and the insurance company compensated the company Ksh. 3,000,000 as the write-off value. 3. The company sunk a borehole at a cost of Ksh. 450,000 which was utilized from 1st November 2017. 4. A loading bay and an extension to the factory building were constructed and utilized with effect from 1st September 2017. The loading bay Ksh. 450,000 while the factory extension cost Ksh. 225,000. Required: Capital allowances due to Kisumu Co. Ltd. For the year ended 31st December 2017.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the capital allowances due to Kisumu Co Ltd for the year ended 31st December 2017 we need to determine the type of asset the date of acqu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started