wanted help for this question w proper formatting(reference answer given):

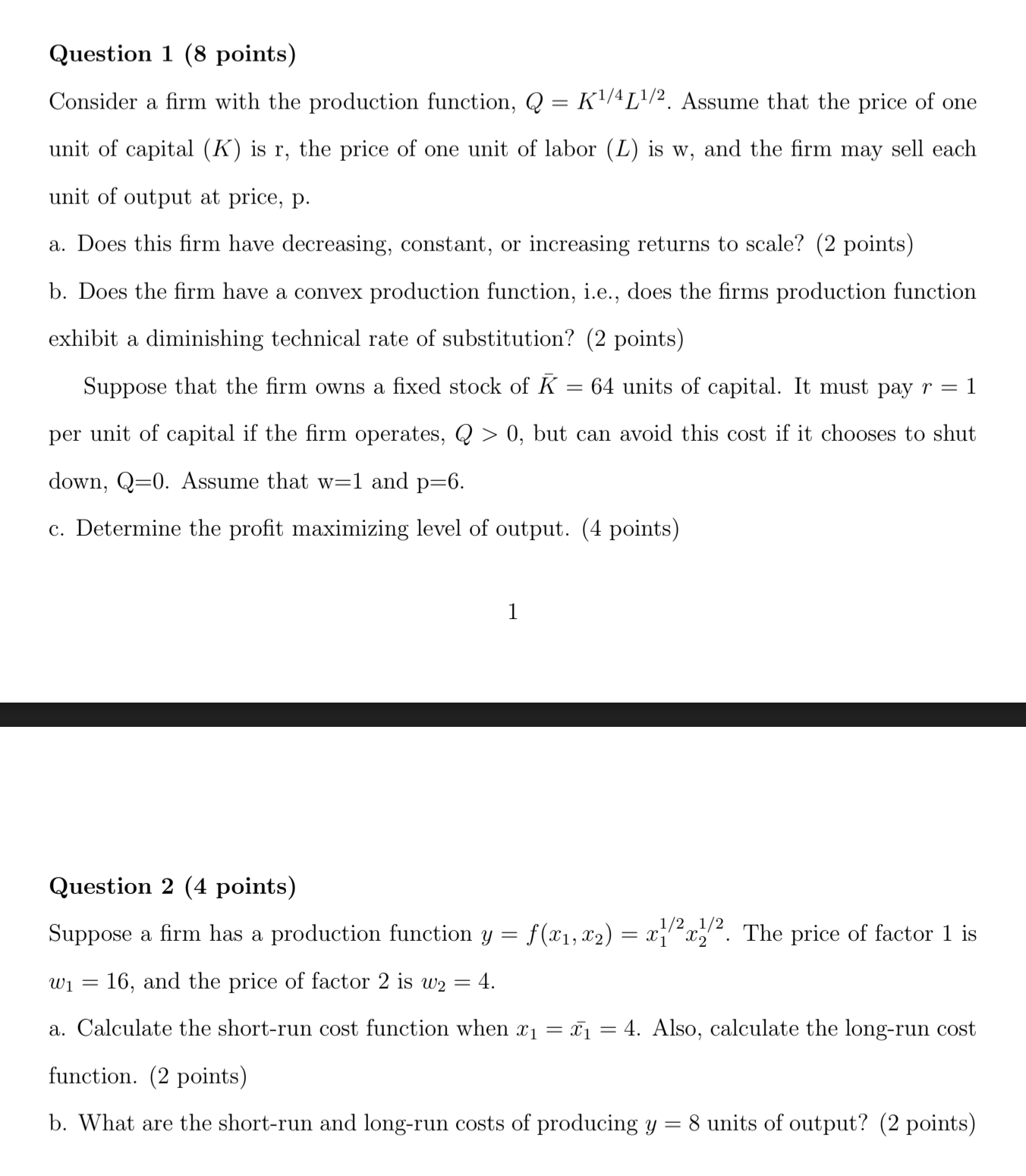

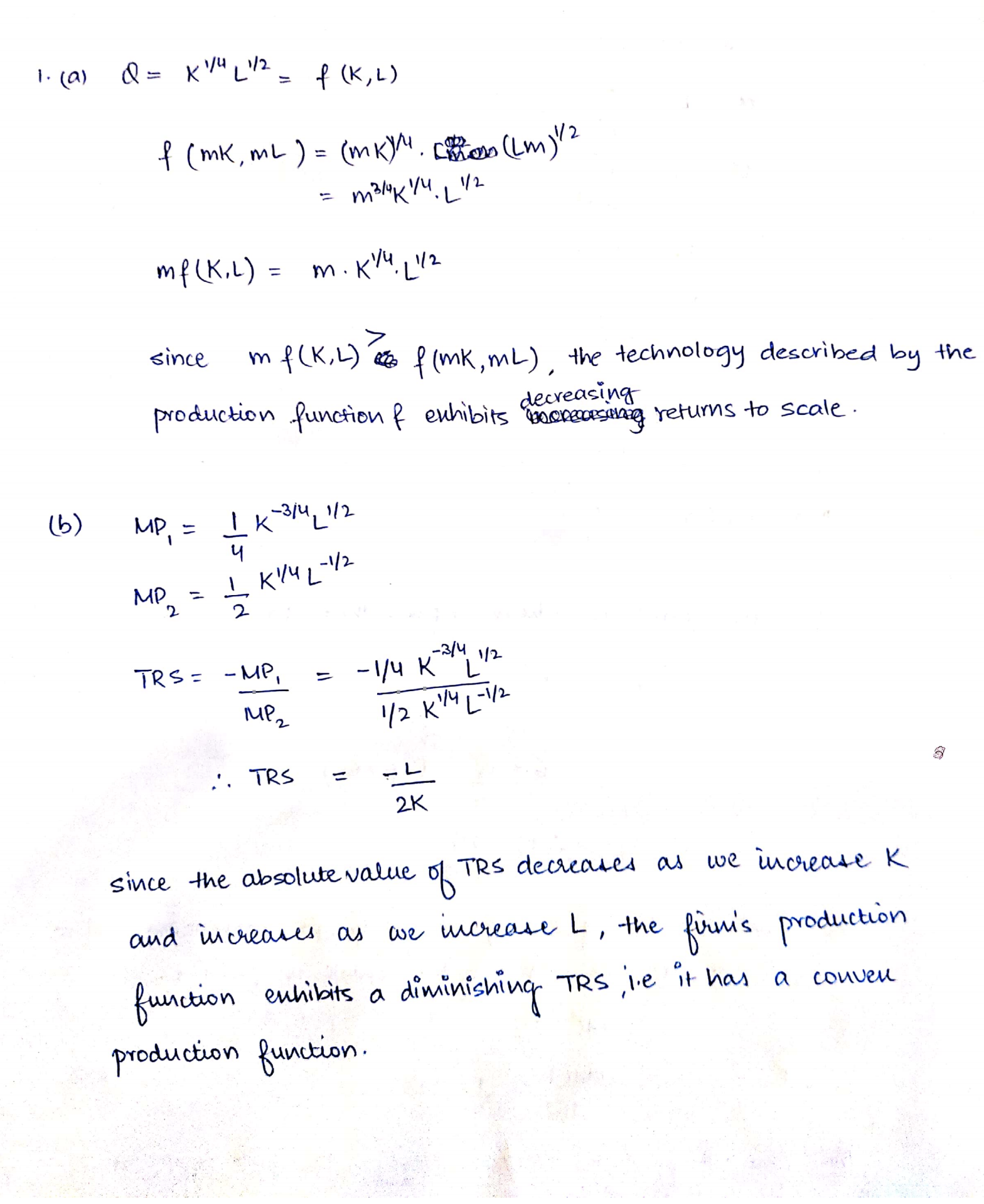

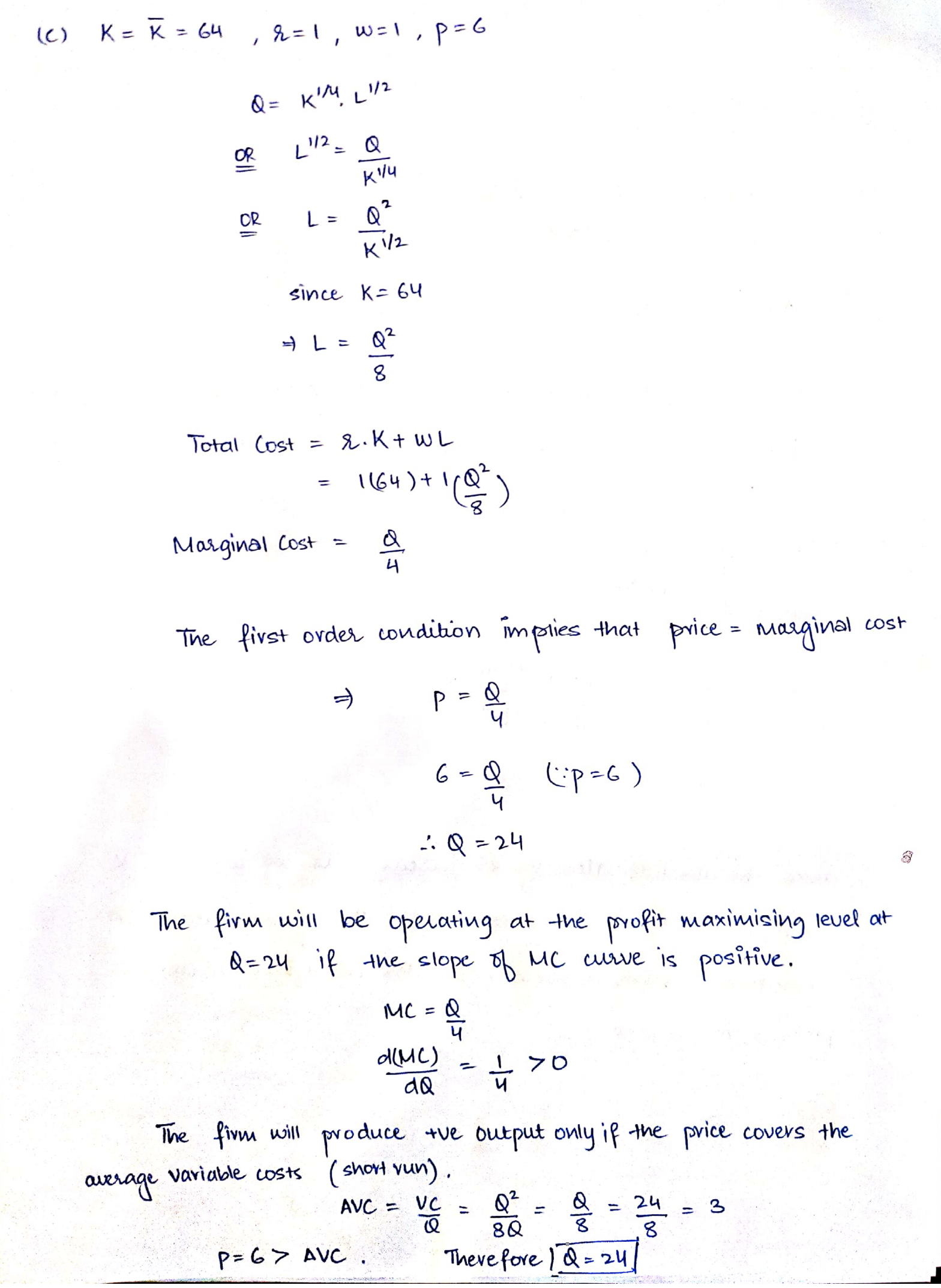

Question 1 (8 points) Consider a rm with the production function, Q = K1/4L1/2. Assume that the price of one unit of capital (K) is r, the price of one unit of labor (L) is w, and the rm may sell each unit of output at price, p. a. Does this rm have decreasing, constant, or increasing returns to scale? (2 points) b. Does the rm have a convex production function, i.e., does the rms production function exhibit a diminishing technical rate of substitution? (2 points) Suppose that the rm owns a xed stock of R = 64 units of capital. It must pay 1" = 1 per unit of capital if the rm operates, Q > 0, but can avoid this cost if it chooses to shut down, Q20. Assume that W=1 and p=6. 