Question

Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll

Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll records and to complete a month of payroll information for Wayland. Wayland Custom Woodworking is located at 1716 Nichol Street, Logan, Utah, 84321, phone number 435-555-9877. The owner is Mark Wayland. Waylands EIN is 91-7444533, and the Utah Employer Account Number is 99992901685WTH. Wayland has determined it will pay its employees on a semimonthly basis. Federal income tax should be computed using the percentage method.

For Part 1 of this project, you will complete payroll for the last month (December) of the fourth quarter (Q4) of 2019, which consists of the final pay periods of the year. Once payroll has been completed for the fourth quarter, you will then file the annual tax forms for Wayland as well as prepare each employee's Form W-2 in Part 2.

The SUTA (UI) rate for Wayland Custom Woodworking is 2.6 percent on the first $35,300. The state withholding rate is 4.95 percent for all income levels, deductions, and marital statuses, a table has been included to assist with calculations of state tax due for employees. No employee will reach the SUTA wage cap.

Rounding can create a challenge. For this project, the hourly rate for the individuals should be rounded to five decimal places. So take their salary and divide by 2,080 (52 weeks at 40 hours per week) for full-time, nonexempt employees.

Example: Annual Salary to Hourly Rate, Nonexempt Employee

Employee Vardens annual salary is $42,000, and he is a nonexempt employee.

Hourly rate = $42,000 / (52 40) = $42,000 / 2,080

Hourly rate = $20.19231 per hour

Example: Period Gross Pay, Salaried Employee

Employee Chinson earns an annual salary of $24,000 and is paid semimonthly.

Period gross pay = $24,000 / 24 = $1,000 gross pay

For pay periods with holiday hours: determine the amount paid per day, multiply by the number of days applicable to each pay.

Annual salary: $24,000 / (52 5) = $24,000 / 260 = $92.30769 (rounded to 5 decimal points) per day.

After the gross pay has been calculated, round the result to only two decimal points prior to calculating taxes or other withholdings. Employees are paid for the following holidays occurring during the final quarter:

- Thanksgiving day and the day after, Thursday and Friday, November 2829.

- Christmas, which is a Wednesday. Employees receive holiday pay for Tuesday, December 24, and Wednesday, December 25.

For the completion of this project, refer to the tax-related information in the table below. For federal withholding calculations, use the percentage method tables in Appendix C, which is provided below. For Utah state withholding calculations, use the Utah Schedule 3 tax tables linked below (ensure to use the appropriate Utah table based on each employee's marital status). Both 401(k) and insurance are pre-tax for federal income tax and Utah income tax. Round calculations to get to final tax amounts and 401(k) contributions after calculating gross pay.

| Federal Withholding Allowance (less 401(k), Section 125) | $175.00 per allowance claimed |

| Federal Unemployment Rate (employer only) | 0.6% on the first $7,000 of wages |

| Semimonthly Federal Percentage Method Tax Table | Appendix C Table #3 |

| State Unemployment Rate (employer only) | 2.6% on the first $35,300 of wages |

| State Withholding Rate (less 401(k), Section 125) | See Utah Schedule 3, Table A-1 or use the Excel Version of Schedule 3 |

October 1:

Wayland Custom Woodworking (WCW) pays its employees according to their job classification. The following employees comprise Waylands staff:

