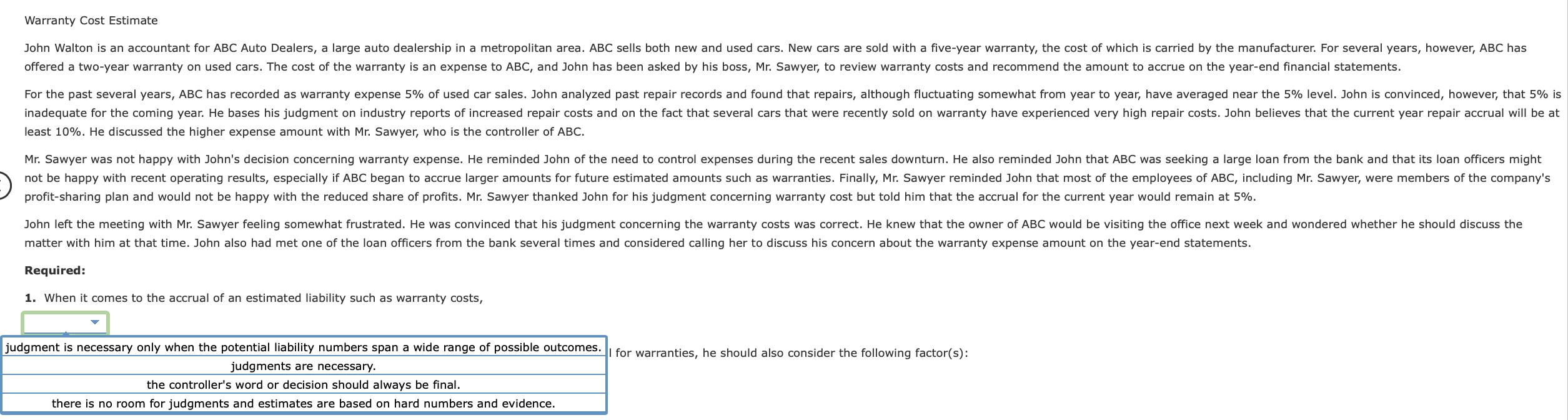

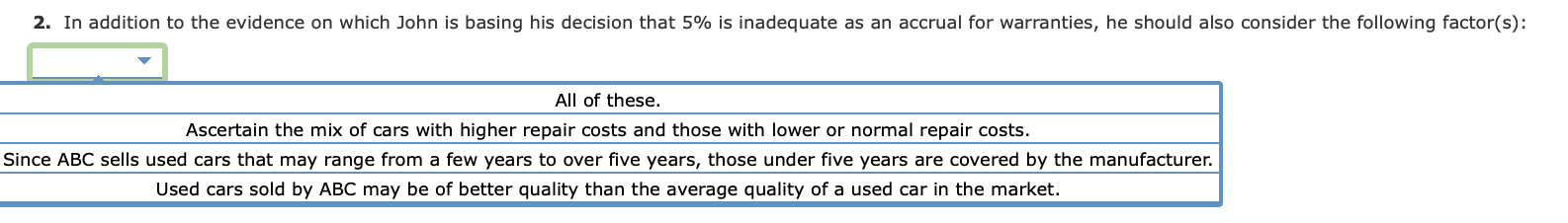

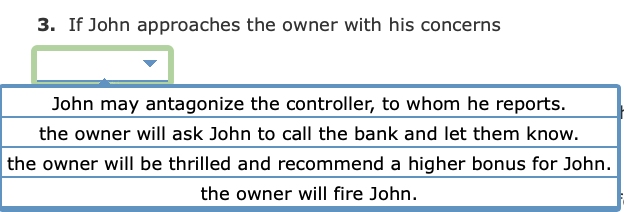

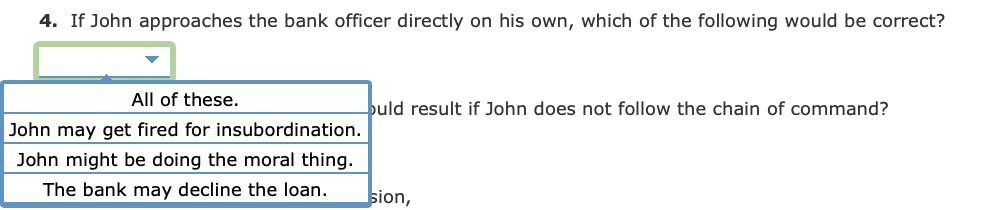

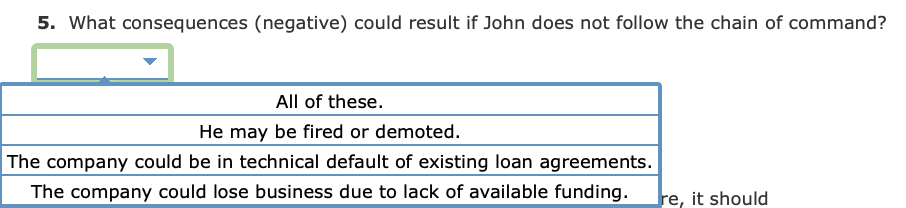

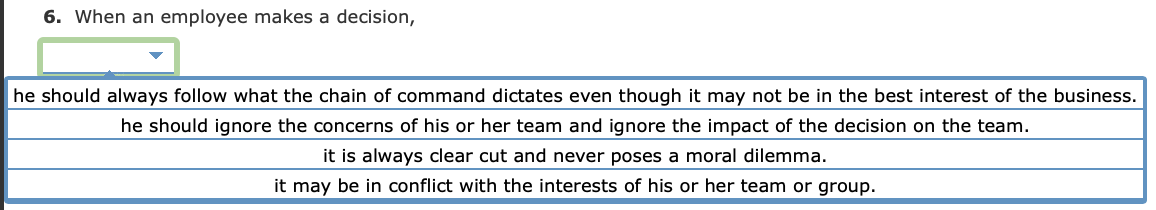

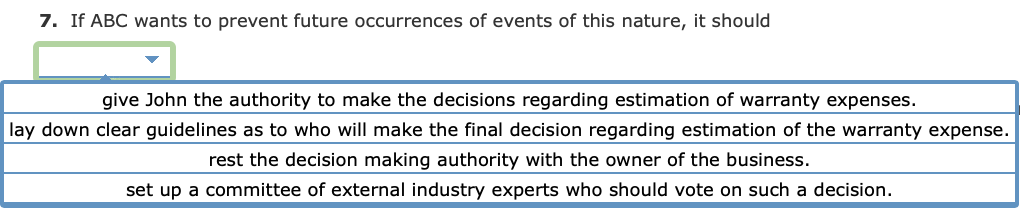

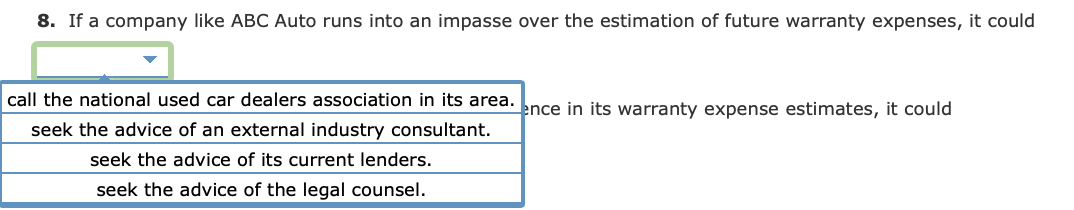

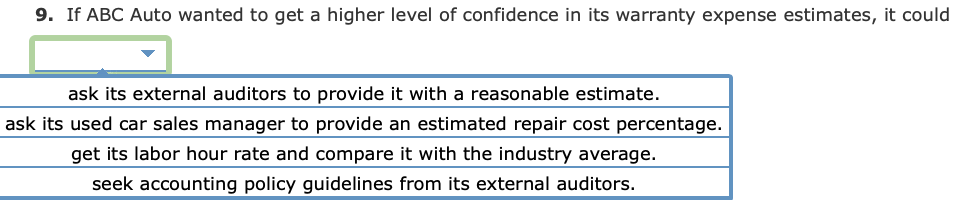

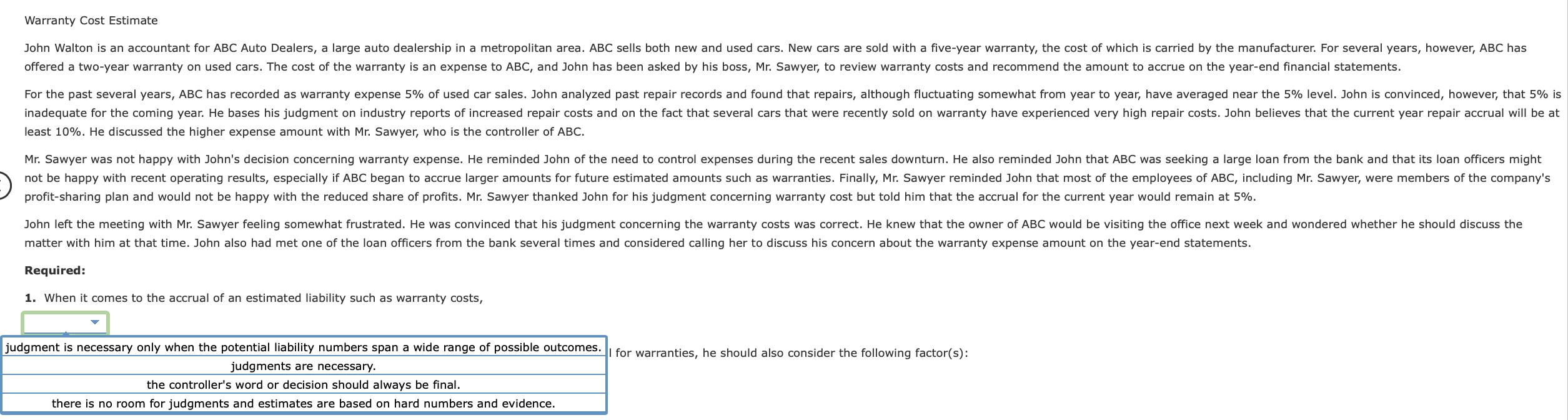

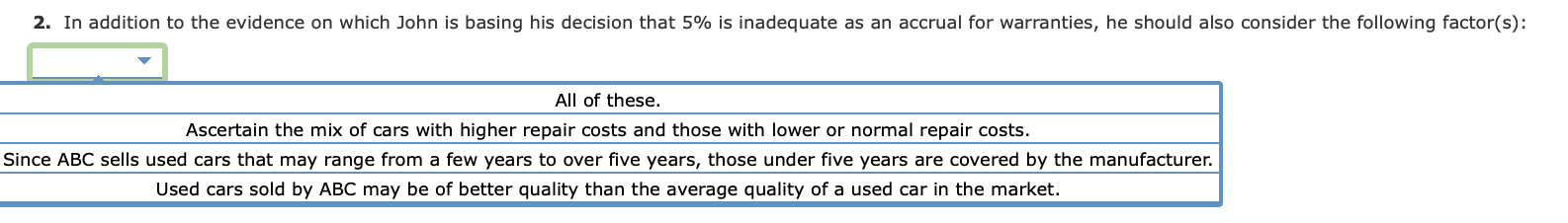

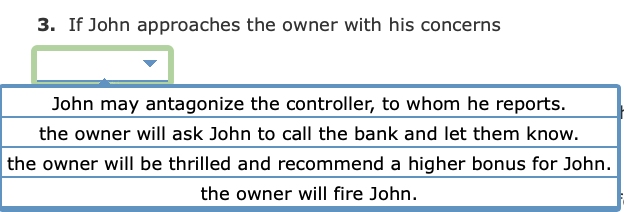

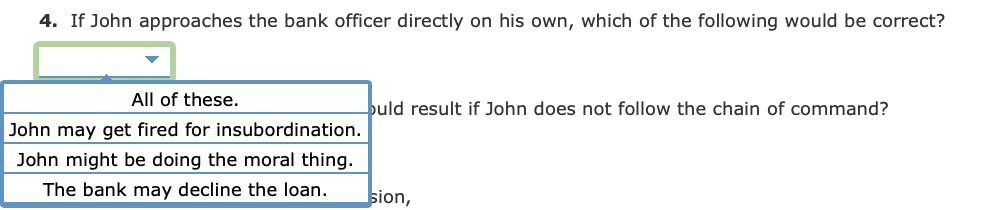

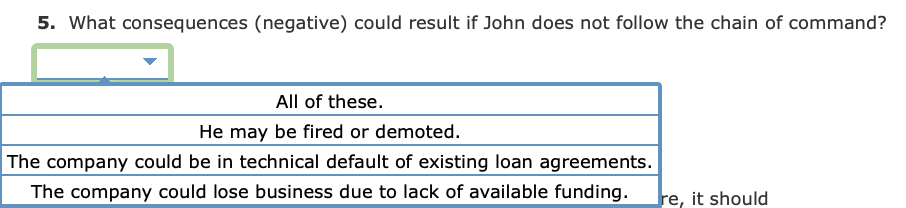

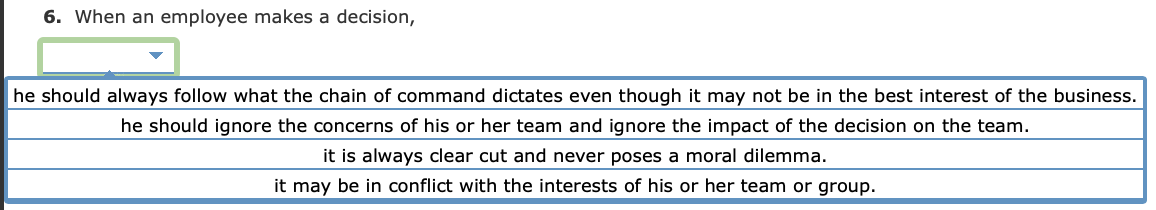

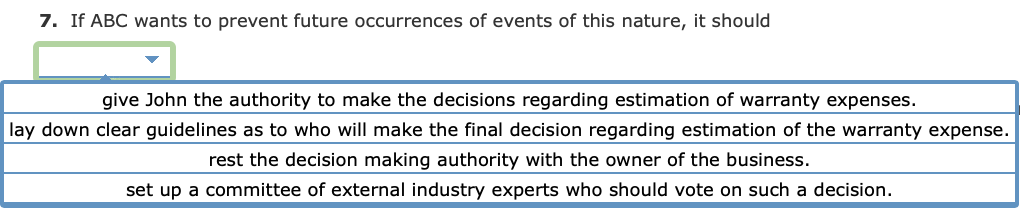

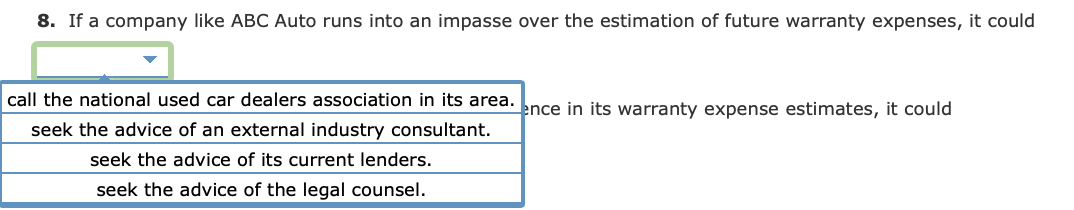

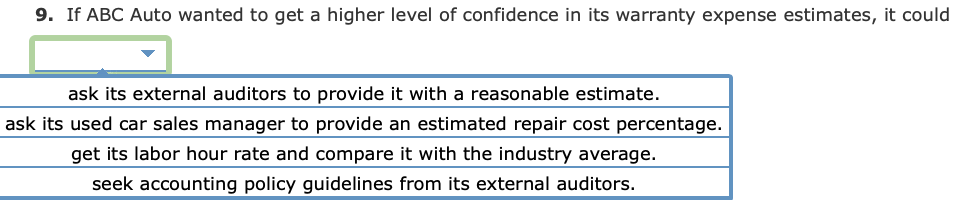

Warranty Cost Estimate John Walton is an accountant for ABC Auto Dealers, a large auto dealership in a metropolitan area. ABC sells both new and used cars. New cars are sold with a five-year warranty, the cost of which is carried by the manufacturer. For several years, however, ABC has offered a two-year warranty on used cars. The cost of the warranty is an expense to ABC, and John has been asked by his boss, Mr. Sawyer, to review warranty costs and recommend the amount to accrue on the year-end financial statements. For the