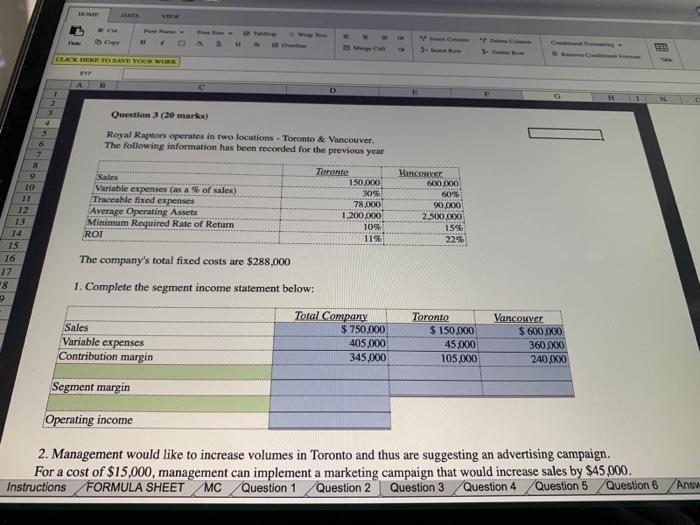

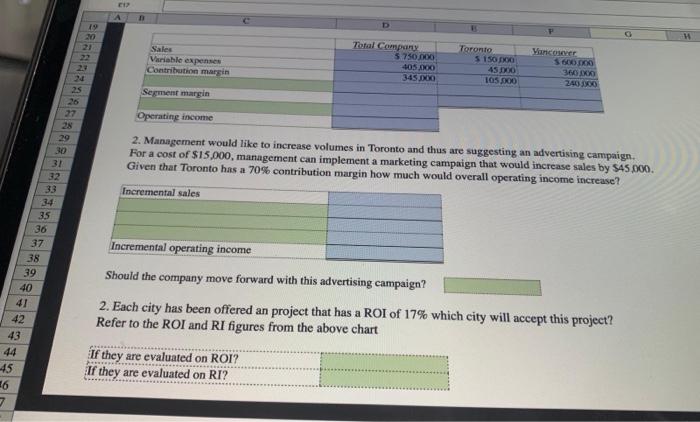

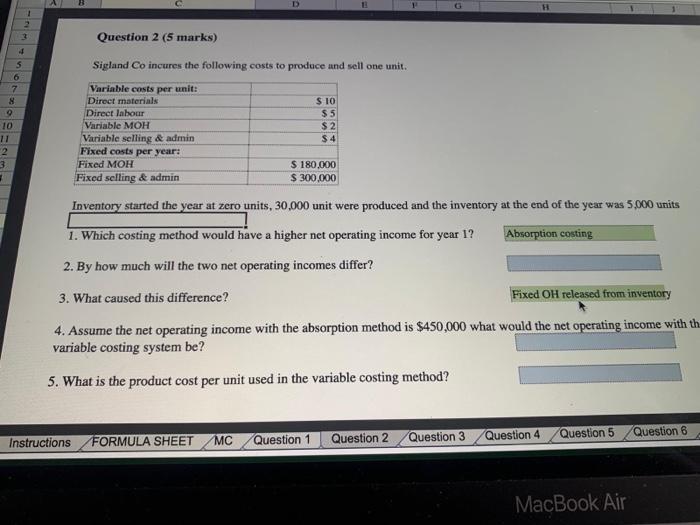

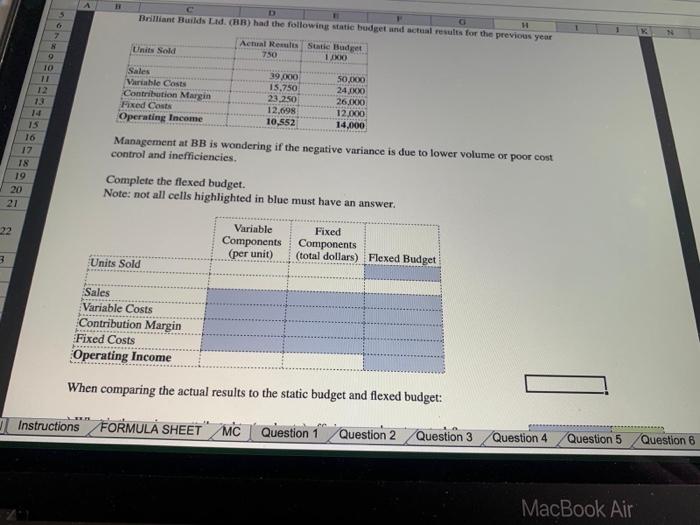

Wat CEREK HERE TO SAVE YOUR WORK D 1 TE 8 Question 3 (20 marks) Royal Raptors operates in two locations - Toronto & Vancouver The following information has been recorded for the previous year Toronto Sales 150.000 Variable expenses (as a % of sales) 30% Traceable fixed expenses 78,000 Average Operating Assets 1.200,00 Minimum Required Rate of Return 10% ROI 1196 Vancouver 600 000 609 90.000 2.500.000 15% 22% 10 11 12 13 14 15 16 17 8 2 The company's total fixed costs are $288,000 1. Complete the segment income statement below: Sales Variable expenses Contribution margin Total Company $ 750.000 405.000 345.000 Toronto $ 150.000 45.000 105.000 Vancouver $ 600.000 360.000 240.000 Segment margin Operating income 2. Management would like to increase volumes in Toronto and thus are suggesting an advertising campaign. For a cost of $15,000, management can implement a marketing campaign that would increase sales by $45,000. Instructions FORMULA SHEET MC Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Answ 19 Sales Variable expenses Contribution margin Total Company 5 750.000 4050 345JXO Toronto 5 15000 45 00 IOS SOD Vancouver S60000 Segment margin Operating income 27 28 29 2. Management would like to increase volumes in Toronto and thus are suggesting an advertising campaign. For a cost of $15,000, management can implement a marketing campaign that would increase sales by $45.000. Given that Toronto has a 70% contribution margin how much would overall operating income increase? 31 33 Incremental sales 35 36 37 38 39 40 Incremental operating income Should the company move forward with this advertising campaign? 