Waterway Company is considering a capital investment of $193,500 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $12,771 and $45,000, respectively. Waterway has a 12% cost of capital rate, which is the required rate of return on the investment.

(a) Compute the cash payback period. (Round answer to 1 decimal place, e.g. 10.5.)

| Cash payback period | | ____________years | |

Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 10.52%.)

| Annual rate of return | | ______________ % | |

(b) Using the discounted cash flow technique, compute the net present value. (If the net present value is negative, use either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round answer for present value to 0 decimal places, e.g. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

| Net present value | | ______________ |

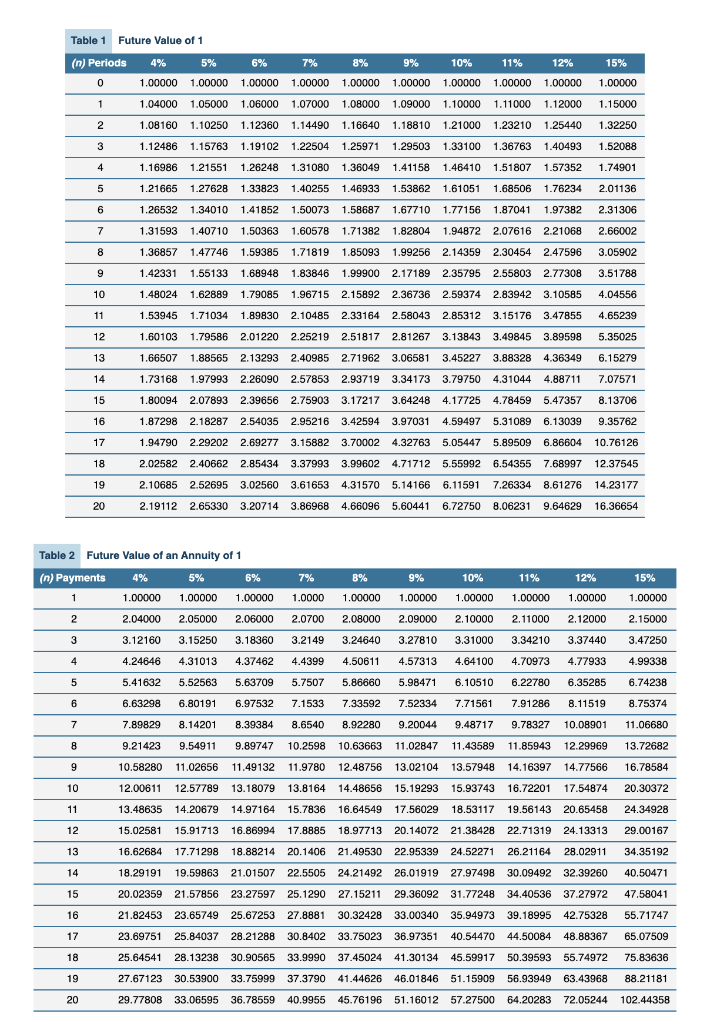

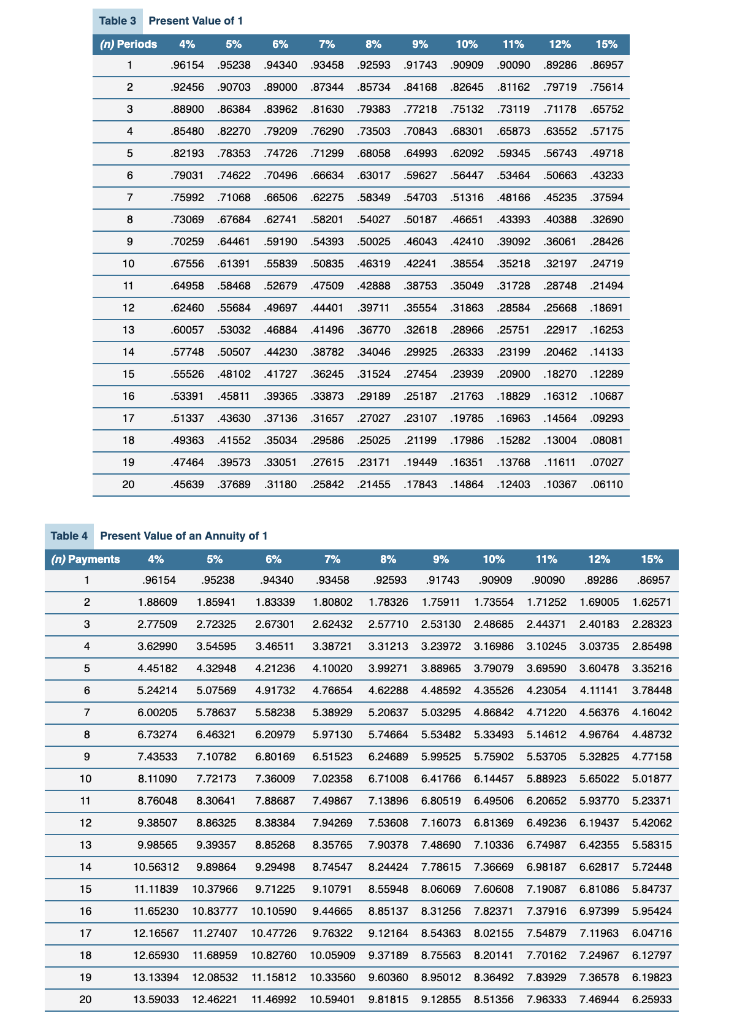

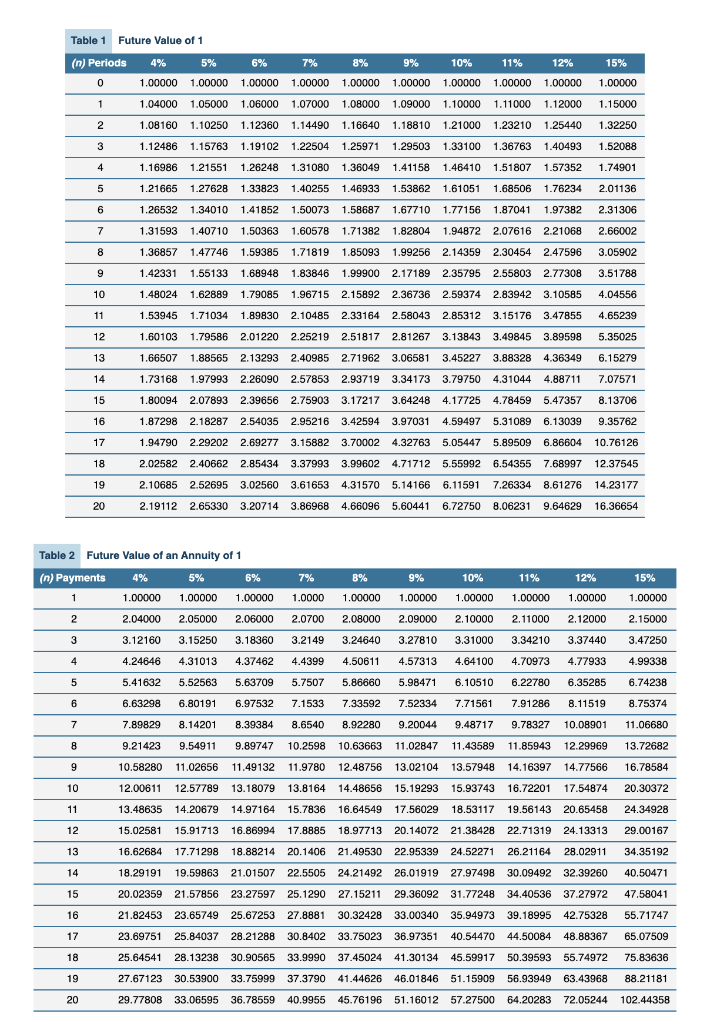

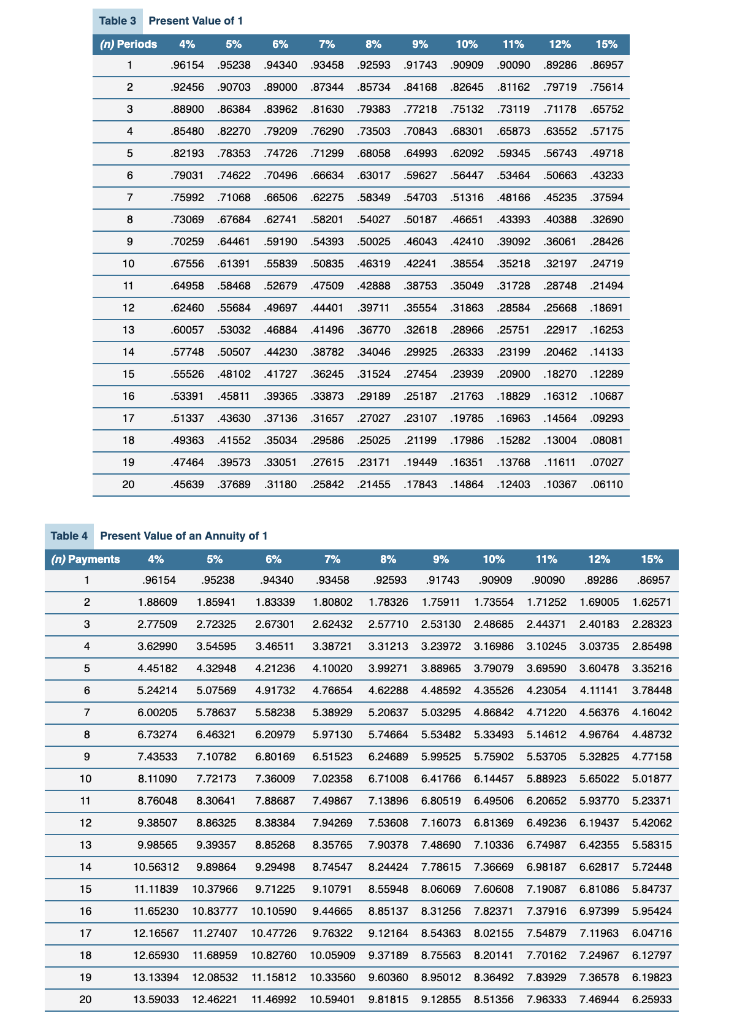

15% 1.00000 1.15000 Table 1 Future Value of 1 (n) Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 0 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1 1.04000 1.05000 1.06000 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 2 1.08160 1.10250 1.12360 1.14490 1.16640 1.18810 1.21000 1.23210 1.25440 3 1.12486 1.15763 1.19102 1.22504 1.25971 1.29503 1.33100 1.36763 1.40493 4 1.16986 1.21551 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 5 1.21665 1.27628 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234 1.32250 1.52088 1.74901 2.01136 6 1.26532 1.34010 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 2.31306 7 1.31593 1.40710 1.50363 1.60578 1.71382 1.82804 1.94872 2.07616 2.21068 2.66002 8 1.36857 1.47746 1.59385 1.71819 1.85093 1.99256 2.14359 2.30454 2.47596 3.05902 9 1.42331 1.55133 1.68948 1.83846 1.99900 2.17189 2.35795 2.55803 2.77308 