| Employee Number | Name and Address | Payroll information |

| 00-Chins | Anthony Chinson | Married, 1 Withholding allowance |

| 530 Sylvann Avenue | Exempt | |

| Logan, UT 84321 | $24,000/year + commission | |

| 435-555-1212 | Start Date: 10/1/2019 | |

| Job title: Account Executive | SSN: 511-22-3333 | |

| 00-Wayla | Mark Wayland | Married, 5 withholding allowances |

| 1570 Lovett Street | Exempt | |

| Logan, UT 84321 | $75,000/year | |

| 435-555-1110 | Start Date: 10/1/2019 | |

| Job title: President/Owner | SSN: 505-33-1775 | |

| 01-Peppi | Sylvia Peppinico | Married, 7 withholding allowances |

| 291 Antioch Road | Exempt | |

| Logan, UT 84321 | $43,500/year | |

| 435-555-2244 | Start Date: 10/1/2019 | |

| Job title: Craftsman | SSN: 047-55-9951 | |

| 01-Varde | Stevon Varden | Married, 2 withholding allowances |

| 333 Justin Drive | Nonexempt | |

| Logan, UT 84321 | $42,000/year | |

| 435-555-9981 | Start Date: 10/1/2019 | |

| Job title: Craftsman | SSN: 022-66-1131 | |

| 02-Hisso | Leonard Hissop | Single, 4 withholding allowances |

| 531 5th Street | Nonexempt | |

| Logan, UT 84321 | $49,500/year | |

| 435-555-5858 | Start Date: 10/1/2019 | |

| Job title: Purchasing/Shipping | SSN: 311-22-6698 | |

| 00-Succe | Student Success | Single, 1 withholding allowance |

| 1650 South Street | Nonexempt | |

| Logan, UT 84321 | $36,000/year | |

| 435-556-1211 | Start Date: 10/1/2019 | |

| Job title: Accounting Clerk | SSN: 555-55-5555 | |

The departments are as follows:

