Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Watko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video.

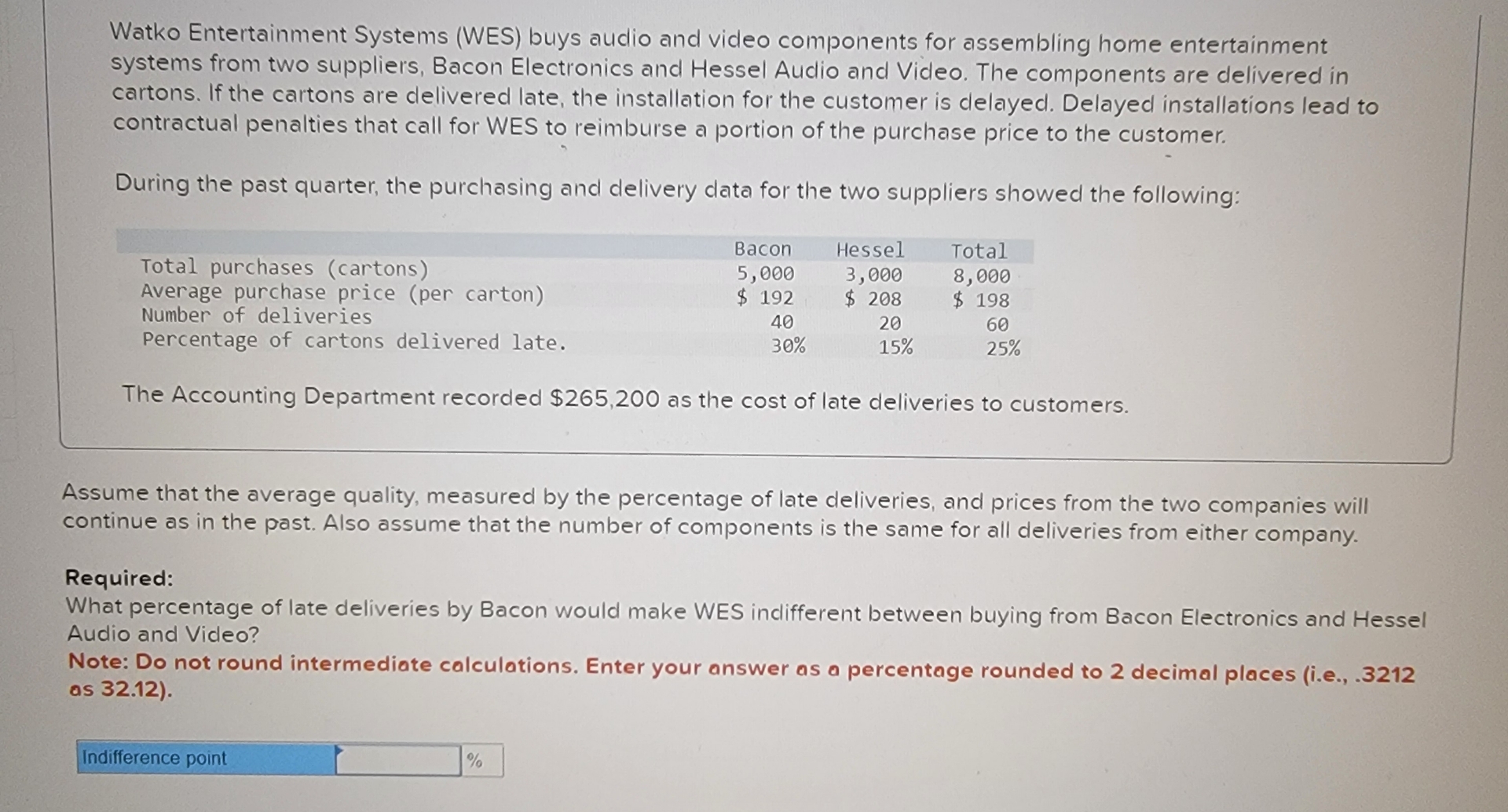

Watko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Total purchases (cartons) Average purchase price (per carton) Number of deliveries Percentage of cartons delivered late. Bacon 5,000 Hessel Total 3,000 8,000 $ 192 $ 208 $ 198 40 30% 20 60 15% 25% The Accounting Department recorded $265,200 as the cost of late deliveries to customers. Assume that the average quality, measured by the percentage of late deliveries, and prices from the two companies will continue as in the past. Also assume that the number of components is the same for all deliveries from either company. Required: What percentage of late deliveries by Bacon would make WES indifferent between buying from Bacon Electronics and Hessel Audio and Video? Note: Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (i.e., .3212 as 32.12). Indifference point %

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started