Answered step by step

Verified Expert Solution

Question

1 Approved Answer

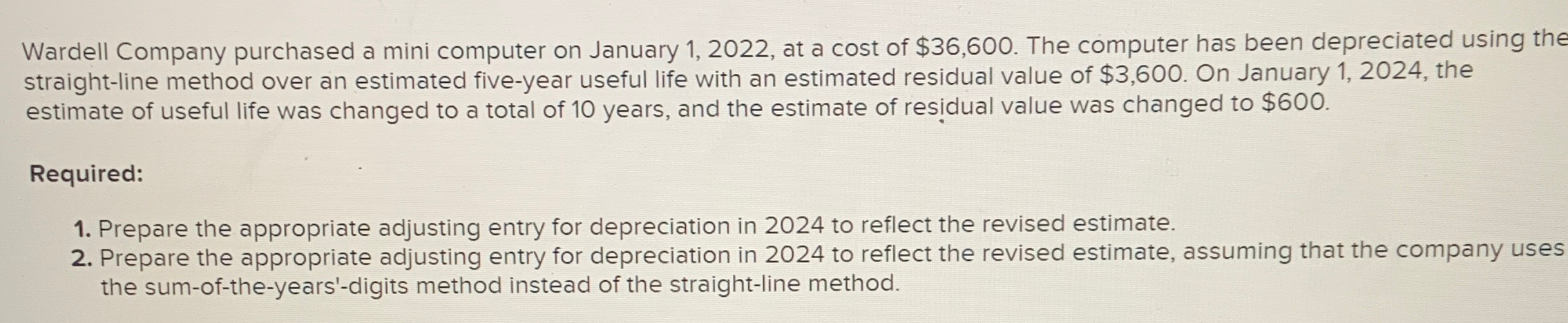

Wardell Company purchased a mini computer on January 1, 2022, at a cost of $36,600. The computer has been depreciated using the straight-line method

Wardell Company purchased a mini computer on January 1, 2022, at a cost of $36,600. The computer has been depreciated using the straight-line method over an estimated five-year useful life with an estimated residual value of $3,600. On January 1, 2024, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $600. Required: 1. Prepare the appropriate adjusting entry for depreciation in 2024 to reflect the revised estimate. 2. Prepare the appropriate adjusting entry for depreciation in 2024 to reflect the revised estimate, assuming that the company uses the sum-of-the-years'-digits method instead of the straight-line method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Wardell Company Depreciation Adjustments 2024 1 Adjusting Entry for Revised Estimate StraightLine Method Since the estimated useful life and residual ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6641f5b9dc779_987124.pdf

180 KBs PDF File

6641f5b9dc779_987124.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started