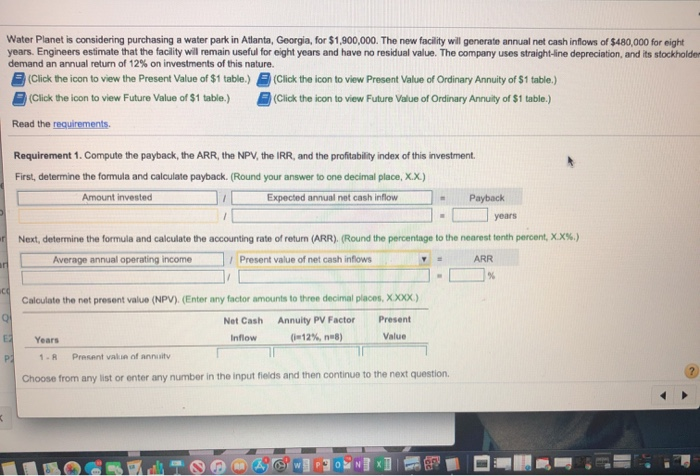

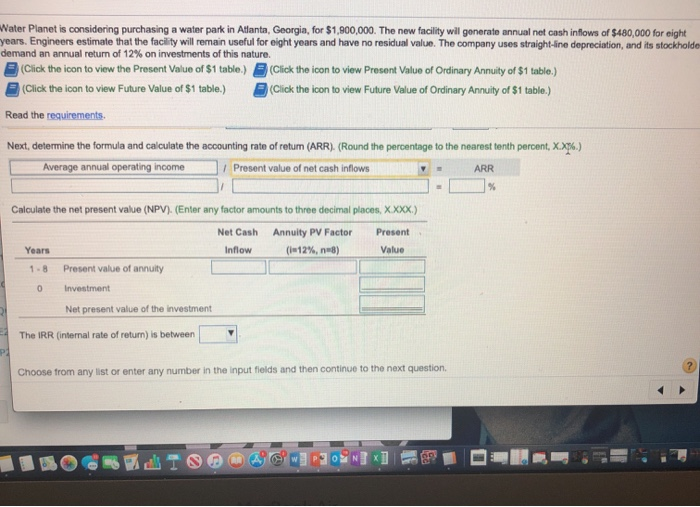

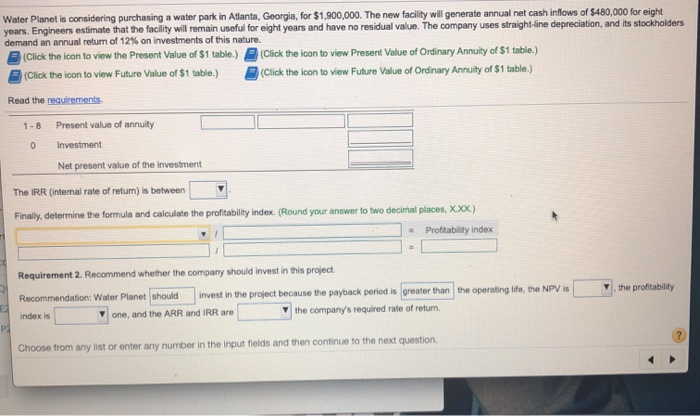

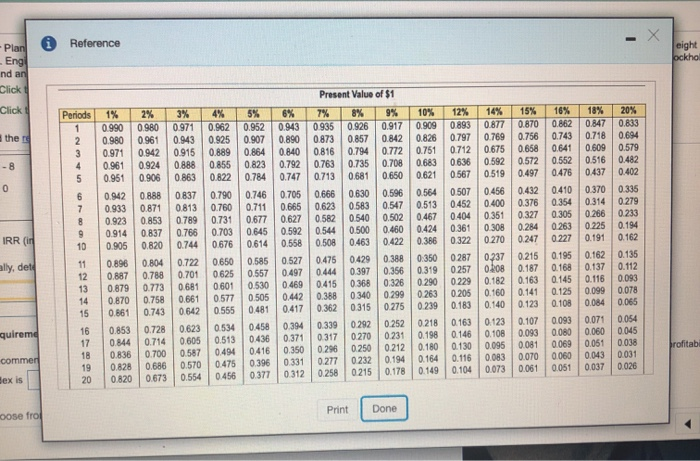

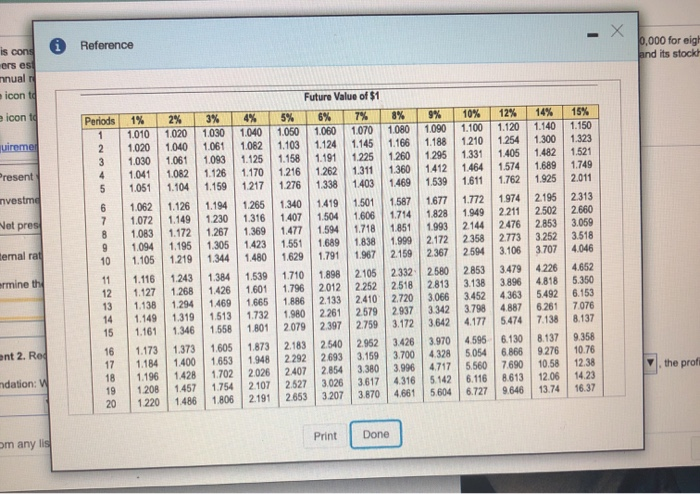

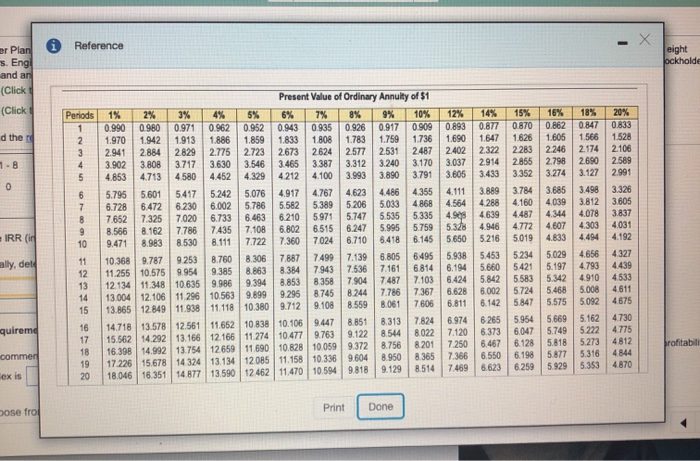

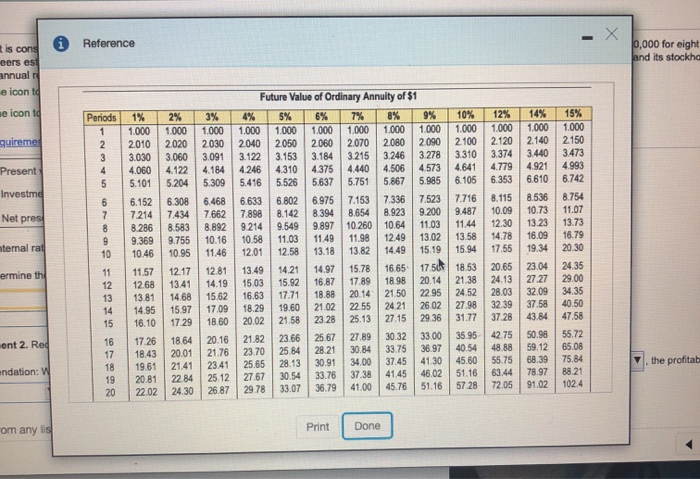

Water Planet is considering purchasing a water park in Atlanta, Georgia, for $1,900,000. The new facility will generate annual net cash inflows of $480,000 for eight years. Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight-line depreciation, and its stockholde demand an annual return of 12% on investments of this nature. (Click the icon to view the Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table. (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements Requirement 1. Compute the payback, the ARR, the NPV, the IRR, and the profitability index of this investment First, determine the formula and calculate payback. (Round your answer to one decimal place, X.X.) Amount invested Expected annual net cash inflow Payback years Next, determine the formula and calculate the accounting rate of return (ARR), (Round the percentage to the nearest tenth percent, XX%) Average annual operating income Present value of net cash inflows ARR Calculate the net present value (NPV). (Enter any factor amounts to three decimal places, X.XXX.) Net Cash Inflow Annuity PV Factor (12%, nes) Present Value Years 1. Procent van of annut ? Choose from any list or enter any number in the input fields and then continue to the next question 110R 230 :02N SID E- Water Planet is considering purchasing a water park in Atlanta, Georgia, for $1,900,000. The new facility wil generate annual net cash infows of $480,000 for eight years. Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight-line depreciation, and its stockholde demand an annual return of 12% on investments of this nature. (Click the icon to view the Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table. (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements Next, determine the formula and calculate the accounting rate of retum (ARR) (Round the percentage to the nearest tenth percent, X.XX%.) Average annual operating income / Present value of net cash inflows ARR Calculate the net present value (NPV). (Enter any factor amounts to three decimal