3.51788 10 1.48024 4.04556 11 1.53945 4.65239 1.62889 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 1.71034 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.15176 3.47855 1.79586 2.01220 2.25219 2.51817 2.81267 3.13843 3.49845 3.89598 1.88565 2.13293 2.40985 2.71962 3.06581 3.45227 3.88328 12 1.60103 5.35025 13 1.66507 6.15279 14 15 1.73168 1.97993 2.26090 2.57853 2.93719 3.34173 3.79750 4.31044 4.31044 4.88711 7.07571 1.80094 2.07893 2.39656 2.75903 3.17217 3.17217 3.64248 4.17725 4.78459 5.47357 8.13706 1.87298 2.18287 2.54035 2.95216 2.95216 3.42594 3.97031 4.59497 5.31089 6.13039 9.35762 1.94790 2.29202 2.69277 3.15882 3.70002 4.32763 5.05447 5.05447 5.89509 6.86604 10.76126 16 17 18 2.02582 2.40662 2.85434 3.37993 3.99602 4.71712 5.55992 6.54355 7.68997 12.37545 19 2.10685 2.52695 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 14.23177 20 2.19112 2.65330 3.20714 3.86968 4.66096 5.60441 6.72750 8.06231 9.64629 16.36654 Table 2 Future Value of an Annuity of 1 (n) Payments 4% 5% 6% 1 1.00000 1.00000 1.00000 7% 8% 9% 10% 11% 12% 15% 1.0000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 2 2.04000 2.05000 2.06000 2.0700 2.08000 2.09000 2.10000 2. 11000 2.12000 2.15000 3 3.12160 3.15250 3.18360 3.2149 3.24640 3.27810 3.31000 3.34210 3.37440 3.47250 4 4.24646 4.31013 4.37462 4.4399 4.50611 4.57313 4.64100 4.70973 4.77933 4.99338 5 5.41632 5.52563 5.63709 5.7507 5.86660 5.98471 6.10510 6.22780 6.35285 6.74238 6 6.63298 6.80191 6.97532 7.1533 7.33592 7.52334 7.71561 7.91286 8.11519 8.75374 7 7.89829 8.14201 8.39384 8.6540 8.92280 9.20044 9.48717 9.78327 10.08901 11.06680 8 9.21423 9.54911 9.89747 10.2598 10.63663 11.02847 11.43589 11.85943 12.29969 13.72682 9 10.58280 11.02656 11.49132 11.9780 13.57948 14.16397 14.77566 16.78584 12.48756 13.02104 14.48656 15.19293 10 12.00611 12.57789 13.18079 13.8164 15.93743 16.72201 17.54874 20.30372 