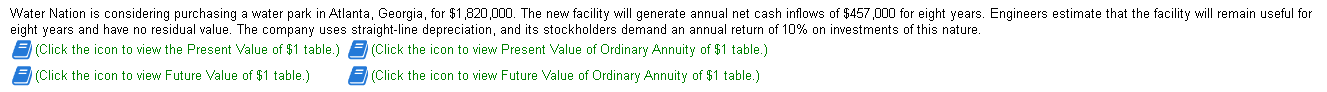

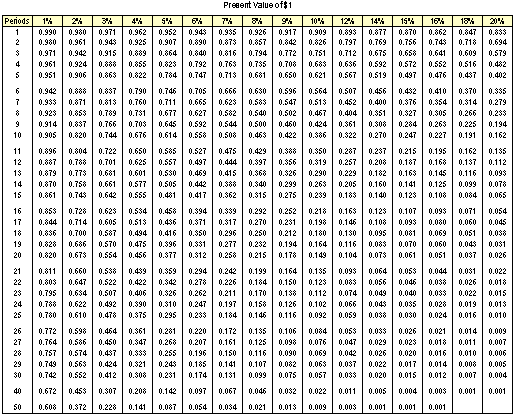

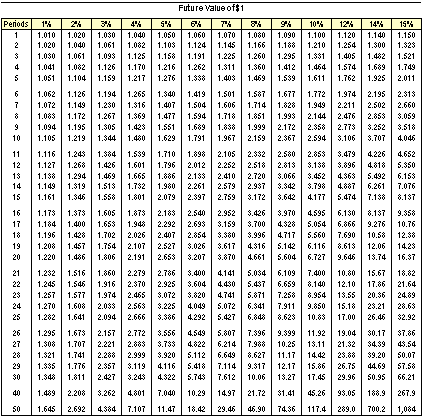

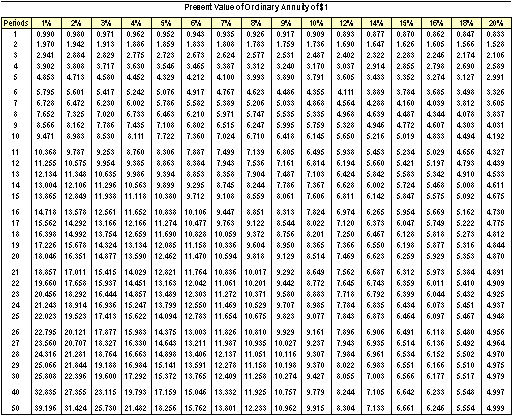

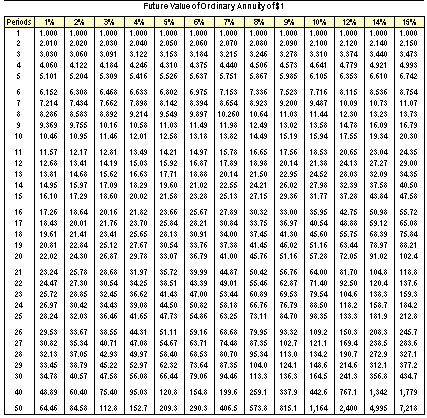

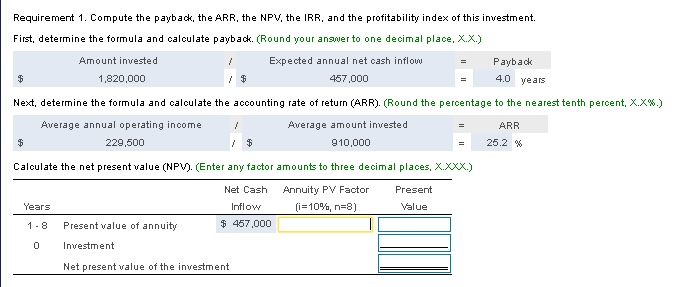

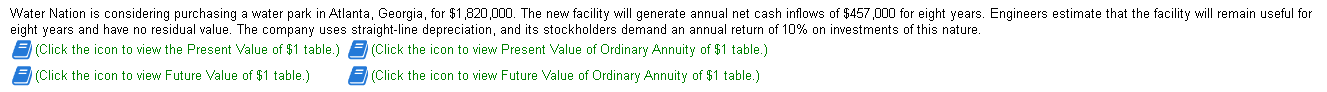

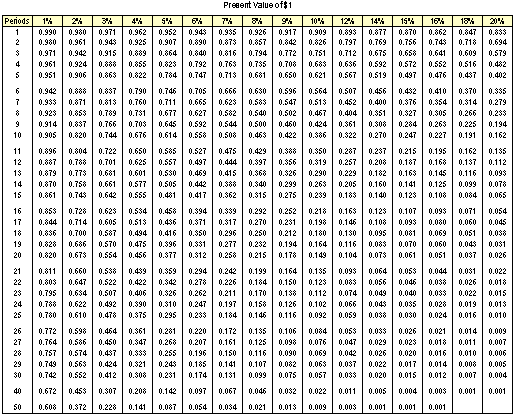

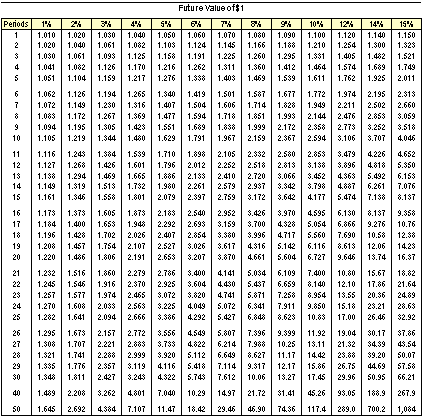

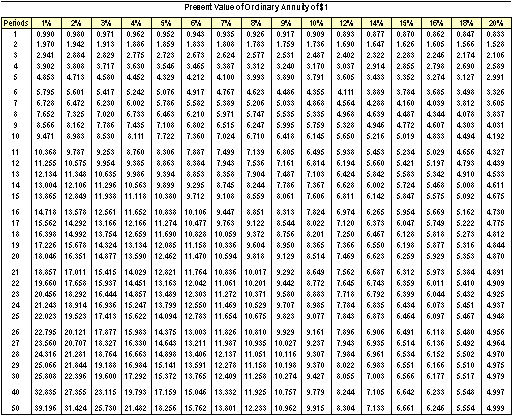

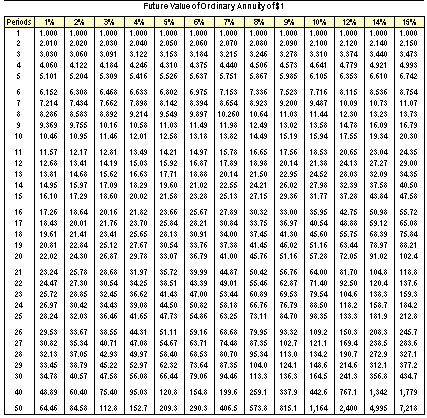

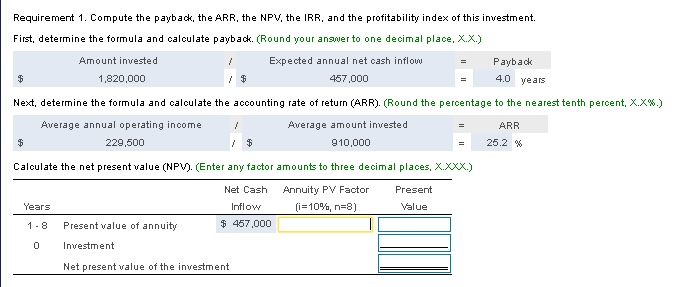

Water Nation is considering purchasing a water park in Atlanta, Georgia, for $1,820,000. The new facility will generate annual net cash inflows of $457,000 for eight years. Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight-line depreciation, and its stockholders demand an annual return of 10% on investments of this nature. (Click the icon to view the Present Value of $1 table.) 3 (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) Click the icon to view Future Value of Ordinary Annuity of $1 table.) Preeent Value of 1 Periods 1% 2% 3% 4% 5% 10% 10% 20% 0990 10% 0.909 0.826 12% 0.89 15% 0.870 0.062 0.900 8% 9% 0.9260.917 0.857 0.794 0.772 0.735 0.708 0.955 0.87$ 0.816 0.768 10% 0.847 0.718 0.609 0.516 0.675 0.694 0.579 0.482 0.402 0.885 0.279 0.194 0.162 0.155 0.112 0.368 0.383 0.340 0.862 0.315 0.10% 0.070 0.065 0.054 0.045 0.317 0.296 0.051 0.043 0.026 0.022 0.019 0.031 0.026 0.022 0.018 0.015 0.018 0.010 0.009 0.007 0.150 0.006 0.005 0.004 0.001 Future Yalue of$1 Pes 12 36% $ 10 T 92 98 10% 12% 14% 19% 1.020 1.00 1.082 1.114 1.210 1.254 1.500 1.040 1.061 1.1581.191 1.331 