Answered step by step

Verified Expert Solution

Question

1 Approved Answer

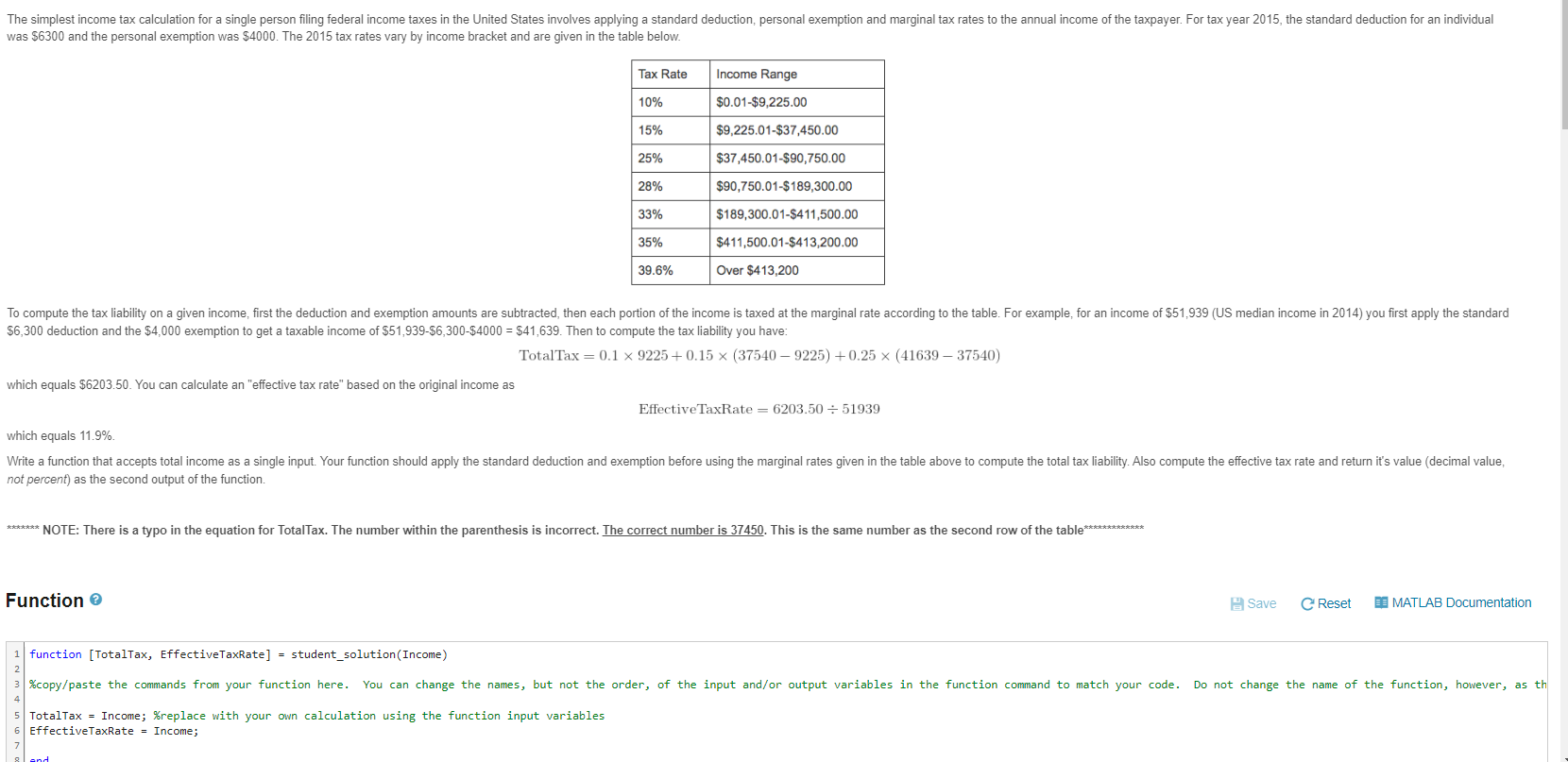

was $ 6 3 0 0 and the personal exemption was $ 4 0 0 0 . The 2 0 1 5 tax rates vary

was $ and the personal exemption was $ The tax rates vary by income bracket and are given in the table below.

$ deduction and the $ exemption to get a taxable income of $$$$ Then to compute the tax liability you have:

TotalTax

which equals $ You can calculate an "effective tax rate" based on the original income as

EffectiveTaxRate

which equals

not percent as the second output of the function.

Function

function TotalTax EffectiveTaxRate studentsolutionIncome

TotalTax Income; replace with your own calculation using the function input variables

EffectiveTaxRate Income;USE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started