Department 00: Sales and Administration

Department 01: Factory workers

Department 02: Delivery and Customer service

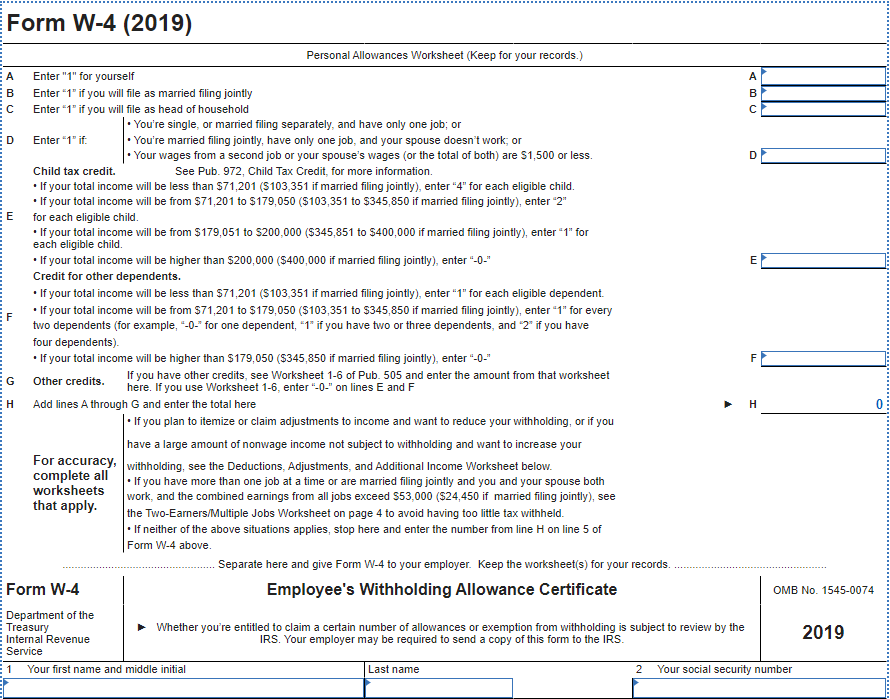

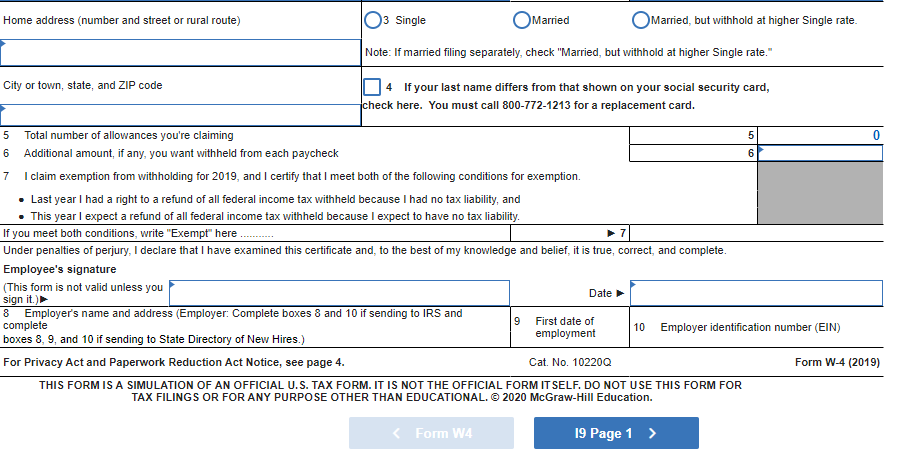

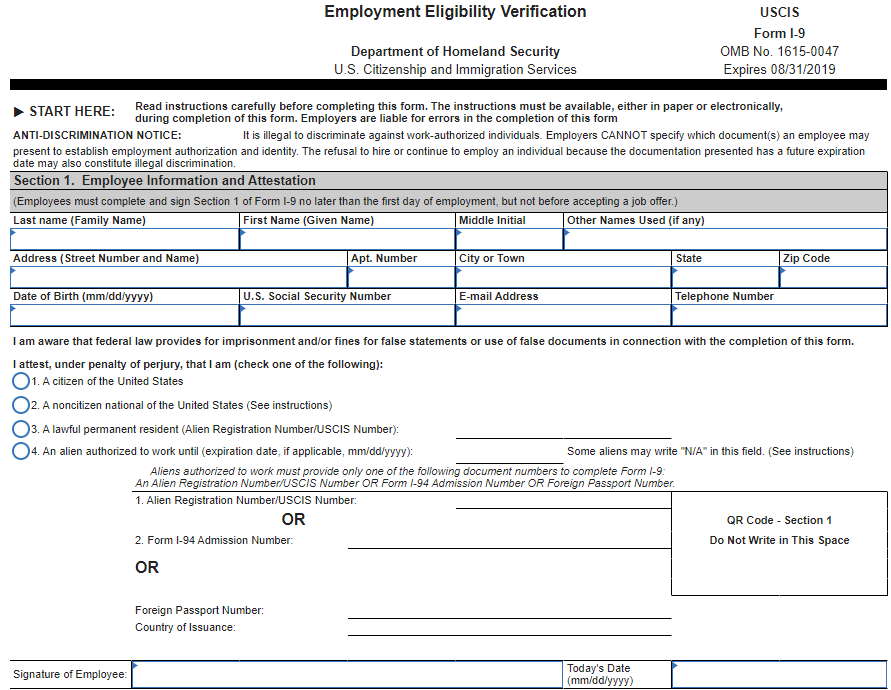

You have been hired as of October 1 as the new accounting clerk. Your employee number is 00-SUCCE. Your name is Student Success. Your address is 1650 South Street, Logan, UT 84321. Your phone number is 435-556-1211, you were born July 16, 1985, your Utah driver's license number is 887743 expiring in 07/16/2024, and your Social Security number is 555-55-5555. You are considered a nonexempt employee, have one withholding allowance, and paid a rate of $36,000 per year.

The balance sheet for WCW as of November 30, 2019, is as follows:

| Wayland Custom Woodworking Balance Sheet November 30, 2019 | ||||||||

| Assets | Liabilities & Equity | |||||||

| Cash | $ | 1,085,254.38 | Accounts Payable | $ | 112,747.25 | |||

| Supplies | 42,240.11 | Salaries and Wages Payable | 10,158.53 | |||||

| Office Equipment | 87,250.00 | Federal Unemployment Tax Payable | 85.71 | |||||

| Inventory | 167,139.49 | Social Security Tax Payable | 3,158.42 | |||||

| Vehicle | 25,000.00 | Medicare Tax Payable | 738.66 | |||||

| Accumulated Depreciation, Vehicle | State Unemployment Tax Payable | 681.74 | ||||||

| Building | 164,000.00 | Employee Federal Income Tax Payable | 1427.61 | |||||

| Accumulated Depreciation, Building | Employee State Income Tax Payable | 1,133.72 | ||||||