places, X.XXX.) Present Net Cash Inflow Annuity PV Factor (112%, ne8) Years Value 1.8 Present value of annuity 0 Investment Net present value of the investment The IRR (internal rate of return) is between Choose from any list or enter any number in the input fields and then continue to the next question Water Planet is considering purchasing a water park in Atlanta, Georgia, for $1,900,000. The new facility will generate annual net cash inflows of $480,000 for eight years. Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight-line depreciation, and its stockholders demand an annual return of 12% on investments of this nature (Click the icon to view the Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Read the requirements 1-8 Present value of annuity 0 Investment Net present value of the investment The IRR (intemal rate of return) is between Finally, determine the formula and calculate the profitability index. (Round your answer to two decimal places, XXX) = Profitability index Requirement 2. Recommend whether the company should invest in this project. the profitability Recommendation: Water Planet should invest in the project because the payback period is greater than the operating life, the NPV is index is one, and the ARR and IRR are the company's required rate of retur, Choose from any list or enter any number in the input fields and then continue to the next question. 0 Reference Plan Eng nd an Click Present Value of $1 Click Periods 15% 16% 18% I the 0935 0.873 0.816 0.763 0.926 0.857 0.794 0.735 0681 0.630 0.583 0.917 0.842 0.772 0.708 0.847 0.718 10% 0.909 0.826 0.751 0.683 0.621 14% 0.877 0.769 0.675 0.592 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.519 12% 0893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0287 0.540 1% 2% 0.990 0,980 0.9800.961 0.971 0942 0.961 0.924 0.951 0.906 0.942 0888 0.933 0.871 0.923 0.853 0.914 0.837 0.905 0.820 0.896 0.804 0.887 0.788 0.879 0.773 0.870 0.758 0.861 0.853 0.728 0.844 0.714 0.836 0.700 0.828 0.686 0.820 0.673 3% 4% 56% 0.971 0.962 0.952 0.943 0.943 0.925 0.9070.890 0.915 0.889 0.864 0.840 0.888 0.855 0.823 0.792 0.863 0.822 0.784 0.747 0.837 0.790 0.746 0.705 0.813 0.760 0.711 0.665 0.789 0.731 0.677 0.627 0.766 0.703 0.645 0.592 0.744 0676 0.614 0.558 0.722 0.650 0.585 0.701 0.625 0.557 0.497 0681 0 601 