Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Was the junior accountant's analysis correct? Why or why not? Lessee Ltd., a British company that applies IFRSs, leased equipment from Lessor Inc. on January

Was the junior accountant's analysis correct? Why or why not?

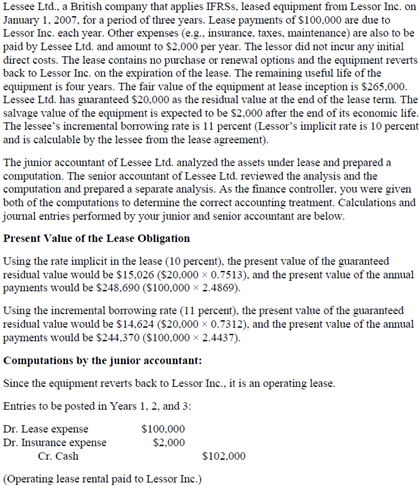

Lessee Ltd., a British company that applies IFRSs, leased equipment from Lessor Inc. on January 1, 2007, for a period of three years. Lease payments of $100,000 are due to Lessor Inc. each year. Other expenses (e.g.. insurance, taxes, maintenance) are also to be paid by Lessee Ltd. and amount to $2,000 per year. The lessor did not incur any initial direct costs. The lease contains no purchase or renewal options and the equipment reverts back to Lessor Inc. on the expiration of the lease. The remaining useful life of the equipment is four years. The fair value of the equipment at lease inception is $265,000. Lessee Ltd. has guaranteed $20,000 as the residual value at the end of the lease term. The salvage value of the equipment is expected to be $2,000 after the end of its economic life. The lessee's incremental borrowing rate is 11 percent (Lessor's implicit rate is 10 percent and is calculable by the lessee from the lease agreement). The junior accountant of Lessee Ltd. analyzed the assets under lease and prepared a computation. The senior accountant of Lessee Ltd. reviewed the analysis and the computation and prepared a separate analysis. As the finance controller, you were given both of the computations to determine the correct accounting treatment. Calculations and journal entries performed by your junior and senior accountant are below. Present Value of the Lease Obligation Using the rate implicit in the lease (10 percent), the present value of the guaranteed residual value would be $15,026 ($20,000 x 0.7513). and the present value of the annual payments would be $24S.690 ($100,000 x 2.4869). Using the incremental borrowing rate (11 percent), the present value of the guaranteed residual value would be $14,624 ($20,000 x 0.7312). and the present value of the annual payments would be $244,370 ($100,000 x 2.4437). Computations by the Junior accountant: Since the equipment reverts back to Lessor Inc., it is an operating lease. Entries to be posted in Years 1, 2, and 3: Dr. Lease expense $100.000 Dr. Insurance expense $2,000 Cr. Cash $102,000 (Operating lease rental paid to Lessor Inc.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started