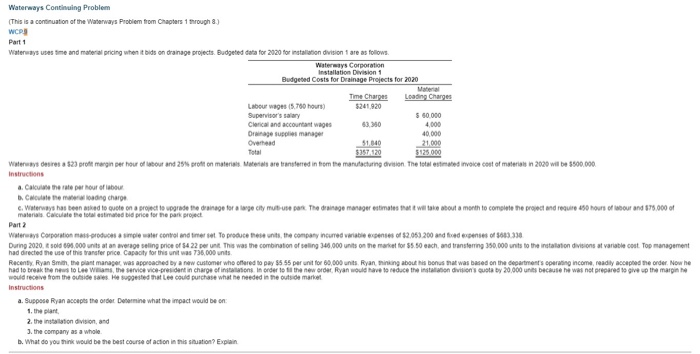

Waterways Continuing Problem (This is a continuation of the Waterways Problem from Chapters 1 through 8.) Waterways uses me and material pricing when it bids on drainage projects. Budgeted data for 2920 for installation division 1 are as follows Ways Corporation Installation Division 1 Budgeted Costs for Drainage Projects for 2020 Time Charpes Loading Changes Labour wages (5.750 hours) $241.920 Supervisor's salary $ 60.000 Clerical and accountant wages 63.360 Orange tus manager 40.000 Overhead 51040 21.000 5357120 $125.000 our and 25 profit on materials Materials are transferred in from the manufacturing division. The total estimated invoice cost of materials in 2020 will be $500.000 Waterways desires a $23 profit margin per hour of a. Calcule the rate per hour of labour Core m ang charge c. Waterways has been a lo quote on a proved to upgrade the material Calculate the estimated bid price for the park project age for large city muu n Thedige manager estimates that we are about a month to complete the project and require 150 hours of our and 78.000 of Part 2 Waterways Corporation des ample water control and meet Torce esents the company incurred variable expenses of $2.053.200 and fed expenses of $603338 During 2020. sold 695.000 units at an average selling price of $422 per unit. This was the combination of seling 348,000 units on the market for 55.50 each, and transferring 350,000 units to the installation divisions at variable cost. Top management had directed the use of this transfer price Capacity for this unit was 735,000 units Recenty Ryan Smith the plant manager was approached by a new customer who offered to pay 15 55 per unit for 6,000 units Ryan ing about his bonusat was based on the department operating income, readily accepted the order Now he had to break the new to Lee w as the service vice-president in charge of ins o ns in order to the new order. Ryan would have to reduce the installation division's cut by 20.000 units because he was not prepared to give up the margine would receive from the outside as He suggested that Lee could purchase what he needed in the outside market a. Suppose Ryan accept the order Demine what the impact would be on: 1. the plant 2. the instalation division, and J. the company as a whole b. What do you think would be the best course of action in this situation? Explain Waterways Continuing Problem (This is a continuation of the Waterways Problem from Chapters 1 through 8.) Waterways uses me and material pricing when it bids on drainage projects. Budgeted data for 2920 for installation division 1 are as follows Ways Corporation Installation Division 1 Budgeted Costs for Drainage Projects for 2020 Time Charpes Loading Changes Labour wages (5.750 hours) $241.920 Supervisor's salary $ 60.000 Clerical and accountant wages 63.360 Orange tus manager 40.000 Overhead 51040 21.000 5357120 $125.000 our and 25 profit on materials Materials are transferred in from the manufacturing division. The total estimated invoice cost of materials in 2020 will be $500.000 Waterways desires a $23 profit margin per hour of a. Calcule the rate per hour of labour Core m ang charge c. Waterways has been a lo quote on a proved to upgrade the material Calculate the estimated bid price for the park project age for large city muu n Thedige manager estimates that we are about a month to complete the project and require 150 hours of our and 78.000 of Part 2 Waterways Corporation des ample water control and meet Torce esents the company incurred variable expenses of $2.053.200 and fed expenses of $603338 During 2020. sold 695.000 units at an average selling price of $422 per unit. This was the combination of seling 348,000 units on the market for 55.50 each, and transferring 350,000 units to the installation divisions at variable cost. Top management had directed the use of this transfer price Capacity for this unit was 735,000 units Recenty Ryan Smith the plant manager was approached by a new customer who offered to pay 15 55 per unit for 6,000 units Ryan ing about his bonusat was based on the department operating income, readily accepted the order Now he had to break the new to Lee w as the service vice-president in charge of ins o ns in order to the new order. Ryan would have to reduce the installation division's cut by 20.000 units because he was not prepared to give up the margine would receive from the outside as He suggested that Lee could purchase what he needed in the outside market a. Suppose Ryan accept the order Demine what the impact would be on: 1. the plant 2. the instalation division, and J. the company as a whole b. What do you think would be the best course of action in this situation? Explain