2. Each city has been offered an project that has a ROI of 17% which city will accept this project? Refer to the ROI and RI figures from the above chart 42 43 If they are evaluated on ROI? If they are evaluated on RI? 45 26 7 H Question 2 (5 marks) + 5 6 7 8 . 10 11 2 3 Sigland Co incures the following costs to produce and sell one unit. Variable costs per unit: Direct materials $ 10 Direct labour $5 Variable MOH $ 2 Variable selling & admin $ 4 Fixed costs per year: Fixed MOH $ 180.000 Fixed selling & admin $ 300.000 Inventory started the year at zero units, 30.000 unit were produced and the inventory at the end of the year was 5.000 units 1. Which costing method would have a higher net operating income for year 1? Absorption costing 2. By how much will the two net operating incomes differ? 3. What caused this difference? Fixed OH released from inventory 4. Assume the net operating income with the absorption method is $450,000 what would the net operating income with th variable costing system be? 5. What is the product cost per unit used in the variable costing method? Instructions Question 1 FORMULA SHEET MC Question 2 Question 4 Question 3 Question 5 Question 6 MacBook Air G D 1 Brilliant Builds Lid. (HR) had the following statie budget and actual results for the previous year Actual Real State Budget Units Sold 750 KO Sales Variable Costs Contribution Margin Fixed Costs Operating Income 39,000 15.750 23.250 12.698 10,552 50.000 24 ) 26.00 12.000 14.000 TO 11 12 13 14 15 16 17 18 19 20 21 Management at BB is wondering if the negative variance is due to lower volume or poor cost control and inefficiencies. Complete the flexed budget. Note: not all cells highlighted in blue must have an answer. 22 Variable Components (per unit) Fixed Components (total dollars) Flexed Budget 3 Units Sold Sales Variable Costs Contribution Margin Fixed Costs Operating Income When comparing the actual results to the static budget and flexed budget: Instructions FORMULA SHEET" MC Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 MacBook Air