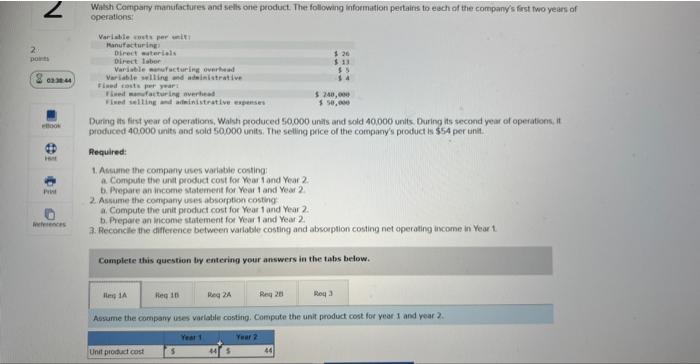

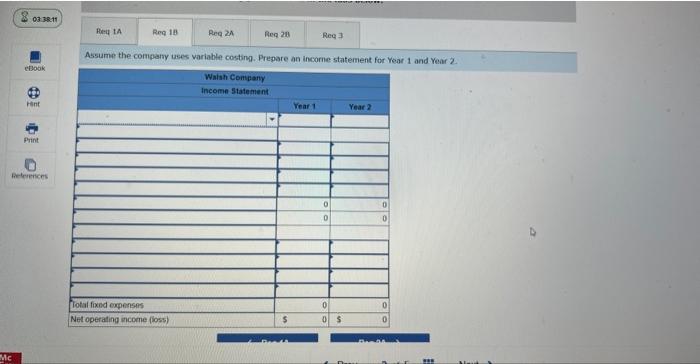

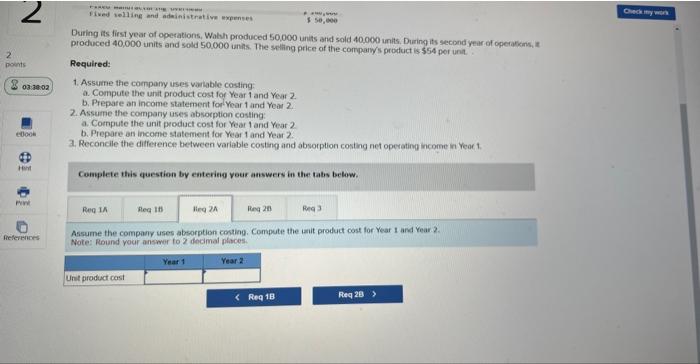

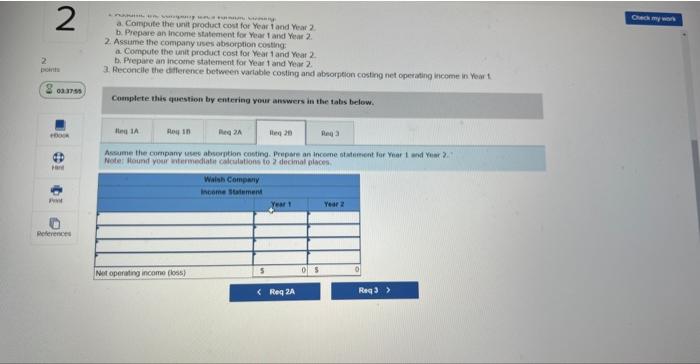

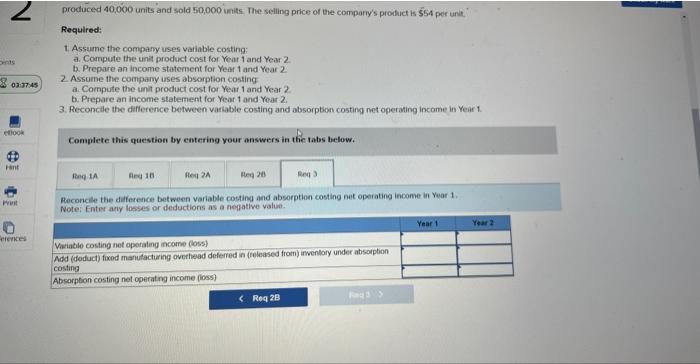

Watsh Compary manufactures and sells orie peoduct. The following information pertains to each of the company's fist furo years of operations: During its first year of operations, Walsh produced 50.000 unils and soid 40.000 units. During its second year of operations, it produced 40.000 units and sold 50.000 units. The selling pice of the company's product is 554 per unit. Required: 1. Asuame the company uses variatile costing: a. Compuie the unit prodict cost for Yoar 1 and Year 2 . b. Prepare an income statement for Year 1 and Year? 2. Assume the company uses absorption costing? a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year.2. 3. Reconcile the chifference between varlable costing and absorption costing net operating income in Year 1. Complete this guestion tw entering your answers in the tabs below. Aosume the company uses varlable costing. Compate the unit product cost for yeor 1 and year 2. Assume the company uses variable costing. Prepare an incorne statement for Year 1 and Year z. During its liest year of operations, Wakh produced 50,000 units and sold 40,000 inits. During its second year of operafins, is produced 40,000 units and sold 50.000 unhis. The seling price of the company/s product iss 554 per unit. Required: 1. Assume the company uses variable costing: a. Compute the anit product cost for Year 1 and Year 2. b. Prepare an income statement forlyear 1 and Yeor 2 2. Assume the company uses absoeption costing: a. Cornpute the unit product cost for Year 1 and Year 2 b. Prepare an income statement for Year 1 and Year 2. 3. Reconcile the difference between variable costing and absotption costing net operating income in Yeor t. Complete this question by enterieig your answers in the tabs below. Assume the company uses absorption costing. Compute the ianit product cost for Year 1 ard Year 2. Note: Round your answer to 2 decimal piaces. a. Coingevte the unit product cost for Year 1 aced Year? b. Propare an incomet statement for Year 1 and Year 2. 2. Assume the company yses absorption costing. a. Compute the unit product cost for Yeat 1 and Year 2. b. PYepare an incosne statement far Year 1 and Yepar 2. 3. Reconcile the ditference between variable costing and absorpelon cesting net operating income in Yoar 1. Camplete the question by entering your answers in the tabs below. Hodef loaund your ntermediatif colculabons to decimal places. produced 40,000 units and sold 50,000 units. The selling price of the comparty's product is $544 per unie? Required: 1. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2 . 2 Assume the company uses absorption costing a. Compute the unit product cost for Year 1 and Year? b. Prepare an income statement for Yeor 1 and Year 2. 3. Reconcile the diflerence between variable costing and absorpbion costing net operating income in Year 1. Complete this question by entering your answers in the tabs below. Reconcle the dilference between variable costing and absorption costing net operating income in Year 1 . Note: Enter ary losses or deductions as a nepative value