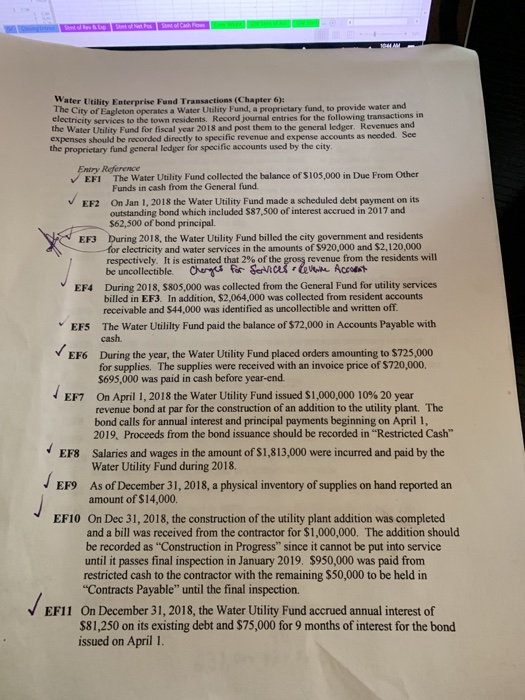

Water Utility Enterprise Fund Transactions (Chapter 6): The The City of Eagleton operates a Water Utility Fund, a proprietary fund, to provide water and electricity services to the town residents. Record journal entries for the following transactions in the Water Utility Fund for fiscal year 2018 and post them to the general ledger. Revenues and expenses should be recorded directly to specific revenue and expense accounts as the proprietary fund general ledger for specific accounts used by the city EFI The Water Utility Fund collected the balance of $105,000 in Due From Other Funds in cash from the General fund EF2 On Jan 1,2018 the Water Utility Fund made a scheduled debt payment on its outstanding bond which included S87,500 of interest accrued in 2017 and $62,500 of bond principal. During 2018, the Water Utility Fund billed the city government and residents for electricity and water services in the amounts of $920,000 and $2,120,000 respectively. It is estimated that 2% of the gross revenue from the residents will be uncollectible Cergs for Services Accos+ EF3 EF4 During 2018, $805,000 was collected from the General Fund for utility services EFS The Water Utililty Fund paid the balance of $72,000 in Accounts Payable with EF6 During the year, the Water Utility Fund placed orders amounting to $725,000 billed in EF3. In addition, $2,064,000 was collected from resident accounts receivable and $44,000 was identified as uncollectible and written off cash. The supplies were received with an invoice price of $720,000. for supplies. $695,000 was paid in cash before year-end On April 1, 2018 the Water Utility Fund issued $1,000,000 10% 20 year EF7 revenue bond at par for the construction of an addition to the utility plant. The bond calls for annual interest and principal payments beginning on April 1, 2019, Proceeds from the bond issuance should be recorded in "Restricted Cash Salaries and wages in the amount of $1,813,000 were incurred and paid by the Water Utility Fund during 2018. EF8 EF9 As of December 31, 2018, a physical inventory of supplies on hand reported an amount of $14,000 EF10 On Dec 31, 2018, the construction of the utility plant addition was completed and a bill was received from the contractor for $1,000,000. The addition should be recorded as "Construction in Progress" since it cannot be put into service until it passes final inspection in January 2019. $950,000 was paid from restricted cash to the contractor with the remaining $50,000 to be held in "Contracts Payable" until the final inspection. On December 31, 2018, the Water Utility Fund accrued annual interest of $81,250 on its existing debt and $75,000 for 9 months of interest for the bond EF11 issued on April 1. Water Utility Enterprise Fund Transactions (Chapter 6): The The City of Eagleton operates a Water Utility Fund, a proprietary fund, to provide water and electricity services to the town residents. Record journal entries for the following transactions in the Water Utility Fund for fiscal year 2018 and post them to the general ledger. Revenues and expenses should be recorded directly to specific revenue and expense accounts as the proprietary fund general ledger for specific accounts used by the city EFI The Water Utility Fund collected the balance of $105,000 in Due From Other Funds in cash from the General fund EF2 On Jan 1,2018 the Water Utility Fund made a scheduled debt payment on its outstanding bond which included S87,500 of interest accrued in 2017 and $62,500 of bond principal. During 2018, the Water Utility Fund billed the city government and residents for electricity and water services in the amounts of $920,000 and $2,120,000 respectively. It is estimated that 2% of the gross revenue from the residents will be uncollectible Cergs for Services Accos+ EF3 EF4 During 2018, $805,000 was collected from the General Fund for utility services EFS The Water Utililty Fund paid the balance of $72,000 in Accounts Payable with EF6 During the year, the Water Utility Fund placed orders amounting to $725,000 billed in EF3. In addition, $2,064,000 was collected from resident accounts receivable and $44,000 was identified as uncollectible and written off cash. The supplies were received with an invoice price of $720,000. for supplies. $695,000 was paid in cash before year-end On April 1, 2018 the Water Utility Fund issued $1,000,000 10% 20 year EF7 revenue bond at par for the construction of an addition to the utility plant. The bond calls for annual interest and principal payments beginning on April 1, 2019, Proceeds from the bond issuance should be recorded in "Restricted Cash Salaries and wages in the amount of $1,813,000 were incurred and paid by the Water Utility Fund during 2018. EF8 EF9 As of December 31, 2018, a physical inventory of supplies on hand reported an amount of $14,000 EF10 On Dec 31, 2018, the construction of the utility plant addition was completed and a bill was received from the contractor for $1,000,000. The addition should be recorded as "Construction in Progress" since it cannot be put into service until it passes final inspection in January 2019. $950,000 was paid from restricted cash to the contractor with the remaining $50,000 to be held in "Contracts Payable" until the final inspection. On December 31, 2018, the Water Utility Fund accrued annual interest of $81,250 on its existing debt and $75,000 for 9 months of interest for the bond EF11 issued on April 1