Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Warm Duck is considering investing in a project whose risk is greater than the firm's current risk level based on any method for assessing

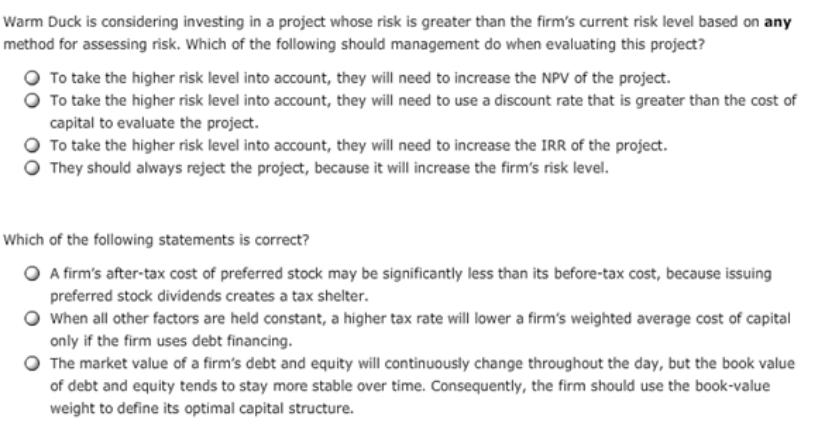

Warm Duck is considering investing in a project whose risk is greater than the firm's current risk level based on any method for assessing risk. Which of the following should management do when evaluating this project? To take the higher risk level into account, they will need to increase the NPV of the project. To take the higher risk level into account, they will need to use a discount rate that is greater than the cost of capital to evaluate the project. To take the higher risk level into account, they will need to increase the IRR of the project. They should always reject the project, because it will increase the firm's risk level. Which of the following statements is correct? O A firm's after-tax cost of preferred stock may be significantly less than its before-tax cost, because issuing preferred stock dividends creates a tax shelter. When all other factors are held constant, a higher tax rate will lower a firm's weighted average cost of capital only if the firm uses debt financing. The market value of a firm's debt and equity will continuously change throughout the day, but the book value of debt and equity tends to stay more stable over time. Consequently, the firm should use the book-value weight to define its optimal capital structure.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer to Warm Duck question Answer is OptionA To take the higher risk level into account they w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started