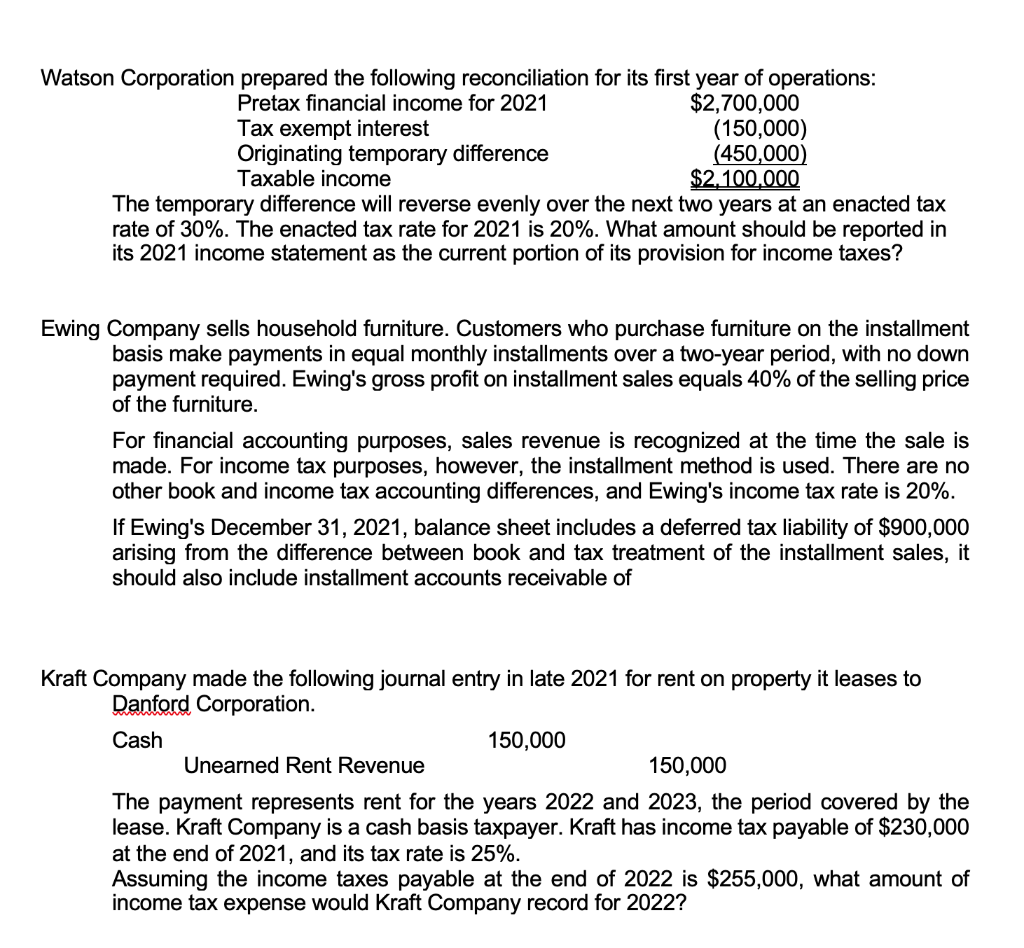

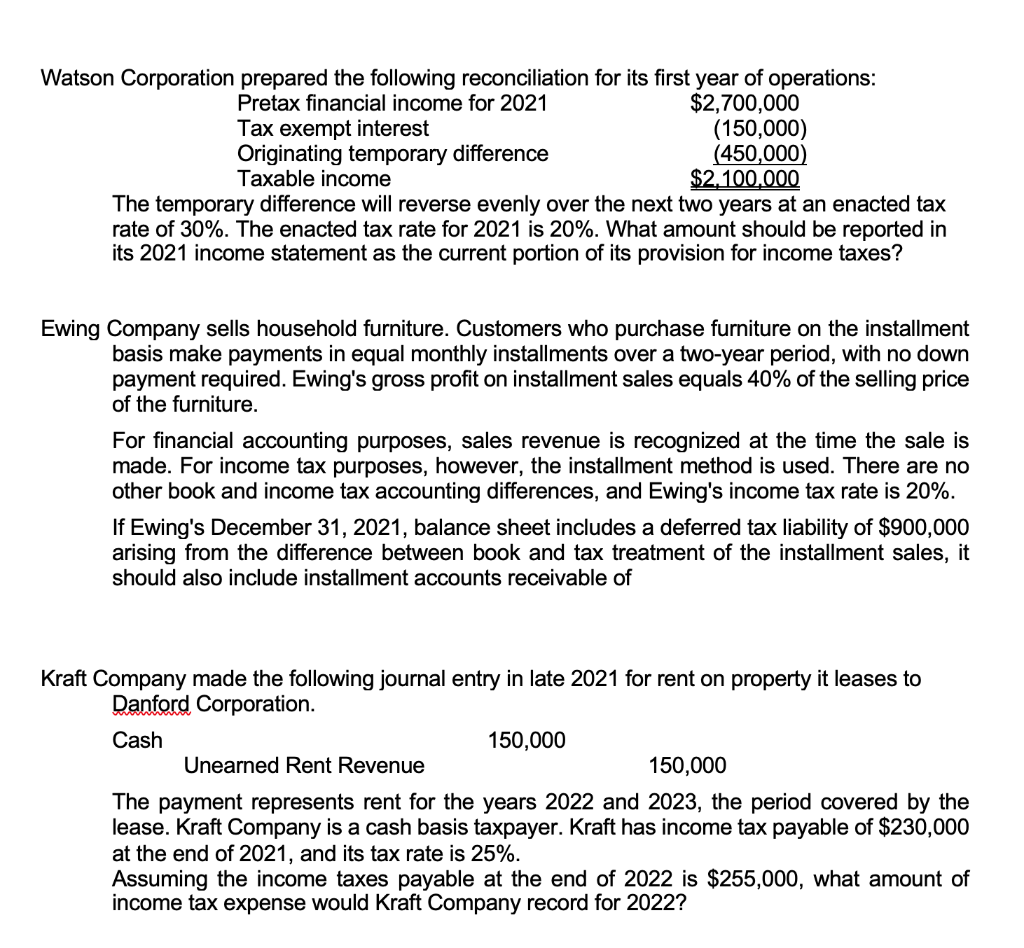

Watson Corporation prepared the following reconciliation for its first year of operations: Pretax financial income for 2021 $2,700,000 Tax exempt interest (150,000) Originating temporary difference (450,000) Taxable income $2.100.000 The temporary difference will reverse evenly over the next two years at an enacted tax rate of 30%. The enacted tax rate for 2021 is 20%. What amount should be reported in its 2021 income statement as the current portion of its provision for income taxes? Ewing Company sells household furniture. Customers who purchase furniture on the installment basis make payments in equal monthly installments over a two-year period, with no down payment required. Ewing's gross profit on installment sales equals 40% of the selling price of the furniture. For financial accounting purposes, sales revenue is recognized at the time the sale is made. For income tax purposes, however, the installment method is used. There are no other book and income tax accounting differences, and Ewing's income tax rate is 20%. If Ewing's December 31, 2021, balance sheet includes a deferred tax liability of $900,000 arising from the difference between book and tax treatment of the installment sales, it should also include installment accounts receivable of Kraft Company made the following journal entry in late 2021 for rent on property it leases to Danford Corporation. Cash 150,000 Unearned Rent Revenue 150,000 The payment represents rent for the years 2022 and 2023, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $230,000 at the end of 2021, and its tax rate is 25%. Assuming the income taxes payable at the end of 2022 is $255,000, what amount of income tax