Question

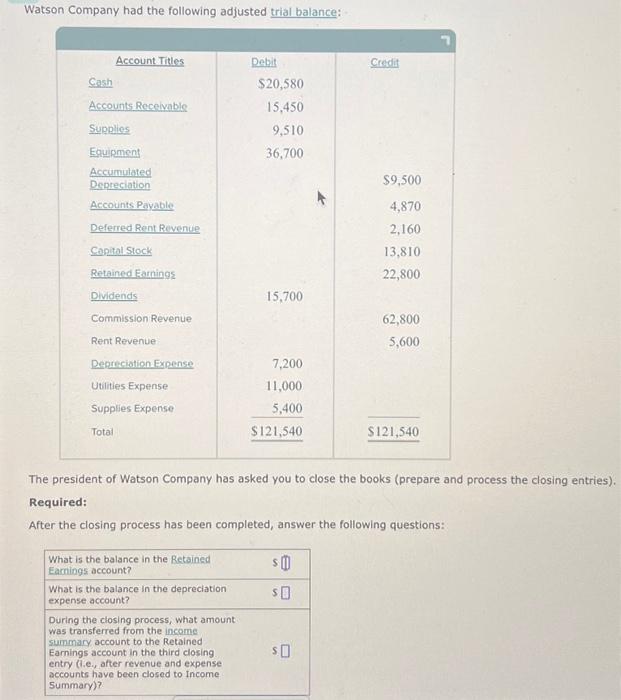

Watson Company had the following adjusted trial balance: Account Titles Debit Credit Cash $20,580 Accounts Receivable 15,450 Supplies 9,510 Equipment 36,700 Accumulated Depreciation $9,500

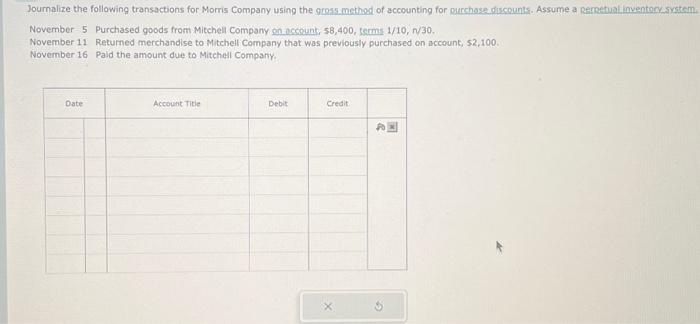

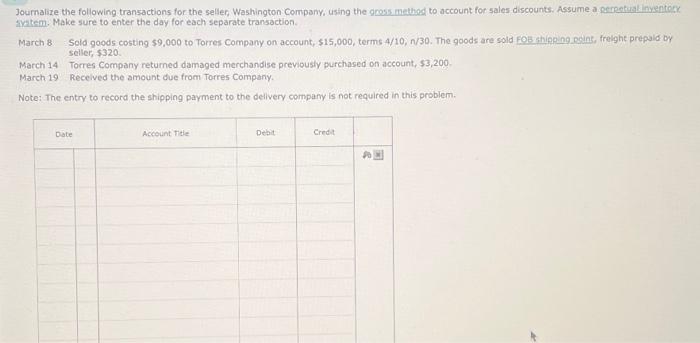

Watson Company had the following adjusted trial balance: Account Titles Debit Credit Cash $20,580 Accounts Receivable 15,450 Supplies 9,510 Equipment 36,700 Accumulated Depreciation $9,500 Accounts Payable Deferred Rent Revenue Capital Stock 4,870 2,160 13,810 Retained Earnings 22,800 Dividends 15,700 Commission Revenue 62,800 Rent Revenue 5,600 Depreciation Expense 7,200 Utilities Expense 11,000 Supplies Expense 5,400 Total $121,540 $121,540 The president of Watson Company has asked you to close the books (prepare and process the closing entries). Required: After the closing process has been completed, answer the following questions: What is the balance in the Retained Earnings account? $00 What is the balance in the depreciation expense account? $0 During the closing process, what amount was transferred from the income summary account to the Retained Earnings account in the third closing $0 entry (i.e., after revenue and expense accounts have been closed to Income Summary)? Journalize the following transactions for Morris Company using the gross method of accounting for purchase discounts. Assume a perpetual inventory system. November 5 Purchased goods from Mitchell Company on account, $8,400, terms 1/10, n/30. November 11 Returned merchandise to Mitchell Company that was previously purchased on account, $2,100. November 16 Paid the amount due to Mitchell Company. Date Account Title Debit Credit Journalize the following transactions for the seller, Washington Company, using the gross method to account for sales discounts. Assume a perpetual inventory avatem. Make sure to enter the day for each separate transaction. March 8 March 14 March 19 Sold goods costing $9,000 to Torres Company on account, $15,000, terms 4/10, n/30. The goods are sold FOB shipping point, freight prepaid by seller, $320. Torres Company returned damaged merchandise previously purchased on account, $3,200. Received the amount due from Torres Company. Note: The entry to record the shipping payment to the delivery company is not required in this problem. Date Account Title Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started