| Land | 35,750.00 | 401(k) Contributions Payable | 1,002.34 | |||||

| Total Assets | 1,606,633.98 | Employee Medical Premiums Payable | 750.00 | |||||

| Notes Payable | 224,750.00 | |||||||

| Utilities Payable | ||||||||

| Total Liabilities | 356,633.98 | |||||||

| Owners' Equity | 1,250,000.00 | |||||||

| Retained Earnings | - | |||||||

| Total Equity | 1,250,000.00 | |||||||

| Total Liabilities and Equity | 1,606,633.98 | |||||||

Voluntary deductions for each employee are as follows:

| Name | Deduction |

| Chinson | Insurance: $50/paycheck |

| 401(k): 3% of gross pay | |

| Wayland | Insurance: $75/paycheck |

| 401(k): 6% of gross pay | |

| Peppinico | Insurance: $75/paycheck |

| 401(k): $50 per paycheck | |

| Varden | Insurance: $50/paycheck |

| 401(k): 4% of gross pay | |

| Hissop | Insurance: $75/paycheck |

| 401(k): 3% of gross pay | |

| Student | Insurance: $50/paycheck |

| 401(k): 3% of gross pay | |

\

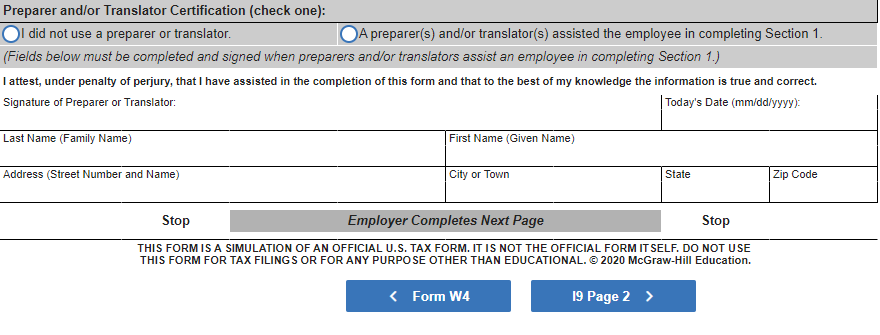

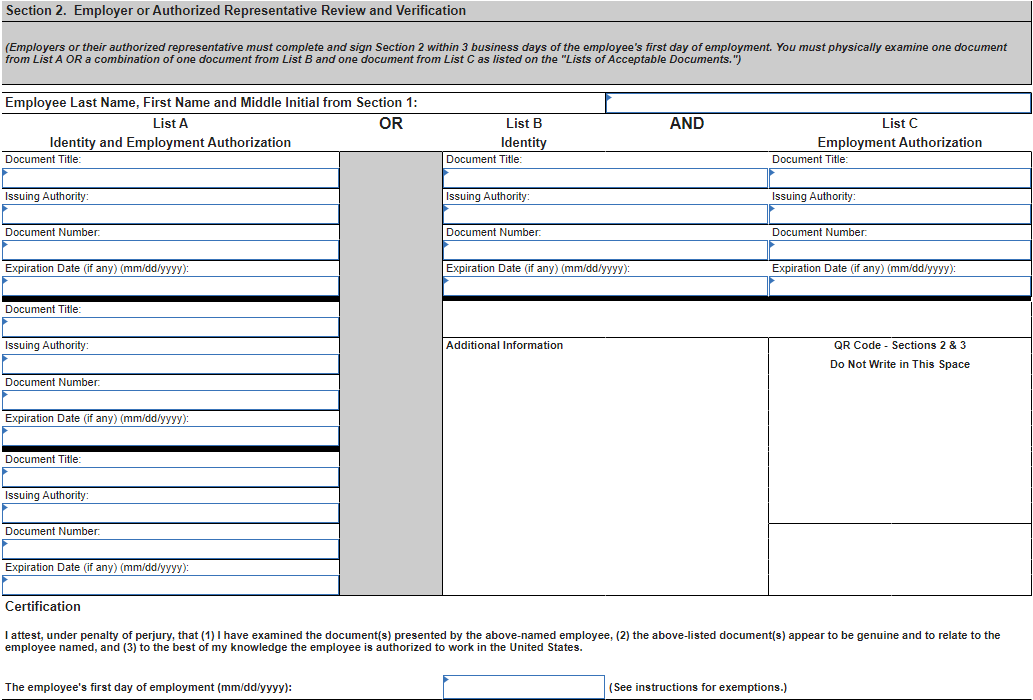

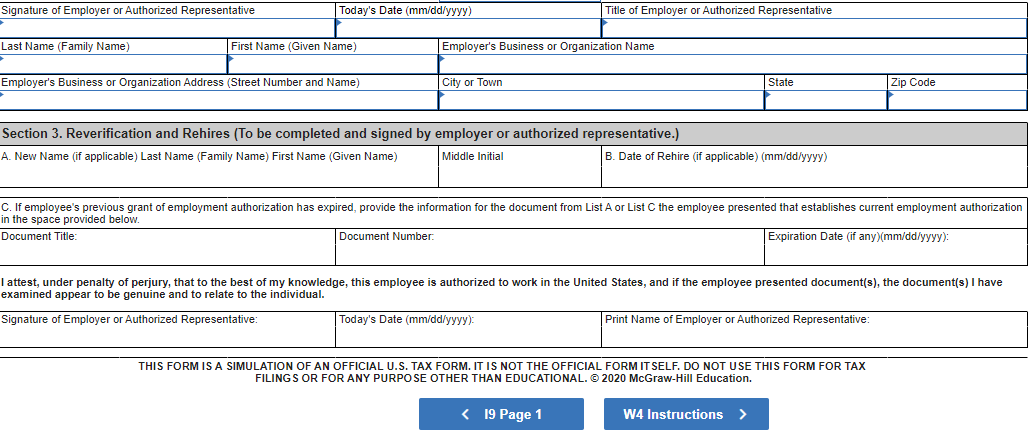

Signature of Employer or Authorized Representative Today's Date (mm/dd/yyyy) Title of Employer or Authorized Representative Last Name (Family Name) First Name (Given Name) Employer's Business or Organization Name Employer's Business or Organization Address (Street Number and Name) City or Town State Zip Code Section 3. Reverification and Rehires (To be completed and signed by employer or authorized representative.) A. New Name (if applicable) Last Name (Family Name) First Name (Given Name) Middle Initial B. Date of Rehire (if applicable) (mm/dd/yyyy) C. If employee's previous grant of employment authorization has expired, provide the information for the document from List A or List C the employee presented that establishes current employment authorization in the space provided below. Document Title: Document Number: