Was having difficulty with this practice problem set. Could you please help? Thank you so much!

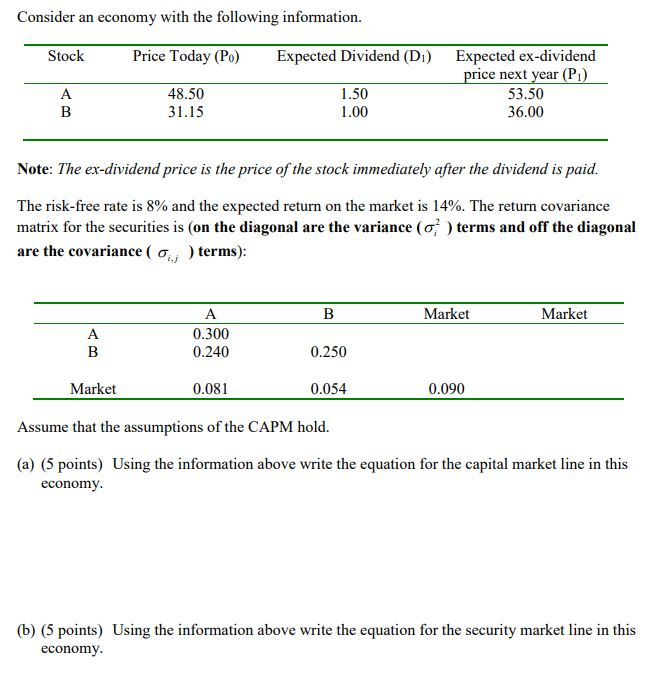

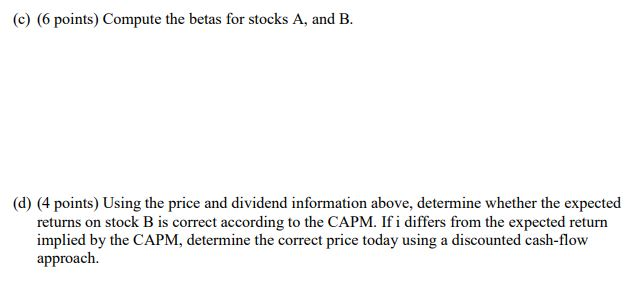

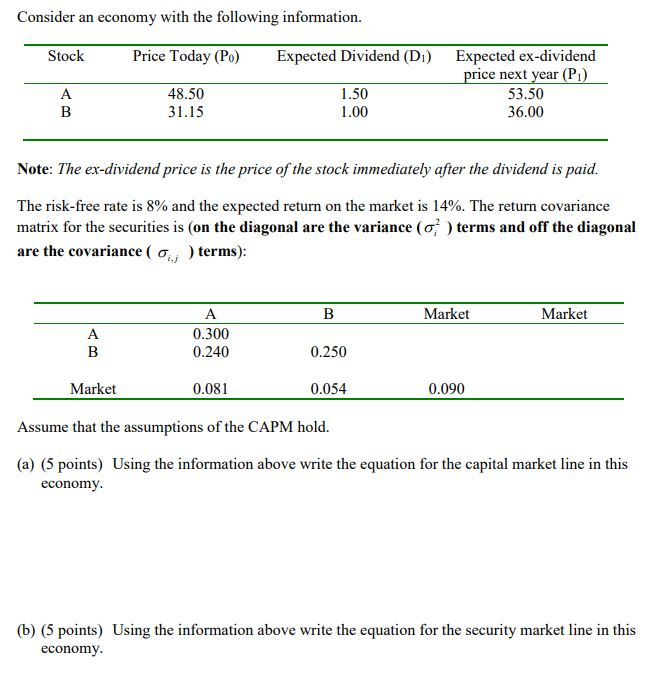

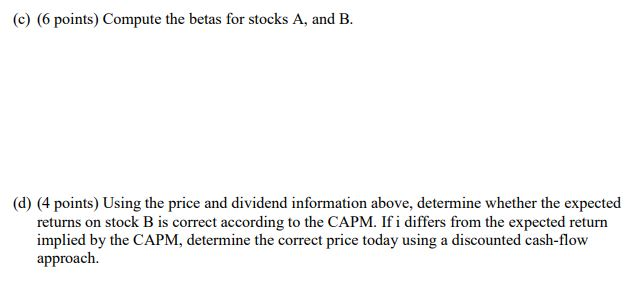

Consider an economy with the following information. Stock Price Today (PC) Expected Dividend (D) Expected ex-dividend price next year (P) 1.50 53.50 1.00 36.00 A B 48.50 31.15 Note: The ex-dividend price is the price of the stock immediately after the dividend is paid. The risk-free rate is 8% and the expected return on the market is 14%. The return covariance matrix for the securities is (on the diagonal are the variance (67 ) terms and off the diagonal are the covariance ( 0, ) terms): B Market Market A B A 0.300 0.240 0.250 Market 0.081 0.054 0.090 Assume that the assumptions of the CAPM hold. (a) (5 points) Using the information above write the equation for the capital market line in this economy. (b) (5 points) Using the information above write the equation for the security market line in this economy. (c) (6 points) Compute the betas for stocks A, and B. (d) (4 points) Using the price and dividend information above, determine whether the expected returns on stock B is correct according to the CAPM. If i differs from the expected return implied by the CAPM, determine the correct price today using a discounted cash-flow approach. Consider an economy with the following information. Stock Price Today (PC) Expected Dividend (D) Expected ex-dividend price next year (P) 1.50 53.50 1.00 36.00 A B 48.50 31.15 Note: The ex-dividend price is the price of the stock immediately after the dividend is paid. The risk-free rate is 8% and the expected return on the market is 14%. The return covariance matrix for the securities is (on the diagonal are the variance (67 ) terms and off the diagonal are the covariance ( 0, ) terms): B Market Market A B A 0.300 0.240 0.250 Market 0.081 0.054 0.090 Assume that the assumptions of the CAPM hold. (a) (5 points) Using the information above write the equation for the capital market line in this economy. (b) (5 points) Using the information above write the equation for the security market line in this economy. (c) (6 points) Compute the betas for stocks A, and B. (d) (4 points) Using the price and dividend information above, determine whether the expected returns on stock B is correct according to the CAPM. If i differs from the expected return implied by the CAPM, determine the correct price today using a discounted cash-flow approach