want solutions of both asap

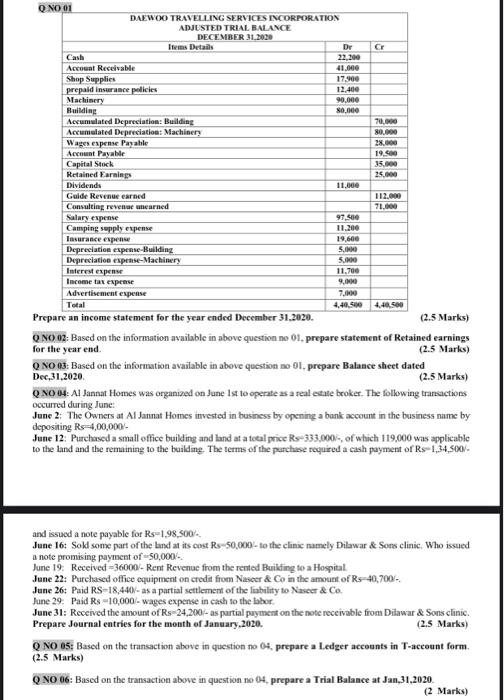

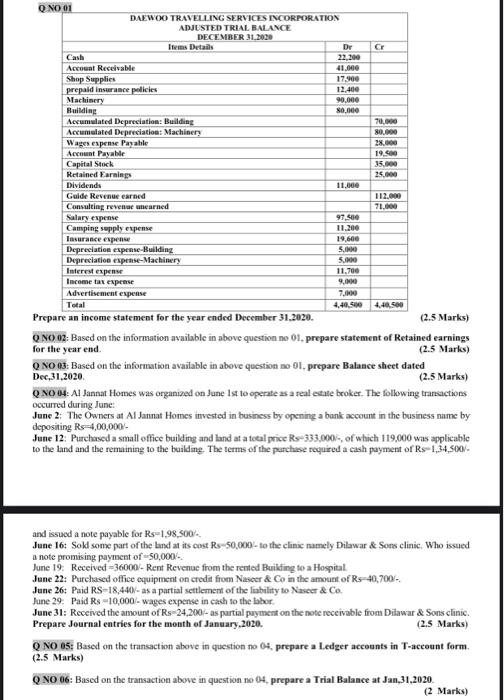

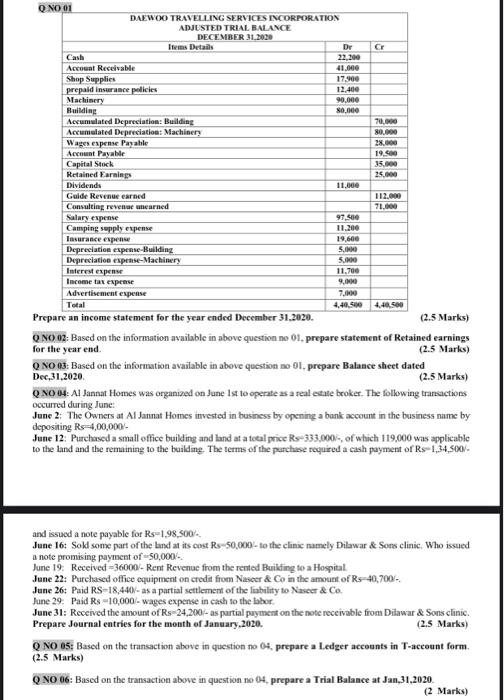

Q NO 01 DAEWOO TRAVELLING SERVICES INCORPORATION ADJUSTED TRIAL BALANCE DECEMBER 31.2020 Im Details Dr CE Cash 22.200 Account Receivable 41.000 Shop Supplies 17.900 prepaid insurance policies 12.400 Machinery 90.000 Building 80.000 Accumulated Depreciation Building 70,000 Accumulated Depreciation Machinery 80,000 Wages expense Payable 2.00 Account Payable 19.500 Capital Stock 35.000 Retained Earning 25.000 Dividends 11.000 Guide Revenue earned 112.000 Consulting revenue unearned 71.000 Salary expense 97.00 Camping supply expense 11.200 Insurance experime 19,600 Depreciation expense-Building S. Depreciation experise Machinery 5. Interest expense 11.700 Income tax expense 9.000 Advertisement expense 7.00 Total 4,40.500 4.40.500 Prepare an income statement for the year ended December 31.2020. (2.5 Marks) (2.5 Marks) (2.5 Marks) O NO 02: Based on the information available in above question ne 01, prepare statement of Retained earnings for the year end. NO 03: Based on the information available in above question no Ol, prepare Balance sheet dated Dec.31.2020 QNO AI Sannat Homes was organized on June 1st to operate as a real estate broker. The following transactions occurred during June June 2: The Owners at Al Jannat Homes invested in business by opening a bank account in the business name by depositing Rs4,00,000/ June 12. Purchased a small office building and land at a total price Rs 333,000-, of which 119,000 was applicable to the land and the remaining to the building. The terms of the purchase required a cash payment of Rs 1,34,500/- and issued a note payable for Rs-1.98.500/- June 16: Sold some part of the land at its cost Rs 50,000 to the clinic namely Dilawar & Sons clinic. Who issued a note promising payment of 50,000 June 19. Received =36000 - Rent Revenue from the rented Building to a Hospital June 22: Purchased office equipment on credit from Nascer & Co in the amount of Rs 40,700 June 26: Paid RS-18,440-as a partial settlement of the liability to Nascer & Co. June 29: Paid Rs 10,000 - wages expense in cash to the labor. June 31: Received the amount of Rs-24.200- as partial payment on the note receivable from Dilawar & Sons clinic. Prepare Journal entries for the month of January.2020. Q NO 05: Based on the transaction above in question no 04, prepare a Ledger accounts in T-account form. (2.5 Marks) (2.5 Marks) Q NO 06: Based on the transaction above in question no 04. prepare a Trial Balance at Jan-31,2020 (2 Marks)