0. Determine the prot maximizing level of output. (4 points) Question 2 (4 points) Suppose a rm has a production function y = f(:131, x2) = 121/ 2mg 2. The price of factor 1 is ml 2 16, and the price of factor 2 is mg 2 4. a. Calculate the short-run cost function when 11:1 2 fl = 4. Also, calculate the long-run cost function. (2 points) b. What are the shortrun and longrun costs of producing y = 8 units of output? (2 points) 1. ( a) Q = K 1/" ( 1/2 = p ( K , L ) f ( mk , ML ) = ( MK)M . Com ( LM ) /2 = m3/4x 1/4. 1/2 me ( K, L ) = m. K1/4 , 1/2 since m f ( K , L ) ( mK , ML ) , the technology described by the production function f exhibits min returns to scale . ( b ) MP. = 1 K -314, 1/2 4 MP = 1 K 1/41 -1/2 TRS = - MP, = - 1/4 K2 1/2 MP, 1/ 2 1 1/4 1 - 1/2 .'. TRS = 2K since the absolutevalue of TRS decreases as we increase K and increases as we increase L , the firmis production function exhibits a diminishing TRS ie it has a convene production function .( C ) K = K = 64 , 9 = 1, W = 1 , P = 6 Q = K 1/4 1 1/ 2 OR L'/2 = Q K 1 /4 OR L = Q 2 * 1/2 since K= 64 L = Total Cost = 2. K + WL = 1(64 ) + 1/Q2 Marginal Cost = Q The first order condition implies that price = marginal cost =) P = Q 6 = Q ( :P = 6 ) :. Q = 24 The firm will be operating at the profit maximising level at Q= 24 if the slope of MC curve is positive . MC = Q 4 d( MC ) 1 70 The firm will produce the output only if the price covers the average variable costs ( short run ) . AVC = VC = Q 2 Q = 24 = 3 8Q 8 8 P= 67 AVC . There fore ) Q = 242. ( a) short run min Win , + W 21/ 20 X , , N 2 such that 1/2 = 4 - 2 WI = 16 W 2 = 4 16 1 = 41 1 = 4 In 2) 4112- 1/2 - 2 = 4 : V 2 = - (3) 4 short- run cost function = 16 ( 4 ) + 4 ( 42 ) = 64 + 42 Long run min 16 hit 412 such that 112 242 1/2 = y Here , a = b = 1/ 2 using Lagrange multipliers c ( w , , wz ly ) = ( a ) aib + ( 9 ) atb / w ,ath w , atb y ath : C ( 16 , 4 , 4 ) = ( 1 + 1 ) . 4. 24 164 ( b ) at y = 8 short run cost function = 28 64 + (8 ) 2 = 128 long run cost function = 16 ( 8 ) = 128 Page 3 +