expense would Kraft Company record for 2022? Watson Corporation prepared the following reconciliation for its first year of operations: Pretax financial income for 2021 $2,700,000 Tax exempt interest (150,000) Originating temporary difference (450,000) Taxable income $2.100.000 The temporary difference will reverse evenly over the next two years at an enacted tax rate of 30%. The enacted tax rate for 2021 is 20%. What amount should be reported in its 2021 income statement as the current portion of its provision for income taxes? Ewing Company sells household furniture. Customers who purchase furniture on the installment basis make payments in equal monthly installments over a two-year period, with no down payment required. Ewing's gross profit on installment sales equals 40% of the selling price of the furniture. For financial accounting purposes, sales revenue is recognized at the time the sale is made. For income tax purposes, however, the installment method is used. There are no other book and income tax accounting differences, and Ewing's income tax rate is 20%. If Ewing's December 31, 2021, balance sheet includes a deferred tax liability of $900,000 arising from the difference between book and tax treatment of the installment sales, it should also include installment accounts receivable of Kraft Company made the following journal entry in late 2021 for rent on property it leases to Danford Corporation. Cash 150,000 Unearned Rent Revenue 150,000 The payment represents rent for the years 2022 and 2023, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $230,000 at the end of 2021, and its tax rate is 25%. Assuming the income taxes payable at the end of 2022 is $255,000, what amount of income tax expense would Kraft Company record for 2022