Expiration Date (if any)(mm/dd/yyyy): I attest, under penalty of perjury, that to the best of my knowledge, this employee is authorized to work in the United States, and if the employee presented document(s), the document(s) I have examined appear to be genuine and to relate to the individual. Signature of Employer or Authorized Representative: Today's Date (mm/dd/yyyy): Print Name of Employer or Authorized Representative: THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2020 McGraw-Hill Education. Signature of Employer or Authorized Representative Today's Date (mm/dd/yyyy) Title of Employer or Authorized Representative Last Name (Family Name) First Name (Given Name) Employer's Business or Organization Name Employer's Business or Organization Address (Street Number and Name) City or Town State Zip Code Section 3. Reverification and Rehires (To be completed and signed by employer or authorized representative.) A. New Name (if applicable) Last Name (Family Name) First Name (Given Name) Middle Initial B. Date of Rehire (if applicable) (mm/dd/yyyy) C. If employee's previous grant of employment authorization has expired, provide the information for the document from List A or List C the employee presented that establishes current employment authorization in the space provided below. Document Title: Document Number: Expiration Date (if any)(mm/dd/yyyy): I attest, under penalty of perjury, that to the best of my knowledge, this employee is authorized to work in the United States, and if the employee presented document(s), the document(s) I have examined appear to be genuine and to relate to the individual. Signature of Employer or Authorized Representative: Today's Date (mm/dd/yyyy): Print Name of Employer or Authorized Representative: THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2020 McGraw-Hill Education.Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started