11 13.48635 14.20679 14.97164 15.7836 16.64549 17.56029 18.53117 19.56143 20.65458 24.34928 12 15.02581 15.91713 16.86994 17.8885 18.97713 20.14072 21.38428 22.71319 24.13313 29.00167 13 16.62684 17.71298 18.88214 20.1406 21.49530 22.95339 24.52271 26.21164 28.02911 34.35192 14 18.29191 19.59863 21.01507 22.5505 24.21492 26.01919 27.97498 27.97498 30.09492 32.39260 40.50471 15 47.58041 16 55.71747 17 20.02359 21.57856 23.27597 25.1290 27.15211 29.36092 31.77248 34.40536 37.27972 21.82453 23.65749 25.67253 27.8881 30.32428 33.00340 35.94973 39.18995 42.75328 23.69751 25.84037 28.21288 30.8402 33.75023 36.97351 40.54470 44.50084 48.88367 25.64541 28.13238 30.90565 33.9990 30.90565 33.9990 37.45024 41.30134 45.59917 50.39593 55.74972 27.67123 30.53900 33.75999 37.3790 41.44626 46.01846 51.15909 56.93949 63.43968 65.07509 18 75.83636 19 88.21181 20 29.77808 33.06595 36.78559 40.9955 45.76196 51.16012 57.27500 64.20283 72.05244 102.44358 Table 3 Present Value of 1 (n) Periods 4% 5% .96154 .95238 6% 7% 8% 9% 12% 15% 10% .90909 11% .90090 1 .94340 93458 .92593 .91743 .89286 .86957 2 .92456 .90703 .89000 .87344 .85734 .84168 .82645 .81162 .79719 .75614 3 .88900 .86384 .83962 .81630 .79383 .77218 .75132 .73119 .71178 .65752 4 .85480 .82270 .79209 .76290 .73503 .70843 .68301 .65873 .63552 .57175 5 .82193 .78353 .74726 .71299 .68058 .64993 .62092 .59345 .56743 .49718 6 79031 .74622 .70496 .66634 .63017 59627 .56447 .53464 .50663 .43233 7 .75992 .71068 .66506 .62275 .58349 .54703 .51316 .48166 45235 .37594 8 .73069 .67684 .62741 58201 .54027 -50187 .46651 .43393 .40388 32690 9 .70259 .64461 .59190 .54393 .50025 .46043 .42410 39092 36061 .28426 10 .67556 .61391 .55839 .50835 .46319 .42241 .38554 35218 .32197 .24719 11 .64958 .58468 .52679 .47509 .42888 .38753 .35049 .31728 28748 .21494 12 .62460 .55684 .49697 44401 .39711 .35554 .31863 28584 25668 .18691 13 .60057 .53032 .46884 41496 .36770 .32618 .28966 .25751 22917 .16253 14 .57748 .50507 44230 .38782 34046 29925 26333 .23199 20462 .14133 15 .55526 48102 .41727 .36245 .31524 27454 .23939 20900 .18270 .12289 16 .53391 .45811 .39365 .33873 .29189 25187 .21763 .18829 16312 . 10687 17 .51337 .43630 .37136 .31657 .27027 23107 .19785 .16963 .14564 .09293 18 .49363 41552 .35034 .29586 25025 21199 .17986 .15282 .13004 .08081 19 .47464 .39573 .33051 27615 .23171 .19449 .16351 .13768 .11611 .07027 20 45639 .37689 .31180 25842 21455 .17843 .14864 .12403 10367.06110 7% 8% 9% 10% 12% 15% Table 4 Present Value of an Annuity of 1 (n) Payments 4% 5% 6% 1 .96154 .95238 .94340 2 1.88609 1.85941 1.83339 11% .90090 .93458 .92593 91743 .90909 .89286 .86957 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 3 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4 3.62990 3.54595 3.46511 3.38721 5 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 6 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 7 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 8 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 5.14612 4.96764 4.96764 4.48732 9 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 10 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 11 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 12 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 13 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 14 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 10.56312 9.89864 11.11839 10.37966 15 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 16 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 17 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.54879 7.11963 6.04716 18 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 19 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 20 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933