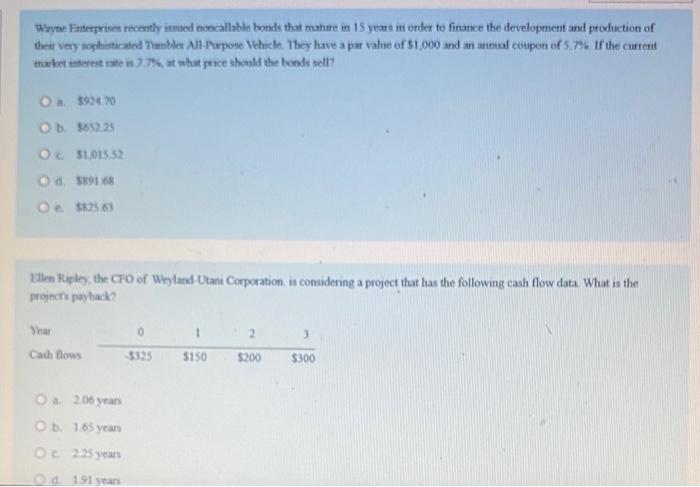

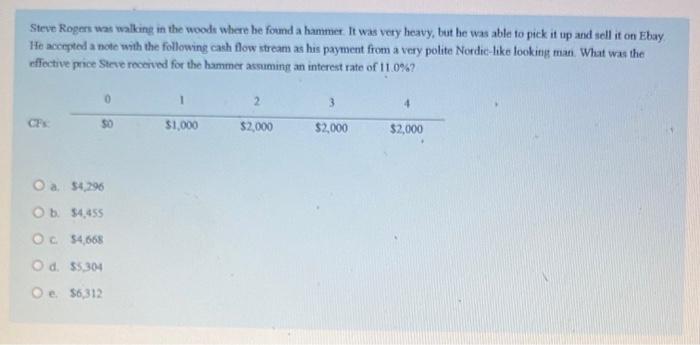

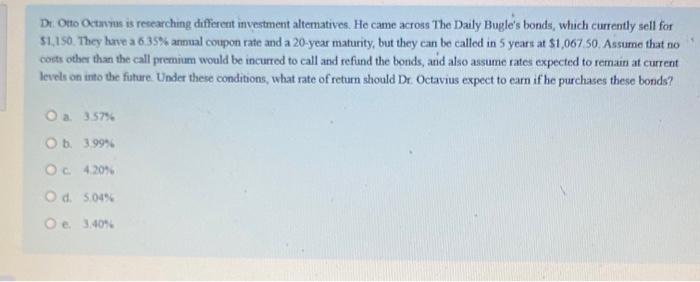

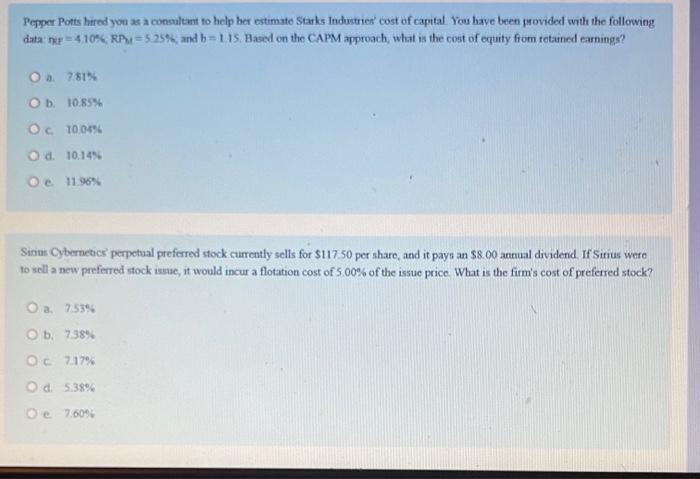

Wayo Fitrrmises recently issuod noncallablo bonds that mature in 15 years in order to finance the development and production of their very aghthiticated Tebble Ali-Purpose Vhicle They have a par value of 51,000 and an amnual coupon of 5.7% If the current maint intereat rate it 7.76 , at what proe should the bonds sell? a. 592470 b. 565225 c 51,015.52 d. 589168 e. 5725 6s Hen Rigley, the CFO of Weyland Utani Corporation. is considering a project that has the following cash flow data. What is the procth paytack? a. 206 years b. 1.65 years c 225 yeas d. 1.91 year Steve Rogers was walking in the woods where be found a hammer. It was very heavy, but he was able to pick it up and sell it on Ebay He accepted a note with the following cash flow stream as his payment from a very polite Nordic-like looking man. What was the effective price Stere rocerved for the hammer assuming an interest rate of 11.0% ? a. 54,296 b. 54,455 c. 54,668 d. 55304 e. $6,312 Dr. Onto Octarms is researching different investment altematives. He came across The Daily Bugle's bonds, which currently sell for 51,150. They have a 6.35% annual coupon rate and a 20-year maturity, but they can be called in 5 years at $1,067.50. Assume that no cots other than the call premium would be incurred to call and refund the bonds, and also assume rates expected to remain at current Ievels on imto the future. Under these conditions, what rate of return should Dr. Octavius expect to earn if he purchases these bonds? a. 3578 b. 399% c. 420% d. 5.04% e. 3.40% Pepper Potts hired you as a consultant to help ber estimate Starks Industries' cost of capital You have been provided with the following data ner =4.10%, RPM =5.25% and b=1.15. Based on the CAPM approach, what is the cost of equity from retarned earnings? a. 781% b. 10.85% c 10.04% d. 10.14% e. 1195% Sinus Cybernetics' perpetual preferred stock currently sells for $117.50 per share, and it pays an $8.00 annual dividend. If Sirrus were to sell a new preferred stock issue, it would incur a flotation cost of 5.00% of the issuc price. What is the firm's cost of preferred stock? a. 753% b. 738% C 7.17% d. 5.38% e. 7.60%