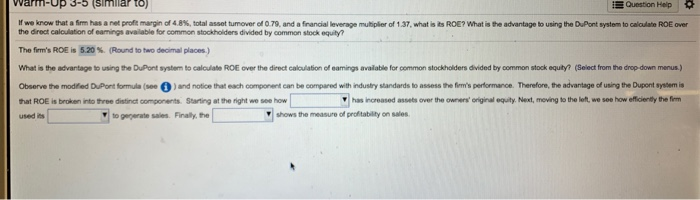

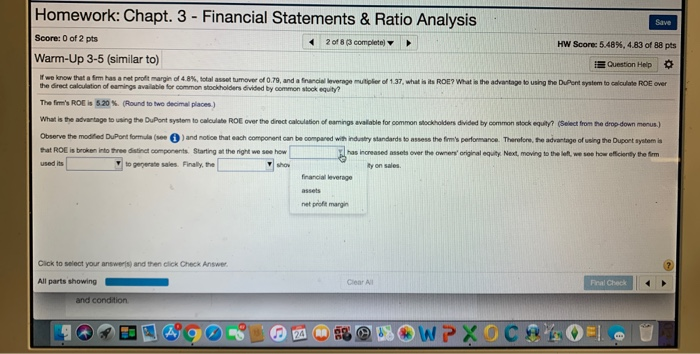

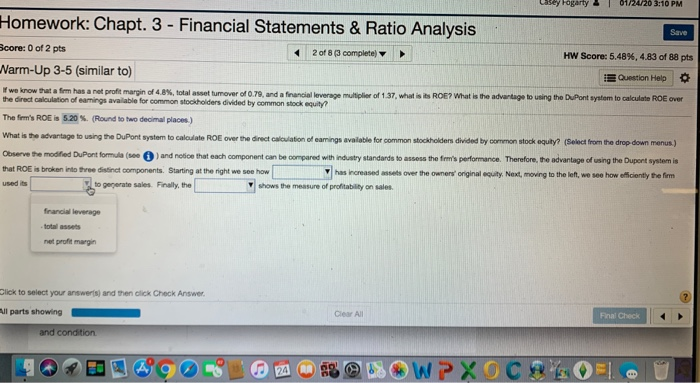

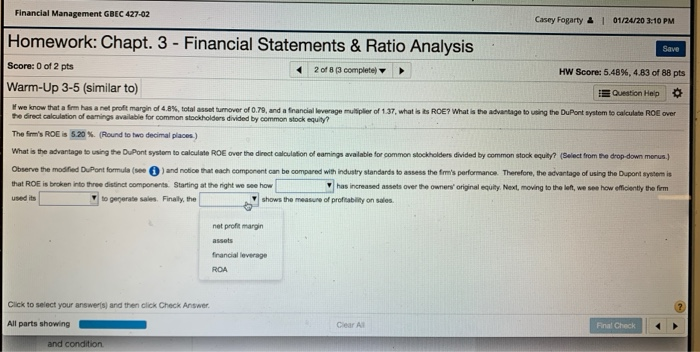

Warm-Up 3-5 (Similar to) Question Help If we know that a firm has a neprofit margin of 4.8% total asset tumover of 79, and a financial leverage multiplier of 137, what is the direct calculation of earnings available for common stockholders divided by common stock equity? ROE? What is the advantage to using the DuPont system to calculate ROE over The firm's ROE is 5.20 %. (Round to two decimal places.) What is the advantage to using the DuPont system to calculate ROE over the direct calculation of carings available for common stockholders divided by common stock equity? (Select from the drop-down menus.) Observe the modified DuPont formula (se ) and notice that each component can be compared with industry standards to assess the firm's performance. Therefore, the advantage of using the Dupont system is that ROE is broken into three distinct components. Starting at the right we see how has increased assets over the owner original equity. Next, moving to the left, we see how efficiently the firm used its to generate sales. Finally, the shows the measure of profitability on sales Homework: Chapt. 3 - Financial Statements & Ratio Analysis Score: 0 of 2 pts 2 of 8 (3 complete) Warm-Up 3-5 (similar to) HW Score: 5.48%, 4.83 of 88 pts Question Help O If we know that a firm has a repromargin of 48%, al mover of 0.70, and a financial leverage the direc t ion of in t elor common ockholders vided by Goon stock equity of 13, what is ROE? What the advantages using the Bunt wystem to calculate ROE over The ROC 5.20 5. Round to teda place What is the advantage o n the Port o ROE Over the direct cation of aming a ble for common stockholders divided by common Select from the drop-down menus) Observe the modified DuPont formule and notice that each component can be compared with industry standards to assess the firm's performance. Therefore, the advantage of using the Duport system is that ROE is broken into the distinct components. Starting at the right we see how has increased sets over the owner original equity Next, moving to the left, we see how efficiently the firm used its to generate sales. Finally, the Iyon sales financial leverage assets net profit margin Click to select your new and then chox Check Answer All parts showing Fral Check and condition 90 90 - LOWPXOCRO U Lyrgy TUWU20 UPM Homework: Chapt. 3 - Financial Statements & Ratio Analysis Save Score: 0 of 2 pts 2 of 8 (3 complete) HW Score: 5.48%, 4.83 of 88 pts Warm-Up 3-5 (similar to) Question Help we know that a frm has a neprofit margin of 4.8%, total asset tumover of 0.70, and financial leverage multiplier of 137, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity The firm's ROE I 520. (Round to two decimal places) What is the vergeling the DuPont system to call ROE over the direct cation of earnings available for common stockholders divided by common stock guy? (Select from the drop down menus Observe the modified DuPont formula (se ) and notice that each component can be compared with industry standards to assess the firm's performance. Therefore, the advantage of using the Duport system is that ROE is broken into three distinct components. Starting at the right we see how has increased over the owners' original equity Next, moving to the left, we see how efficiently the firm used is to generate sales. Finally, the shows the measure of profitability on sales francia leverage Dlick to select your answers and then click Check Answer will parts showing Clear All Final Check and condition 12 BOA OO ZA MASWPXOCO Financial Management GBEC 427-02 Casey Fogarty & 01/24/20 2:10 PM Homework: Chapt. 3 - Financial Statements & Ratio Analysis Score: 0 of 2 pts