Question

Warren Marina owns a large marina that contains numerous boat slips of various sizes. Warren contracts with boat owners to provide slips to house the

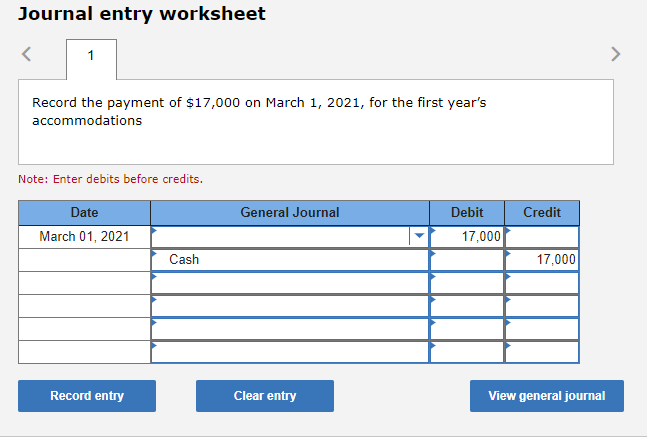

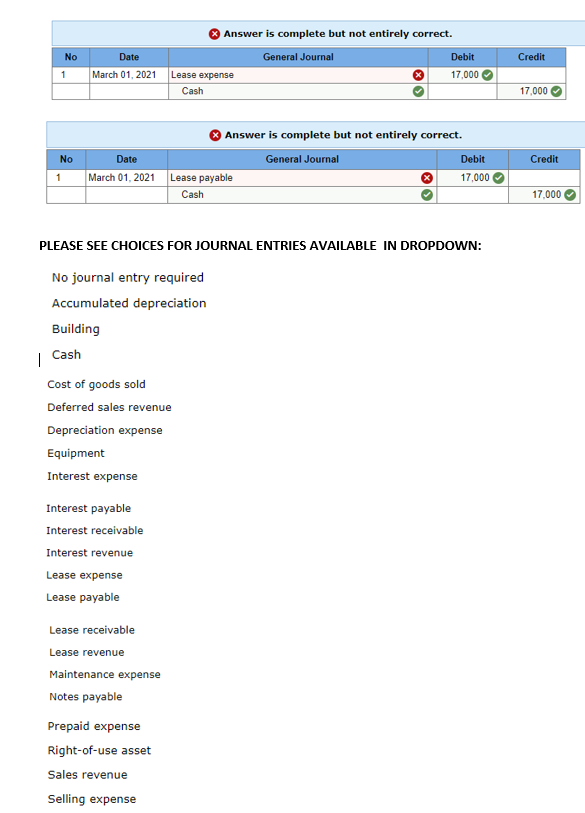

Warren Marina owns a large marina that contains numerous boat slips of various sizes. Warren contracts with boat owners to provide slips to house the customers boats. Lucky Fisherman Fleet contracted with Warren to provide space for four of its fishing boats. The contract specifies that Lucky Fishermans boats will be kept in identified slips in the marina. However, Warren has the right to shift the boats to other slips within its marina at its discretion, subject to the requirement to provide 45-foot slips per boat for a three-year period. Warren frequently rearranges its customers boats to meet the needs of new contracts. Costs of reallocating space is low relative to the benefits of being able to accommodate more customers and their specific requests. Lucky Fisherman Fleet paid $17,000 on March 1, 2021, for the first years accommodations. The market rate of interest is 7%. Required: Prepare the appropriate entry(s) for Lucky Fisherman Fleet at March 1, the commencement of the agreement. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started