Want to know the answer for the 3rd and 4th pic

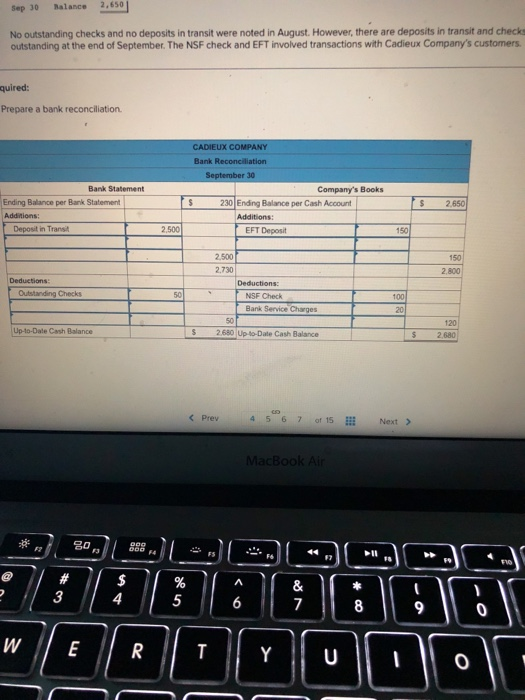

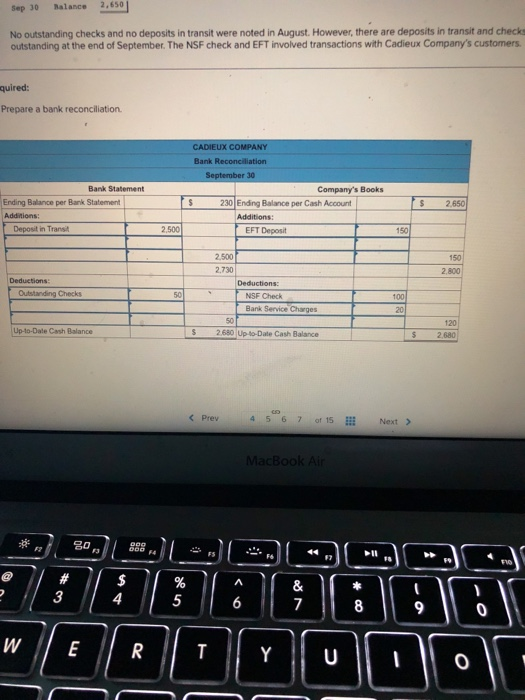

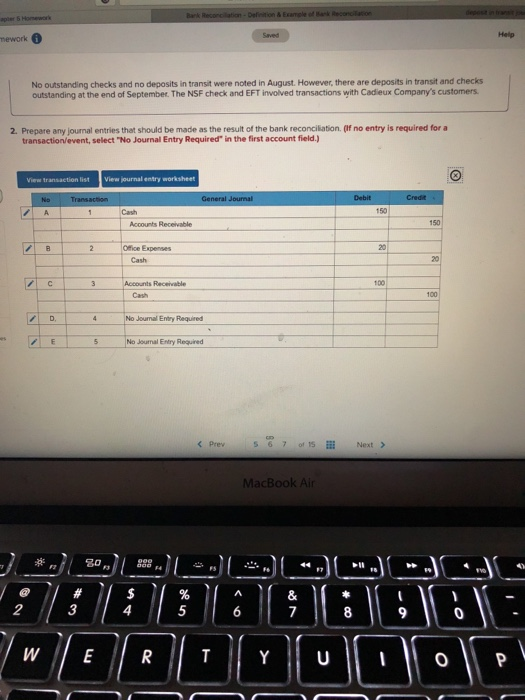

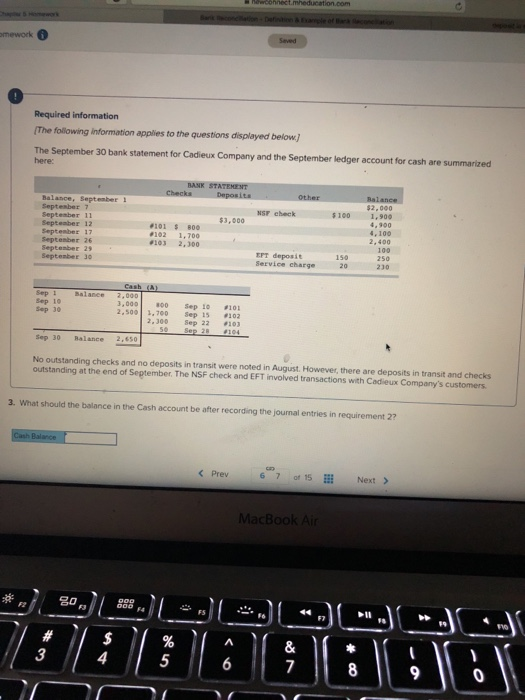

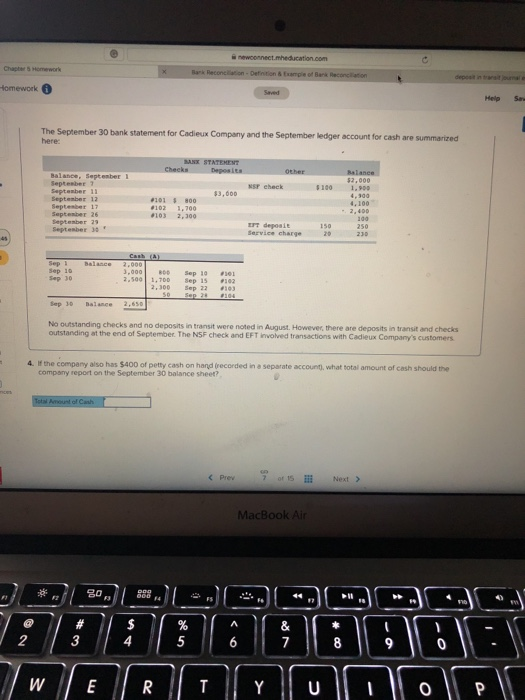

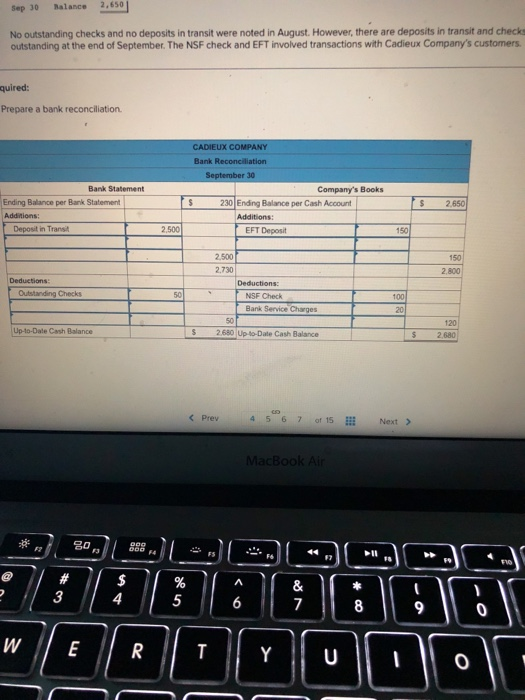

Sep 30 alance 2,650 No outstanding checks and no deposits in transit were noted in August.However, there are deposits in transit and checks outstanding at the end of September. The NSF check and EFT involved transactions with Cadieux Company's customers quired: Prepare a bank reconciliation Bank Reconciliation Bank Statement Company's Books Ending Balance per Bank Statement 230 Ending Balance per Cash Account 2,650 Deposit in Trans 2,500 EFT Deposit 150 2.500 2.730 150 2,800 Deductions: Outstanding Checks NSF Check Bank Service Charges 50 120 Up-to-Dale Cash Balance S 2,680 Upto-Date Cash Balance $ 2.,680 C Prev 4 567 of 15 Next > 3 4 mework No outstanding checks and no deposits in transit were noted in August. However, there are deposits in transit and checks outstanding at the end of September The NSF check and EFT involved transactions with Cadieux Company's customers 2. Prepare any journal entries that should be made as the result of the bank reconciliation. (If no entry is required for a transaction/event,select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet 150 Accounts Receivable Office Expenses 20 Cash 20 Accounts Receivable Cash No Journal Entry Required No Journal Entry Required Prev 2 3 mework Required information The following information applies to the questions displayed below) The