Answered step by step

Verified Expert Solution

Question

1 Approved Answer

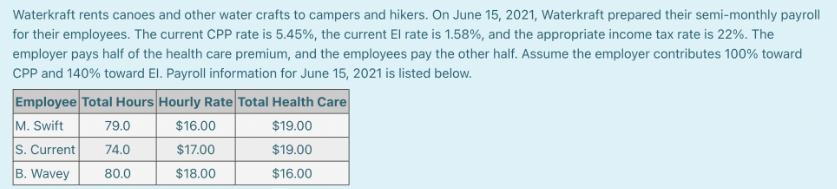

Waterkraft rents canoes and other water crafts to campers and hikers. On June 15, 2021, Waterkraft prepared their semi-monthly payroll for their employees. The

Waterkraft rents canoes and other water crafts to campers and hikers. On June 15, 2021, Waterkraft prepared their semi-monthly payroll for their employees. The current CPP rate is 5.45%, the current El rate is 1.58%, and the appropriate income tax rate is 22%. The employer pays half of the health care premium, and the employees pay the other half. Assume the employer contributes 100% toward CPP and 140% toward El. Payroll information for June 15, 2021 is listed below. Employee Total Hours Hourly Rate Total Health Care M. Swift 79.0 $19.00 S. Current 74.0 $19.00 B. Wavey 80.0 $16.00 $16.00 $17.00 $18.00 a) Calculate gross and net pay for each employee. b) Calculate the employer contributions. c) Prepare the payroll journal entries for June 15, 2021 to record the salaries payable to the employees and accrue the employer contributions. d) Prepare the entry to pay the employees on June 17, 2021. e) Prepare the entry to pay the liability to the health insurance company on June 30, 2021. f) Prepare the entry to pay the liabilities to the government on July 15, 2021.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Gross and Net Pay for Each Employee Employee M Swift Total Hours 79 Hourly Rate 16 Total Health Care 19 Gross Pay Total Hours Hourly Rate 79 hours 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started