1.521 1.145 1.225 1.311 1.403 1.166 1.260 1.360 1.469 1.295 1.412 1.539 1.005 1.574 1.749 2,011 1.611 1.925 1.104 1.126 1.14 1 501 1.587 1.677 1.828 2.318 1.714 2.542 1.504 1.594 1.993 1.172 1.195 1.551 1.606 1.718 1.838 1.967 2.105 1.651 1.999 2.172 2.85$ 3.252 3.707 2.159 1.050 1.041 1.051 1.062 1.072 1.08$ 1.094 1.105 1.116 1.127 1.188 1.149 1.161 1.178 1.184 1.196 1.208 2.367 3.059 3.510 4,046 4662 5.850 2332 4.226 6.1$ 1.314 1.346 1.875 1.400 6.261 7.138 8.137 1.605 9.276 12.06 7,076 0.137 9.858 10.76 12.88 14.23 16.37 18.82 21.64 24.89 28.63 1.220 1.232 1.245 1.257 1.270 1.282 1.295 32.32 37.86 43.54 $0.07 $7.50 66.21 287.3 76021,414 4% 9% 10% 10% 0.960 Present Value of ordinary Annuity of$1 0% 10% 0.945 0.955 0.917 0.909 1.868 1.789 1.759 1.756 2.551 2.487 $.$12 3.170 12% 0.893 1.690 14% 0.877 15% 0.870 362 2 577 2412 SSAT 3.037 2.174 2.690 20% 0.833 1.526 2.106 2.589 2.991 3.326 3.605 3.887 6.710 1.159 7.904 6.628 9.712 978 7.120 7.256 7.366 4.844 4,870 7.556 12.134 11.346 8.85$ 8.358 18.004 12.106 11.29 10.568 9.899 9.295 8.745 8.244 18.865 12.849 11.118 10.880 9.108 8.559 14.718 18.578 12.561 11.652 10.888 10.106 9.447 8.851 15.862 14.292 13.166 12.166 11.274 10.4779.763 9.122 16.898 14.992 13.754 12.659 11.690 10.828 10.059 9.872 17.226 15.678 14.324 18.134 12.085 11.158 10.336 16.351 14.877 13.590 12.462 11.470 10.5949.818 17.011 15.415 14.029 12.821 11.764 10.836 10.017 15.937 14.451 13.163 12.042 11.061 10.201 16.444 14.857 13.439 12.303 11.272 10.371 16.956 15.247 13.799 12.550 11.459 10.529 9.707 17.418 15.622 14.094 12.783 11.654 10.675 9.823 20.121 17.877 15.983 14.375 13.00 11.826 10.810 9.929 18.327 16.330 14.643 13.211 11.987 10.935 10.027 18.764 16.663 14.898 13. 