September 30 bank statement for Cadieux Company and the September ledger account for cash are summarized here: Balance, Septeaber 1 Septenber 7 Septenber 11 Septenber 12 Septenber 17 Septenber 26 Septenber 29 SeptenbeE 3 $2,000 100 1,900 NSF check $3,000 #101 S 800 #102 1,700 103 2,300 4,100 2,400 100 EFT deposit Service charge 20 230 Sep i Sep 10 Sep 30 Balance 2,000 3,000 800 Sep 10 #101 2,500 .700 Sep 15 #102 2,300 Sep 22 #103 Sep 30 Balance 2,60 No outstanding checks and no deposits in transit were noted in August. However, there are deposits in transit and checks outstanding at the end of September. The NSF check and EFT involved transactions with Codieux Company's customers 3. What should the balance in the Cash account be after recording the journal entries in requirement 27 , MacBook omework Help San The September 30 bank statement for Cadieux Company and the September ledger account for cash are summarized here: balance, Septesber l Septenber 2,000 NSr eheck 1001,9 3,000 Septenber 12 Septenber 17 101 800 #102 1,700 #103 2,300 ErT deposle Service charge Septenber 30 230 Sep 10 Sep 30 ,0001 800 sop 10 #iei 2,saa 1,700 Sep 15 #102 2.300 Sep 22 #103 Sep 30 Dalance 2:650 No outstanding checks and no deposits in transit were noted in August. However there are deposits in transit and checks outstanding at the end of September. The NSF check and EFT involved transactions with Cadieux Company's customers 4. If the company also has $400 of petty cash on hand (recorded in e separate account, what total amount of cash should the company report on the September 30 balance sheet? 7ot iS i Next > MacBook 2 4