Adams DJ Services has three employees who work on an hourly basis and are paid weekly. The

Question:

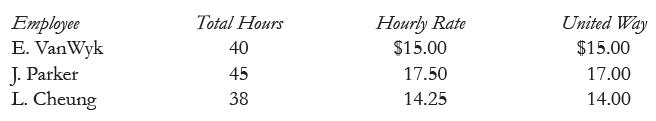

Adam’s DJ Services has three employees who work on an hourly basis and are paid weekly. The current CPP rate is 5.10%; the current EI rate is 1.62%; and the appropriate income tax rate is 23%. Each employee contributes a portion of their pay to the United Way. Payroll information for the week ending August 20, 2020 is listed below. (No employee has reached the maximum for CPP and EI deductions.)

Required

a. Calculate gross and net pay for each employee (employees are paid overtime rate of 1.5 after working 40 hours), and complete the payroll register. Remember to properly account for the $3,500 exemption.

b. Prepare the journal entry to record this payroll.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 9780135222416

14th Canadian Edition

Authors: Jeffrey Slater, Debra Good