Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wan's AGI last year was $266,000. Her Federal income tax came to $79,800, paid through both withholding and estimated payments. This year, her AGI

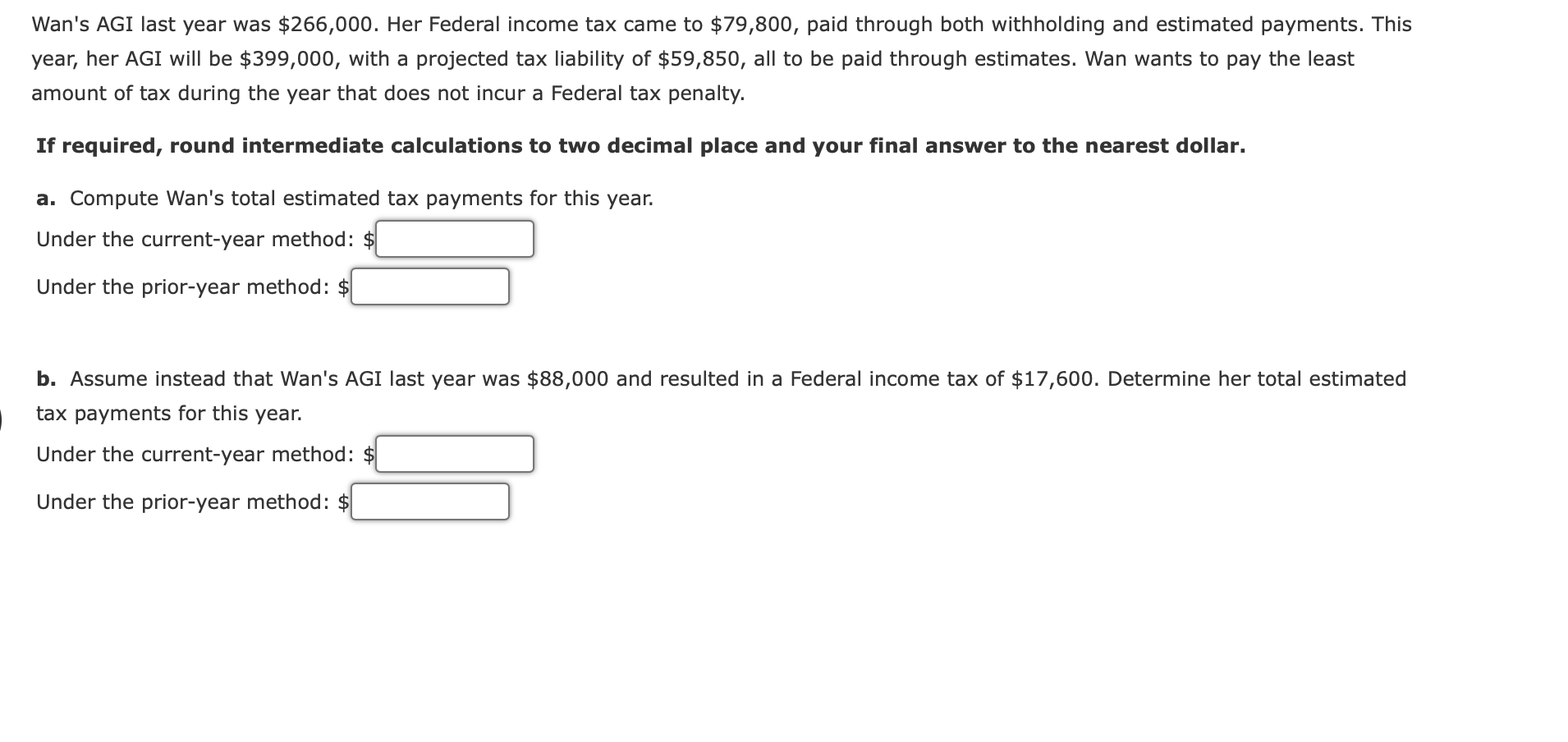

Wan's AGI last year was $266,000. Her Federal income tax came to $79,800, paid through both withholding and estimated payments. This year, her AGI will be $399,000, with a projected tax liability of $59,850, all to be paid through estimates. Wan wants to pay the least amount of tax during the year that does not incur a Federal tax penalty. If required, round intermediate calculations to two decimal place and your final answer to the nearest dollar. a. Compute Wan's total estimated tax payments for this year. Under the current-year method: $ Under the prior-year method: $ b. Assume instead that Wan's AGI last year was $88,000 and resulted in Federal income tax of $17,600. Determine her total estimated tax payments for this year. I Under the current-year method: $ Under the prior-year method: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Wans total estimated tax payments for this year we need to consider two methods the currentyear method and the prioryear method The goal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started