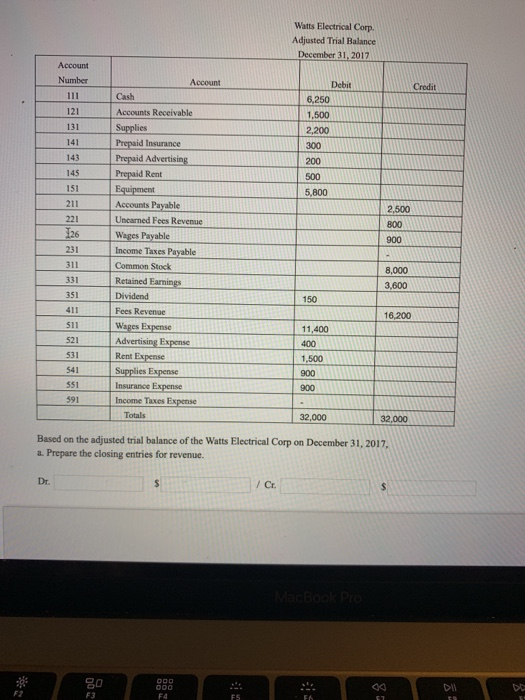

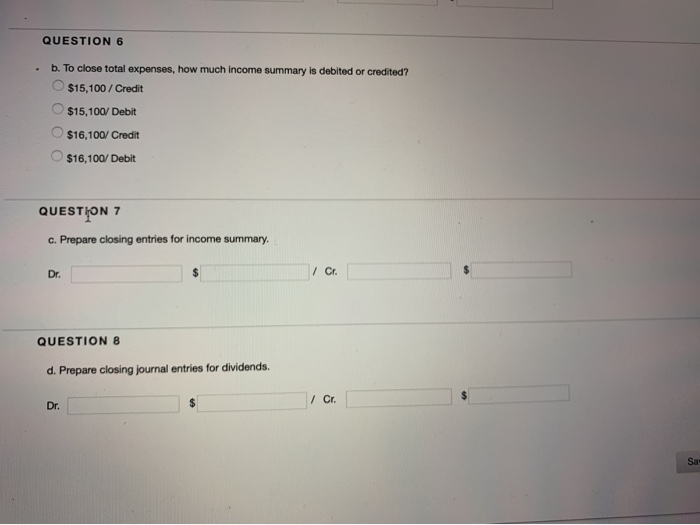

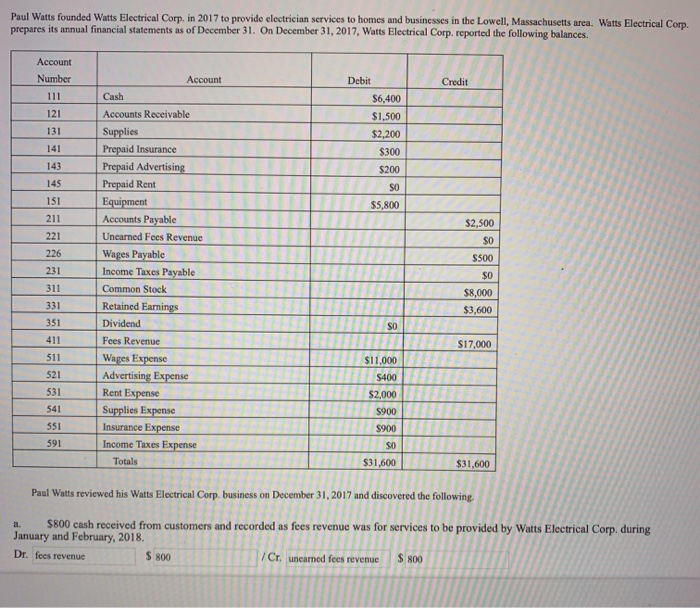

Watts Electrical Corp. Adjusted Trial Balance December 31, 2017 Account Number Debit Credit Account 6,250 1,500 2,200 300 200 Cash 121 Accounts Receivable 131 Supplies 141 143 Prepaid Advertising |Prepaid Rent 145 15 Equipment 211 5,800 2,500 800 900 Accounts Payable Uncarned Fees Revenue 221 Payable Income Taxes Payable Common Stock Retained Earnings 231 311 331 351 411 511 Wages Expense 521 531 541 Supplies Expense 8,000 3,600 150 16,200 Fees Revenue 11,400 Advertising Expense Rent Expense 1,500 900 900 Insurance Expense 591Income Taxes Expense 32,000 32,000 Totals Based on the adjusted trial balance of the Watts Electrical Corp on December 31, 2017, a. Prepare the closing entries for revenue. Dr. F4 F3 QUESTION 6 b. To close total expenses, how much income summary is debited or credited? . $15,100/Credit $15,100/ Debit O $16,100/ Credit $16,100/ Debit QUESTION 7 c. Prepare closing entries for income summary. / Cr Dr. QUESTION 8 d. Prepare closing journal entries for dividends. Dr. Sa Paul Watts founded Watts Electrical Corp. in 2017 to provide electrician services to homes and businesses in the Lowel, Massachusetts area. Watts Electrical Corp prepares its annual financial statements as of December 31. On December 31, 2017, Watts Electrical Corp. reported the following balances. Account Number Account Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance S6,400 $1,500 $2,200 S300 $200 SO $5,800 121 131 141 143 Prepaid Advertising 145 151 211 221 Prepaid Rent Accounts Payable $2,500 $O S500 SO $8,000 $3,600 Unearned Fees Revenue 226 Wages Payable 231 311 331 351 411 511 Income Taxes Payable Common Stock Retained Earmings Dividend Fees Revenue Wages Expense SO $17,000 $11,000 400 $2.000 521 Advertising Expense 531Rent Expense 541 551 591 Supplies Expense Insurance Expense Income Taxes Expense SO Totals S31,600 $31,600 Paul Watts reviewed his Watts Electrical Corp. business on December 31, 2017 and discovered the following a. $800 cash received from customers and recorded as fees revenue was for services to be provided by Watts Electrical Corp. during January and February, 2018. Dr. fees revenue $800 $ 800 /Cr, unearned fees revenue