Answered step by step

Verified Expert Solution

Question

1 Approved Answer

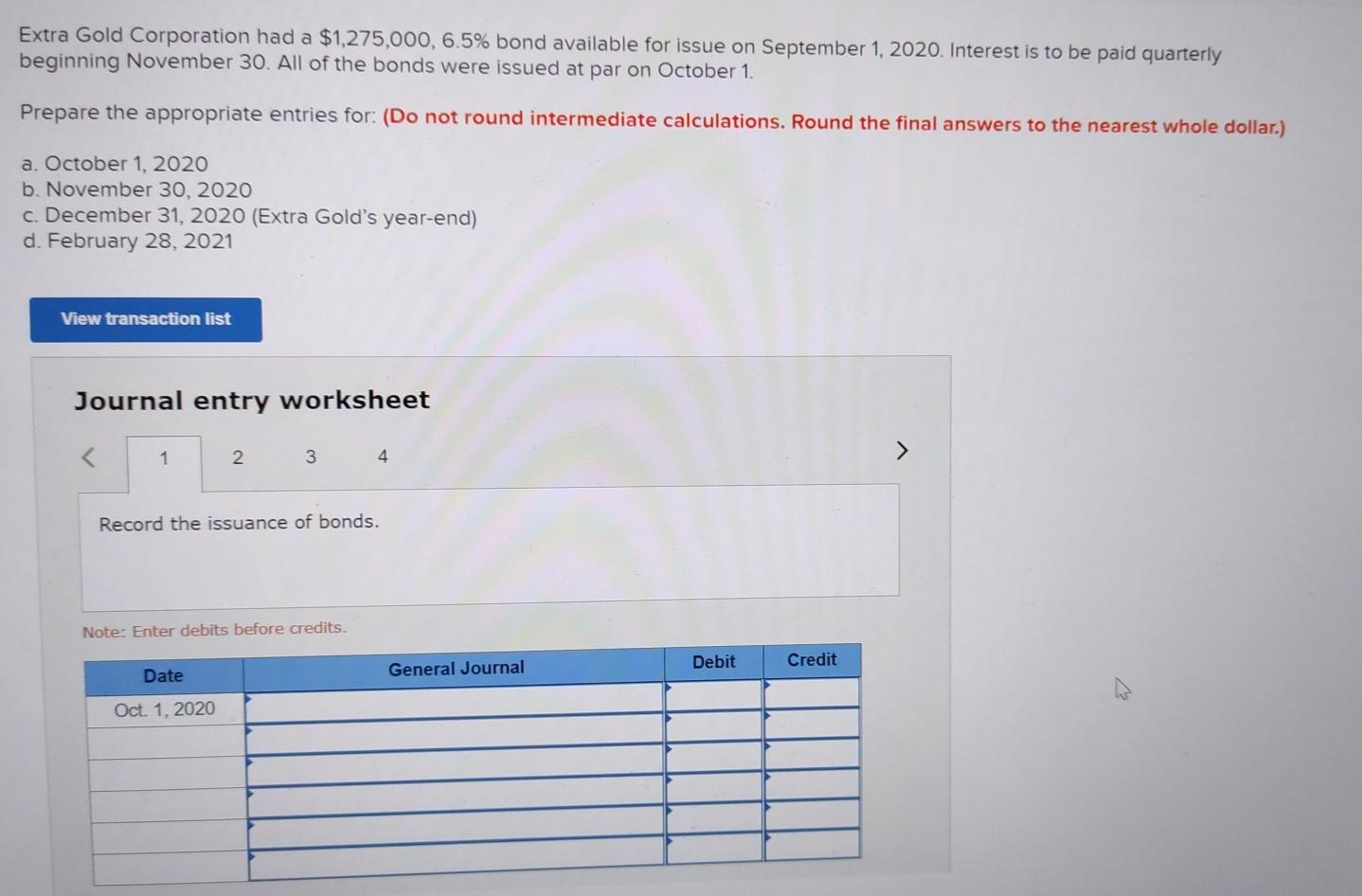

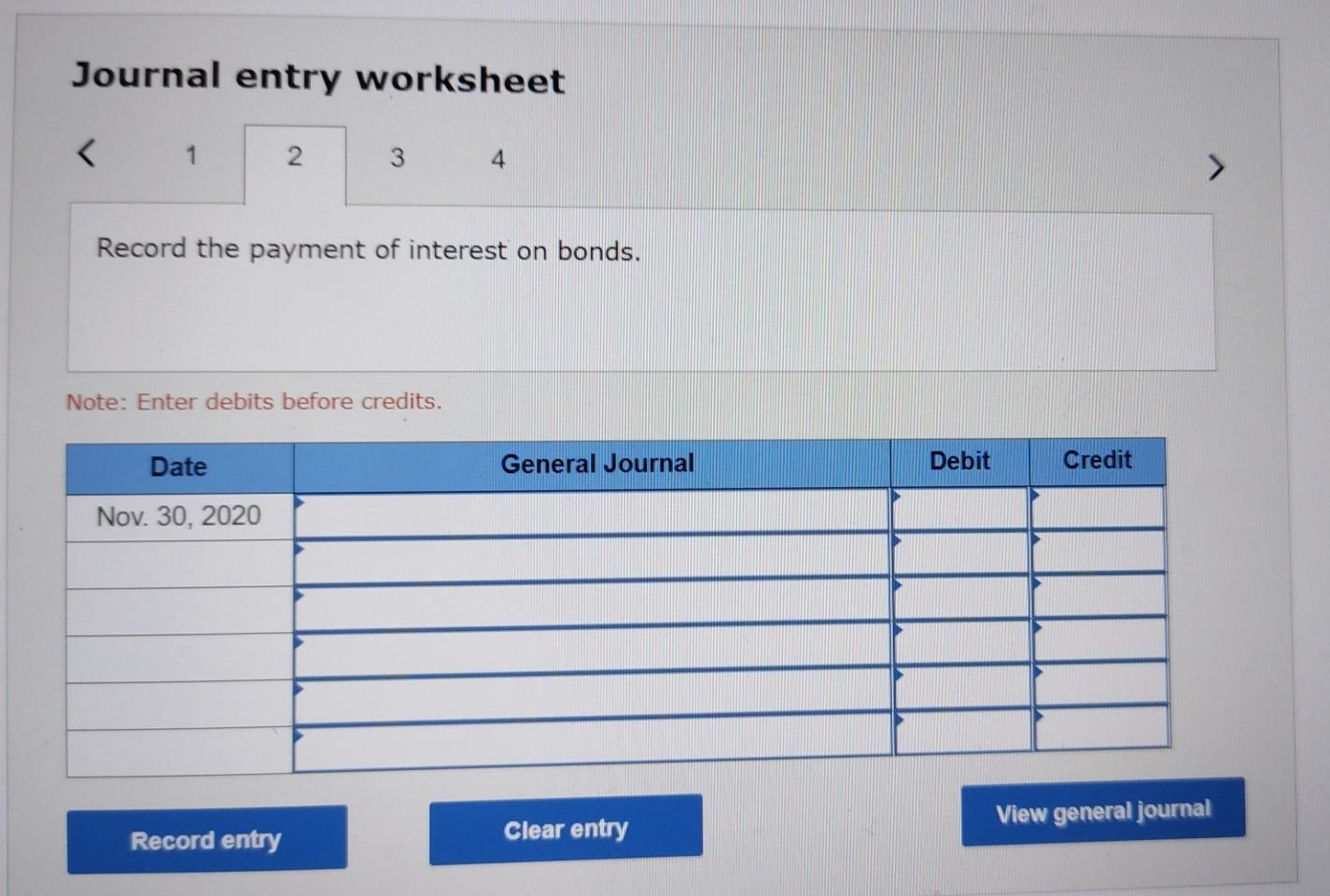

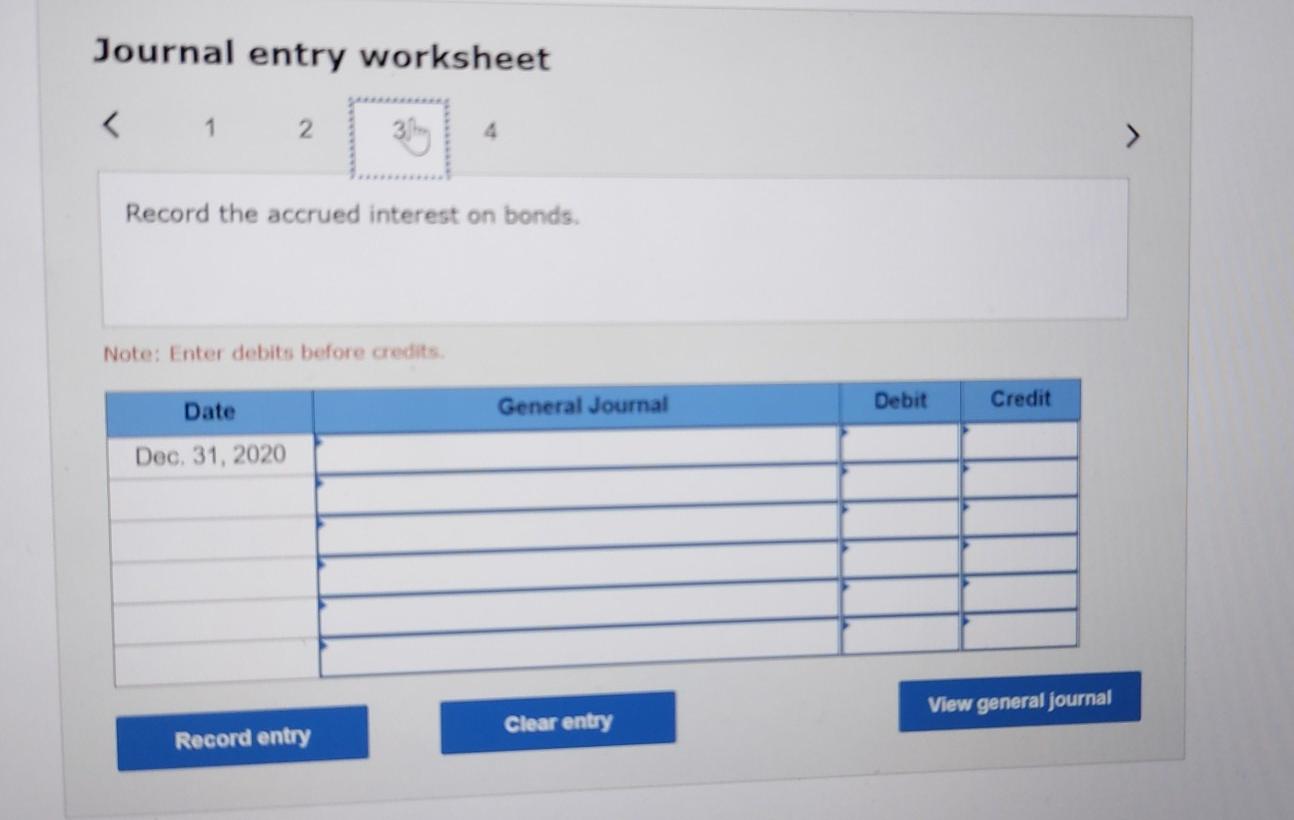

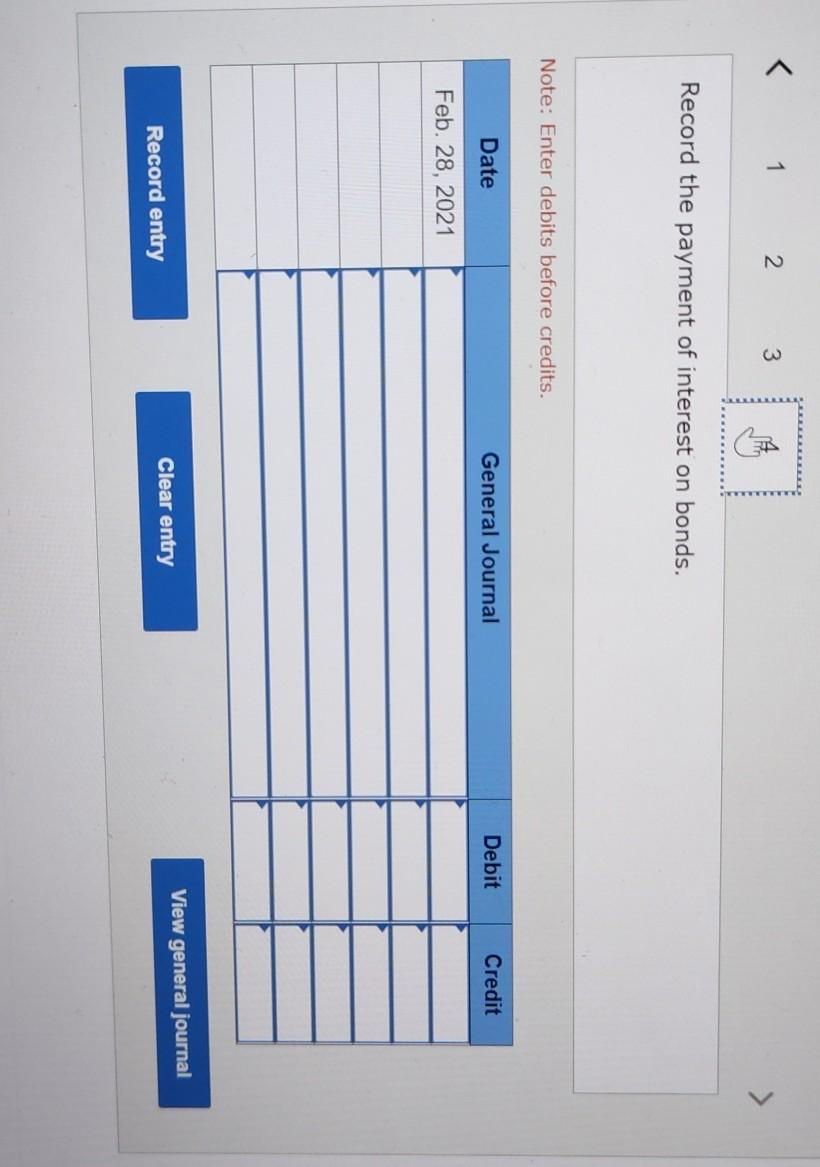

want answers of all parts Extra Gold Corporation had a $1,275,000, 6.5% bond available for issue on September 1, 2020. Interest is to be paid

want answers of all parts

Extra Gold Corporation had a $1,275,000, 6.5% bond available for issue on September 1, 2020. Interest is to be paid quarterly beginning November 30. All of the bonds were issued at par on October 1. Prepare the appropriate entries for: (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) a. October 1, 2020 b. November 30, 2020 c. December 31, 2020 (Extra Gold's year-end) d. February 28, 2021 View transaction list Journal entry worksheet 1 2 3 4 Record the issuance of bonds. Note: Enter debits before credits. Debit Credit Date General Journal Oct. 1, 2020 Journal entry worksheet Record the payment of interest on bonds. Note: Enter debits before credits. Date General Journal Debit Credit Nov. 30, 2020 View general journal Record entry Clear entry Journal entry worksheet 1 2 3) Record the accrued interest on bonds. Note: Enter debits before credits General Journal Debit Credit Date Dec 31, 2020 View general journal Clear entry Record entryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started