Answered step by step

Verified Expert Solution

Question

1 Approved Answer

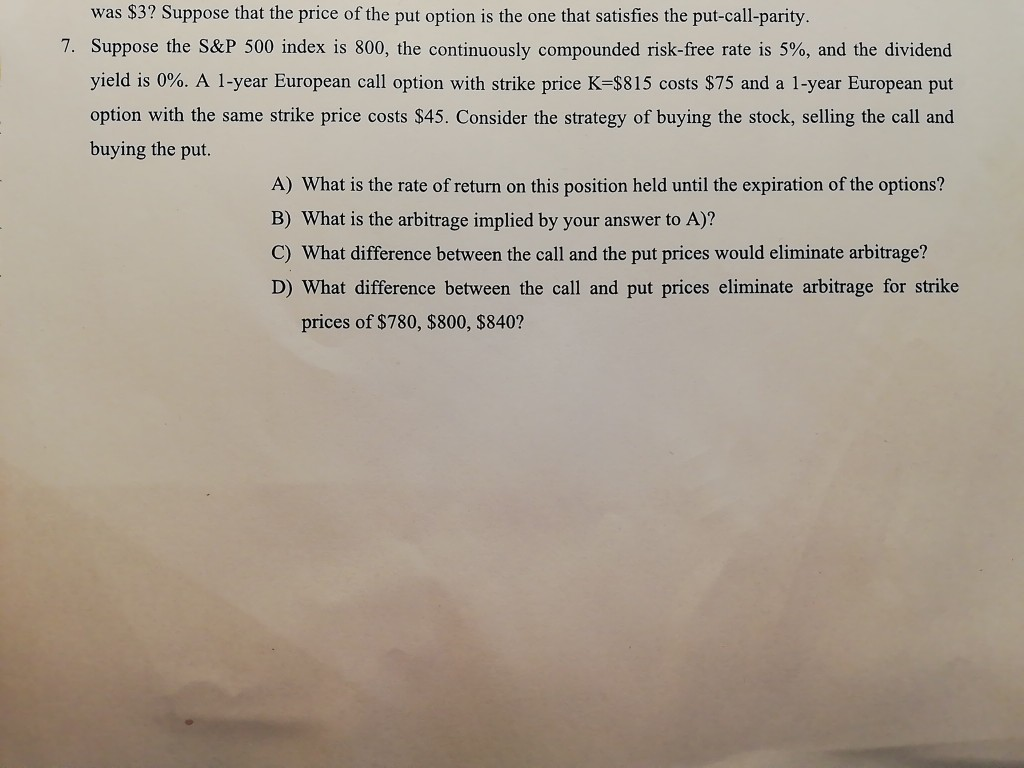

was $3? Suppose that the price of the put option is the one that satisfies the put-call-parity. 7. Suppose the S&P 500 index is 800,

was $3? Suppose that the price of the put option is the one that satisfies the put-call-parity. 7. Suppose the S&P 500 index is 800, the continuously compounded risk-free rate is 5%, and the dividend yield is 0%. A 1-year European call option with strike price K=$815 costs $75 and a 1-year European put option with the same strike price costs $45. Consider the strategy of buying the stock, selling the call and buying the put A) What is the rate of return on this position held until the expiration of the options? B) What is the arbitrage implied by your answer to A)? C) What difference between the call and the put prices would eliminate arbitrage? D) What difference between the call and put prices eliminate arbitrage for strike prices of $780, $800, $840

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started