past several years, ABC has recorded as warranty expense 5% of used car sales. John analyzed past repair records and found that repairs, although fluctuating somewhat from year to year, have averaged near the 5% level. John is convinced, however, that 5% is inadequate for the coming year. He bases his judgment on industry reports of increased repair costs and on the fact that several cars that were recently sold on warranty have experienced very high repair costs. John believes that the current year repair accrual will be at least 10%. He discussed the higher expense amount with Mr. Sawyer, who is the controller of ABC. Mr. Sawyer was not happy with John's decision concerning warranty expense. He reminded John of the need to control expenses during the recent sales downturn. He also reminded John that ABC was seeking a large loan from the bank and that its loan officers might not be happy with recent operating results, especially if ABC began to accrue larger amounts for future estimated amounts such as warranties. Finally, Mr. Sawyer reminded John that most of the employees of ABC, including Mr. Sawyer, were members of the company's profit-sharing plan and would not be happy with the reduced share of profits. Mr. Sawyer thanked John for his judgment concerning warranty cost but told him that the accrual for the current year would remain at 5%. John left the meeting with Mr. Sawyer feeling somewhat frustrated. He was convinced that his judgment concerning the warranty costs was correct. He knew that the owner of ABC would be visiting the office next week and wondered whether he should discuss the matter with him at that time. John also had met one of the loan officers from the bank several times and considered calling her to discuss his concern about the warranty expense amount on the year-end statements. Required: 1. When it comes to the accrual of an estimated liability such as warranty costs, judgment is necessary only when the potential liability numbers span a wide range of possible outcomes. I for warranties, he should also consider the following factor(s): judgments are necessary. the controller's word or decision should always be final. there is no room for judgments and estimates are based on hard numbers and evidence. 2. In addition to the evidence on which John is basing his decision that 5% is inadequate as an accrual for warranties, he should also consider the following factor(s): All of these. Ascertain the mix of cars with higher repair costs and those with lower or normal repair costs. Since ABC sells used cars that