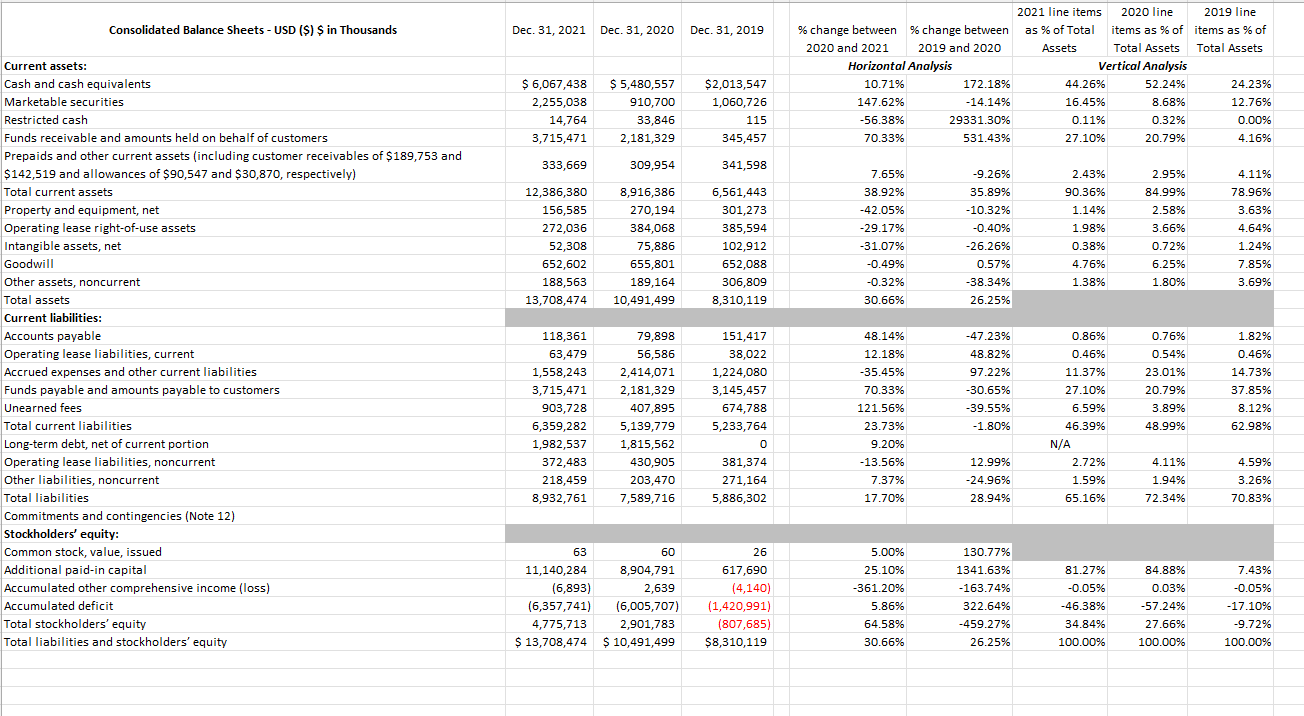

Want to perform a financial analysis on Airbnb's balance sheet for the past 3 years. Any help appreciated!

2021 line items 2020 line 2019 line Consolidated Balance Sheets - USD ($) $ in Thousands Dec. 31, 2021 Dec. 31, 2020 Dec. 31, 2019 % change between % change between as % of Total items as % of items as % of 2020 and 2021 2019 and 2020 Assets Total Assets Total Assets Current assets: Horizontal Analysis Vertical Analysis Cash and cash equivalents $ 6,067,438 $ 5,480,557 $2,013,547 10.71% 172.18% 44.26% 52.24% 24.23% Marketable securities 2,255,038 910,700 1,060,726 147.62% -14.14% 16.45% 8.68% 12.76% Restricted cash 14,764 33,846 115 -56.38% 29331.30% 0.11% 0.32% 0.00% Funds receivable and amounts held on behalf of customers 3,715,471 2,181,329 345,457 70.33% 531.43% 27.10% 20.79% 4.16% Prepaids and other current assets (including customer receivables of $189,753 and 333,669 309,954 341,598 $142,519 and allowances of $90,547 and $30,870, respectively) 7.65% -9.26% 2.43% 2.95% 4.11% Total current assets 12,386,380 8,916,386 6,561,443 38.92% 35.89% 90.36% 84.99% 78.96% Property and equipment, net 156,585 270,194 301,273 -42.05% -10.32% 1.14% 2.58% 3.63% Operating lease right-of-use assets 272,036 384,068 385,594 -29.17% -0.40% 1.98% 3.66% 4.64% Intangible assets, net 52,308 75,886 102,912 -31.07% -26.26% 0.38% 0.72% 1.24% Goodwill 652,602 655,801 652,088 0.49% 0.57% 4.76% 6.25% 7.85% Other assets, noncurrent 188,563 189,164 306,809 -0.32% -38.34% 1.38% 1.80% 3.69% Total assets 13,708,474 10,491,499 8,310,119 30.66% 26.25% Current liabilities: Accounts payable 118,361 79,898 151,417 48.14% -47.23% 0.86% 0.76% 1.82% Operating lease liabilities, current 63,479 56,586 38,022 12.18% 48.82% 0.46% 0.54% 0.46% Accrued expenses and other current liabilities 1,558,243 2,414,071 1,224,080 -35.45% 97.22% 11.37% 23.019 14.73% Funds payable and amounts payable to customers 3,715,471 2,181,329 3,145,457 70.33% -30.65% 27.10% 20.79% 37.85% Unearned fees 903,728 407,895 674,788 121.56% -39.55% 6.59% 3.89% 8.12% Total current liabilities 6,359,282 5,139,779 5,233,764 23.73% -1.80% 46.39% 48.99% 62.98% Long-term debt, net of current portion 1,982,537 1,815,562 9.20% N/A Operating lease liabilities, noncurrent 372,483 430,905 381,374 13.56% 12.99% 2.72% 4.11% 4.59% Other liabilities, noncurrent 218,459 203,470 271,164 7.37% -24.96% 1.59% 1.94% 3.26% Total liabilities 8,932,761 7,589,716 5,886,302 17.70% 28.94% 65.16% 72.34% 70.83% Commitments and contingencies (Note 12) Stockholders' equity: Common stock, value, issued 63 60 26 5.00% 130.77% Additional paid-in capital 11,140,284 8,904,791 617,690 25.10% 1341.63% 81.27% 84.88% 7.43% Accumulated other comprehensive income (loss) (6,893) 2,639 (4,140) -361.20% -163.74% -0.05% 0.03% -0.05% Accumulated deficit (6,357,741) (6,005,707) (1,420,991) 5.86% 322.64% -46.38% -57.24% -17.10% Total stockholders' equity 4,775,713 2,901,783 (807,685) 64.58% 459.27% 34.84% 27.66% -9.72% Total liabilities and stockholders' equity $ 13,708,474 $ 10,491,499 $8,310,119 30.66% 26.25% 100.00% 100.00% 100.00%