Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Waterway & Blossom Fabricators produces commemorative bricks that organizations use for fundraising projects. Daniel Waterway, the company's vice president of marketing, has prepared the

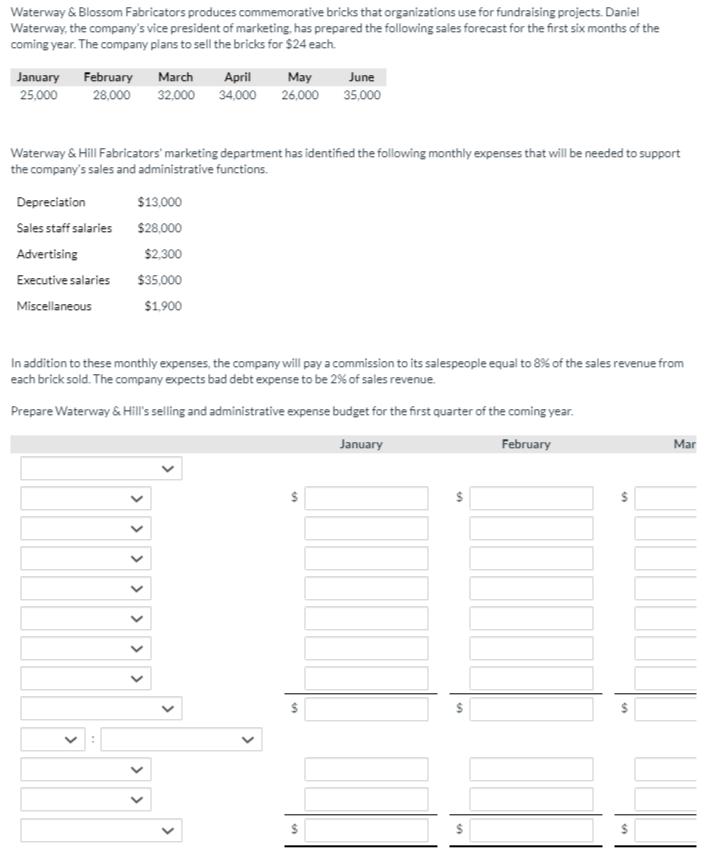

Waterway & Blossom Fabricators produces commemorative bricks that organizations use for fundraising projects. Daniel Waterway, the company's vice president of marketing, has prepared the following sales forecast for the first six months of the coming year. The company plans to sell the bricks for $24 each. June January February March April May 25,000 28,000 32,000 34,000 26,000 35,000 Waterway & Hill Fabricators' marketing department has identified the following monthly expenses that will be needed to support the company's sales and administrative functions. Depreciation $13,000 Sales staff salaries $28,000 Advertising $2,300 Executive salaries $35,000 Miscellaneous $1,900 In addition to these monthly expenses, the company will pay a commission to its salespeople equal to 8% of the sales revenue from each brick sold. The company expects bad debt expense to be 2% of sales revenue. Prepare Waterway & Hill's selling and administrative expense budget for the first quarter of the coming year. January February Mar S 50 $ S $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Selling and administrative expenses budget January Februa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started