may range from a few years to over five years, those under five years are covered by the manufacturer. Used cars sold by ABC may be of better quality than the average quality of a used car in the market. 3. If John approaches the owner with his concerns John may antagonize the controller, to whom he reports. the owner will ask John to call the bank and let them know. the owner will be thrilled and recommend a higher bonus for John. the owner will fire John. 4. If John approaches the bank officer directly on his own, which of the following would be correct? All of these. buld result if John does not follow the chain of command? John may get fired for insubordination. John might be doing the moral thing. The bank may decline the loan. sion, 5. What consequences (negative) could result if John does not follow the chain of command? All of these. He may be fired or demoted. The company could be in technical default of existing loan agreements. The company could lose business due to lack of available funding. re, it should 6. When an employee makes a decision, he should always follow what the chain of command dictates even though it may not be in the best interest of the business. he should ignore the concerns of his or her team and ignore the impact of the decision on the team. it is always clear cut and never poses a moral dilemma. it may be in conflict with the interests of his or her team or group. 7. If ABC wants to prevent future occurrences of events of this nature, it should give John the authority to make the decisions regarding estimation of warranty expenses. lay down clear guidelines as to who will make the final decision regarding estimation of the warranty expense. rest the decision making authority with the owner of the business. set up a committee of external industry experts who should vote on such a decision. 8. If a company like ABC Auto runs into an impasse over the estimation of future warranty expenses, it could call the national used car dealers association in its area. Ince in its warranty expense estimates, it could seek the advice of an external industry consultant. seek the advice of its current lenders. seek the advice of the legal counsel. 9. If ABC Auto wanted to get a higher level of confidence in its warranty expense estimates, it could ask its external auditors to provide it with a reasonable estimate. ask its used car sales manager to provide an estimated repair cost percentage. get its labor hour rate and compare it with the industry average. seek accounting policy guidelines from its external auditors