0.530 0.469 0.661 0.577 0.505 0.442 062 0.555 0.481 0.417 0.623 0.534 0.394 0.605 0.513 0.587 0.494 0.350 0.570 0.475 0.396 0.331 0.5540456 0.377 0.312 IRR ( 0.456 0.400 0.361 0.308 0.270 0.737 0.500 0463 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 ally, det 052 0.397 0.368 0229 0.078 0.743 0340 0.315 0292 0.270 0.250 0.108 0.093 0.080 0.112 0.093 0.066 0.054 0.045 0.038 0.031 0.026 quiremd 0436 0.371 0.416 0.071 0.060 0.061 0.043 0.037 0.069 commer 0232 0.060 0.051 ex is 0.215 ose fro Print Done is cong i Reference 0,000 for eig and its stock ers es nnual icon to icon to Future Value of $1 Periods 1 uiremed 1.100 1.210 1.070 1.145 1225 1.311 1.403 1.090 1.188 1 295 1412 1.539 1331 1.140 1.300 1.482 1.689 1.925 resent 1.120 1.254 1405 1.574 1.762 1.974 2211 2.476 nvestme 2.196 Net presi 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 1.898 2012 2.133 2261 2.397 2773 1% 2% 3% 1.010 1.020 1.030 1.020 1.0401.061 1.030 1.061 1.093 1.041 1.082 1.126 1.0511.104 1.159 1062 1.126 1.194 1.072 1.149 1230 1,083 1.172 1.267 1.094 1.195 1.305 1.105 1.219 1.344 1.116 12431384 1.127 1.2681.426 1.138 1469 1.149 1.319 1.513 1.161 1 346 1.558 1.373 1.605 1.400 1.653 1.196 1.428 1702 208 1.457 1.754 1.486 1.806 Hemal rat 5% 1.040 1050 1.0821.103 1.125 1.158 1.170 1.216 1217 1.276 1.265 1 340 1.316 1.407 1.369 1.477 1.423 1.551 1.480 1.629 1.539 1.710 1.601 1.796 1.665 1.886 1.732 1.980 2079 1.873 2.183 1.948 2292 2026 2407 2.107 2.191 1.501 1.606 1.718 1838 1.967 2105 2252 2410 2579 3.106 1.080 1.166 1260 1360 1.469 1.587 1714 1851 1.999 2.159 2332 2518 2.720 2937 3.172 3.426 3.700 3.996 4.316 4.661 1.150 1.323 1.521 1.749 2.011 2.313 2660 3.059 3.518 4,046 4.652 5.350 6.153 7.076 8.137 9.358 10.76 12.38 14.23 16.37 ermine the 2813 1.294 1801 2759 mnt 2. Rec 1.173 3.066 3.342 3.642 3.970 4.328 4717 5142 5604 6.130 866 1.184 2.952 3.159 3.380 3.617 3.870 7.138 8.137 9276 10.58 12.06 13.74 7690 the prof 2693 2854 3.026 3.207 ndation: 2527 8.613 1220 2653 9.646 6.727 many lis Print Done 0 Reference eight ockholde Plan 5. Eng and an (Click (Click Periods 9% 15% 12% 0893 0.877 0.862 0.847 20% 0.833 1.528 0.870 1626 2283 d the 2.589 6.00 7020 7435 IRR (id Present Value of Ordinary Annuity of 51 1% 2% 10% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 01909 1.970 1.942 1.913 1.886 1.859 