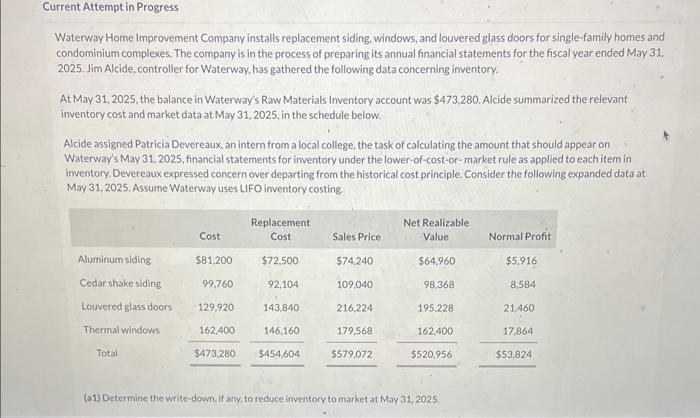

Waterway Home improvement Company installs replacement siding, windows, and louvered glass doors for single-family homes and condominium complexes. The company is in the process of preparing its annual financial statements for the fiscal year ended May 31. 2025. Jim Alcide, controller for Waterway, has gathered the following data concerning inventory. At May 31, 2025, the balance in Waterway's Raw Materials Inventory account was $473,280. Alcide summarized the relevant inventory cost and market data at May 31, 2025, in the schedule below. Alcide assigned Patricia Devereaux, an intern from a local college, the task of calculating the amount that should appear on Waterway's May 31, 2025, financial statements for inventory under the lower-of-cost-or-market rule as applicd to each item in inventory. Devereaux expressed concern over departing from the historical cost principle. Consider the following expanded data at May 31, 2025. Assume Waterway uses LIFO inventory costing (a1) Determine the write-down, if any, to reduce inventory to market at May 31, 2025. (a1) Determine the write-down, if any, to reduce inventory to market at May 31, 2025. Inventoryloss (a2) For the fiscal year ended May 31,2025, prepare the entry to record the decline in inventory to market, if any, using the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Waterway Home improvement Company installs replacement siding, windows, and louvered glass doors for single-family homes and condominium complexes. The company is in the process of preparing its annual financial statements for the fiscal year ended May 31. 2025. Jim Alcide, controller for Waterway, has gathered the following data concerning inventory. At May 31, 2025, the balance in Waterway's Raw Materials Inventory account was $473,280. Alcide summarized the relevant inventory cost and market data at May 31, 2025, in the schedule below. Alcide assigned Patricia Devereaux, an intern from a local college, the task of calculating the amount that should appear on Waterway's May 31, 2025, financial statements for inventory under the lower-of-cost-or-market rule as applicd to each item in inventory. Devereaux expressed concern over departing from the historical cost principle. Consider the following expanded data at May 31, 2025. Assume Waterway uses LIFO inventory costing (a1) Determine the write-down, if any, to reduce inventory to market at May 31, 2025. (a1) Determine the write-down, if any, to reduce inventory to market at May 31, 2025. Inventoryloss (a2) For the fiscal year ended May 31,2025, prepare the entry to record the decline in inventory to market, if any, using the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.)