Question

Wasting Cash, Inc. has significant excess cash and purchased an Apple 4-year, 2.5% Coupon, $150,000 par value bond. The Apple bond pays interest annually and

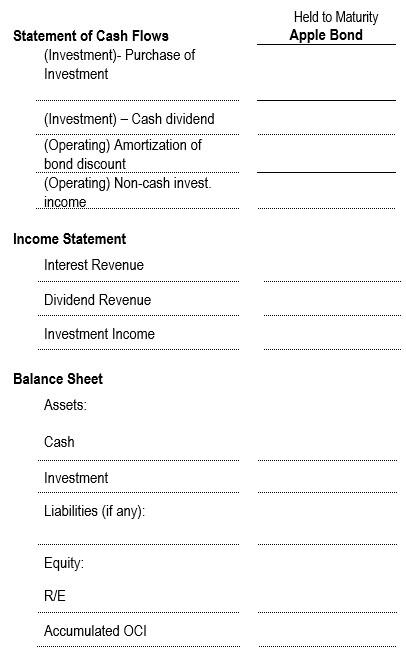

Wasting Cash, Inc. has significant excess cash and purchased an Apple 4-year, 2.5% Coupon, $150,000 par value bond. The Apple bond pays interest annually and was purchased when the YTM (bond market rate of interest) was 3.75%. Wasting Cash, Inc. paid $143,154 for the Apple bond on January 1 of this year and intends to hold the bond until maturity. Wasting Cash, Inc.s year end is December 31. At December 31 of this year, the fair value of the Apple bond was $149,500. How does this transaction affect Wasting Cash, Inc.s financial statement in year one of the purchase (use attached template)? [Hint; this is a hold to maturity fixed income security so you should create a bond amortization schedule for the Apple Bond to correctly determine the financial statement amounts.]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started