1.833 1808 1.783 1.759 1.736 2.9412.8842829 | 2.775 2.723 2.673 2624 2.577 2.531 2.487 3.902 3.808 3.717 3.630 3.546 3.465 3.387 4.853 4713 4580 4452 4212 4.100 3.993 5.795 5.601 5417 4.917 4.767 4.623 6.728 6.472 6.230 5.786 5.582 5.3895206 7.652 7.325 6.733 6.463 6.210 5971 5.747 8.566 8.162 7.786 7.108 6.802 6.515 6.247 9.471 8.983 8.530 8.111 7.722 7.360 7024 10.368 9.787 9253 8.760 8.30678877499 6.495 11.255 10.575 9.954 9 385 8.8638.3847943 7536 6.814 7.161 12134 11.348 10 635 99869394 8.853 8 358 7.904 7487 13.004 12.106 11.296 10.563 9.899 7367 9.295 8.745 8.244 7.786 13 165 12 549 11 908 11 118 10 380 9.7129 108 8.559 8.0617600 14.718 13.578 12.561 11.652 10838 10.1069.447 8.851 8.313 11 274 10.477 9.122 15.56214 292 13.166 12 166 9.763 8.544 8.022 14.992 16 398 13.754 12659 11 690 10 828 10.059 9.372 8201 8.756 143241313412085 8.950 9.604 17226 15.678 11.158 10.336 8.365 8.046 16.35114877 13.590 12 462 11.470 10.594 9.129 8514 9.818 6.710 ally, dels 7.103 7824 quiremd commer 4870 ex is bose froll Print Done ] i Reference 0,000 for eight and its stockho is cong bers est annual iconto e icon to Periods 10% 960 quireme 2.120 1.000 2.140 3.440 4.921 6.610 Present Investme 3% 1.000 2030 3.091 4.184 5.309 6.468 7.662 8.892 10.16 11.46 1281 14.19 Net pres 15% 1.000 2.150 3473 4.993 6.742 8.754 11.07 13.73 16.79 1% 1.000 1.000 2.010 2020 3.0303.060 4.060 4.122 5.101 5.204 6.152 6.308 7.214 7.434 8.286 8.583 9.369 9.755 10.46 10.95 11.57 12.17 1268 13.41 13.81 14.68 14.95 15.97 16.10 17.29 17.26 18.64 18.43 20.01 21.41 8.115 10.09 12.30 mtemal rat Future Value of Ordinary Annuity of S1 4% 5% 1.000 1.000 1.000 1.000 1.000 1.000 2.040 2050 2060 2.070 2.080 2090 3.122 3.153 3.184 3.215 3.246 3.278 4246 4310 4.375 4.440 4.506 4.573 5.416 5.526 5.637 5.751 5,867 5.985 6.802 6.975 7.153 7.336 7.523 8.394 8.654 9.200 9.549 9.897 10.260 11.03 11.03 11.49 11.98 13.02 13.18 15.19 15.78 16.65 17.500 16.87 17.89 20.14 20.14 21.50 22.95 21.02 22.55 24 21 2602 27.15 29.36 30,32 33.00 33.75 36.97 34.00 37.45 41.30 41.45 46.02 45.76 51.16 SEN * 13.82 BONBOD S&S BBS 988 1.000 2.100 3.310 4.641 6.105 7.716 9.487 1144 13.58 15.94 18.53 21.38 24.52 27.98 31.77 35.95 40.54 45,60 51.16 57 28 ermine the B92889*8N 2567 20.16 27.89 $ && NESS* & ent 2. Red 55.28 ndation: the profitat so om any lis Print Done