6 12.137 1 11.051 10.116 21.844 19.18% 16.984 15.141 13.591 12.278 11.15 10.198 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 $2.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 39.196 51.44 25.750 21.42 18.286 15.762 13.01 12.285 10 2 7.718 4.925 7.784 Future Value of Ordinary Annuity of$1 S": 4.505 4.575 5.4$$ 2.120 ,4 3 440 4.54] 4779 | 4.221 | 499 5.16] 6.35 ) 6.611 | 6.742 7716 754 11.07 12.73 14.78 15.79 17.55 20.0 map 7.1 7.55 SA 42 10.260 11.3% 12. 13. 14.49 15. 15.65 = 13.02 15.19 17.56 20.14 22.95 | me smm E - = 14.68 15.6 1997 29.00 4.50 . 1 21.50 24.21 27.15 - - 6.0 5.39 - 1. - 91.02 51.15 57.2 64.00 71.40 50 | 75.4 :21 | 102.4 11. 17.6 159. 1.70 10. 12.4 1046 158.7 142 212 -- , 71 : 1.7 4% | T1 Requirement 1. Compute the payback, the ARR, the NPV, the IRR, and the profitability index of this investment. First, determine the formula and calculate payback. (Round your answer to one decimal place, X.X.) = Amount invested 1,820,000 Expected annual net oash inflow 467,000 Payback 4.0 years Next, determine the formula and calculate the accounting rate of return (ARR). (Round the peroentage to the nearest tenth percent, X.XX.) ARR 25.2 % Average annual operating income 1 Average amount invested = 229,500 910,000 = Caloulate the net present value (NPV). (Enter any factor amounts to three decimal places, X.XXX.) Net Cash Annuity PV Factor Present Years Inflow (i=10%, n=8) Value 1-8 Present value of annuity $ 457,000 0 Investment Net present value of the investment