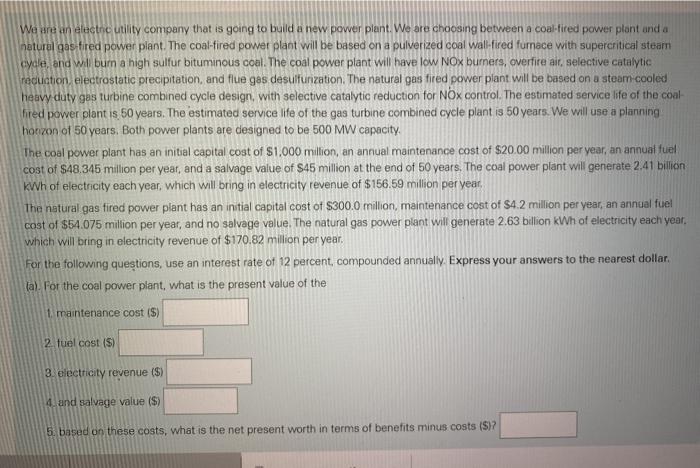

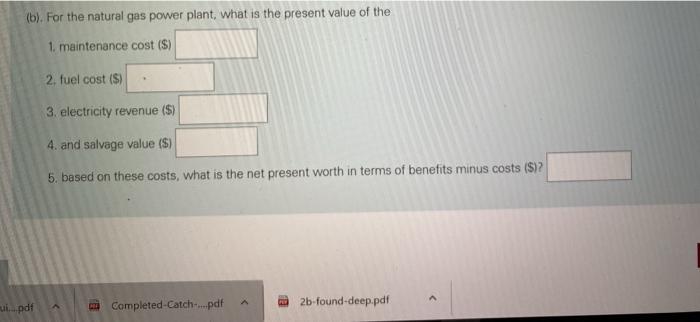

We are an electnc utility company that is going to build a new power plant. We are choosing between a coal-tired power plant and a natural gas tired power plant. The coal-fired power plant will be based on a pulverized coal wal-fired furnace with supercritical steam cycle, and will burn a high sulfur bituminous coal. The coal power plant will have low NOx burners, averfire air selective catalytic reduction, electrostatic precipitation, and flue gas desulfurization. The natural gas fired power plant will be based on a steam cooled heavy duty gas turbine combined cycle design, with selective catalytic reduction for NOx control. The estimated service life of the coal- fred power plant is 50 years. The estimated service life of the gas turbine combined cycle plant is 50 years. We will use a planning houzon of 50 years. Both power plants are designed to be 500 MW capacity The coal power plant has an initial capital cost of $1.000 million, an annual maintenance cost of $20.00 million per year, an annual fuel cost of $48.345 million per year, and a salvage value of $45 million at the end of 50 years. The coal power plant will generate 2.41 billion kWh of electricity each year, which will bring in electricity revenue of $156.59 million per year, The natural gas fired power plant has an initial capital cost of $300.0 million, maintenance cost of $42 million per year, an annual fuel cost of $54.075 million per year, and no salvage value. The natural gas power plant will generate 2.63 billion kWh of electricity each year, which will bring in electricity revenue of $170.82 million per year. For the following questions, use an interest rate of 12 percent, compounded annually. Express your answers to the nearest dollar, (a) For the coal power plant, what is the present value of the 1. maintenance cost ($) 2. fuel cost (5) 3. electricity revenue ($) 4. and salvage value ($) 5. based on these costs, what is the net present worth in terms of benefits minus costs ($)? (b). For the natural gas power plant, what is the present value of the 1. maintenance cost ($) 2. fuel cost ($) 3. electricity revenue ($) 4. and salvage value (5) 5. based on these costs, what is the net present worth in terms of benefits minus costs ($)? ui...pdf Completed-Catch-....pdf 2b-found-deep.pdf