Answered step by step

Verified Expert Solution

Question

1 Approved Answer

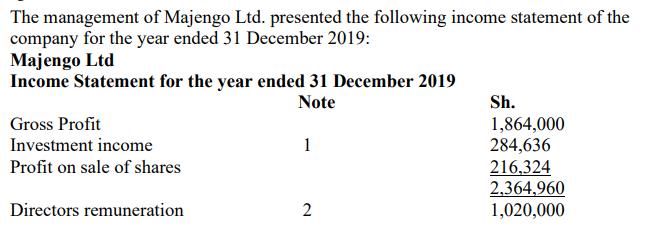

The management of Majengo Ltd. presented the following income statement of the company for the year ended 31 December 2019: Majengo Ltd Income Statement

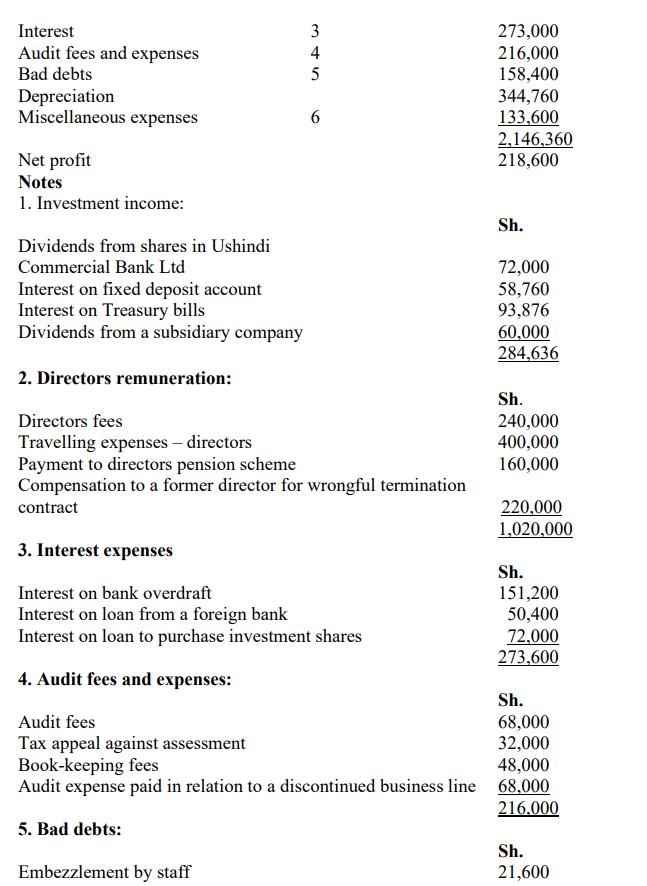

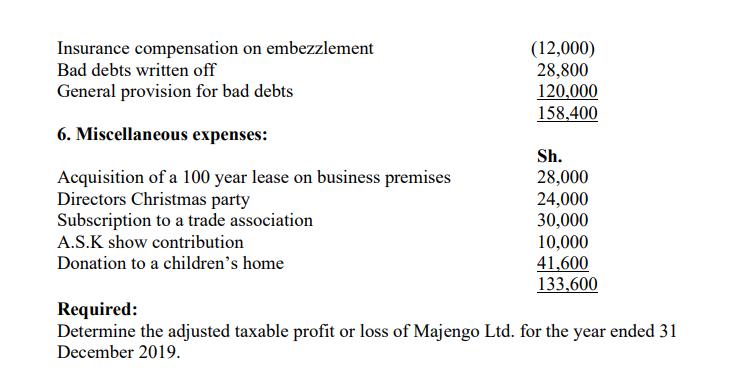

The management of Majengo Ltd. presented the following income statement of the company for the year ended 31 December 2019: Majengo Ltd Income Statement for the year ended 31 December 2019 Note Gross Profit Investment income Profit on sale of shares Directors remuneration 1 2 Sh. 1,864,000 284,636 216,324 2,364,960 1,020,000 Interest Audit fees and expenses Bad debts Depreciation Miscellaneous expenses Net profit Notes 1. Investment income: Dividends from shares in Ushindi Commercial Bank Ltd Interest on fixed deposit account Interest on Treasury bills Dividends from a subsidiary company 2. Directors remuneration: 345 3 4 Embezzlement by staff 5 6 Directors fees Travelling expenses - directors Payment to directors pension scheme Compensation to a former director for wrongful termination contract 3. Interest expenses Interest on bank overdraft Interest on loan from a foreign bank Interest on loan to purchase investment shares 4. Audit fees and expenses: 273,000 216,000 158,400 344,760 133,600 2,146,360 218,600 Sh. 72,000 58,760 93,876 60,000 284,636 Sh. 240,000 400,000 160,000 220,000 1,020,000 Sh. 151,200 50,400 72,000 273,600 Sh. Audit fees 68,000 Tax appeal against assessment 32,000 Book-keeping fees 48,000 Audit expense paid in relation to a discontinued business line 68,000 216,000 5. Bad debts: Sh. 21,600 Insurance compensation on embezzlement Bad debts written off General provision for bad debts 6. Miscellaneous expenses: Acquisition of a 100 year lease on business premises Directors Christmas party Subscription to a trade association A.S.K show contribution Donation to a children's home (12,000) 28,800 120,000 158,400 Sh. 28,000 24,000 30,000 10,000 41,600 133,600 Required: Determine the adjusted taxable profit or loss of Majengo Ltd. for the year ended 31 December 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the adjusted taxable profit or loss of Majengo Ltd we need to make adjustments for nond...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started