Question

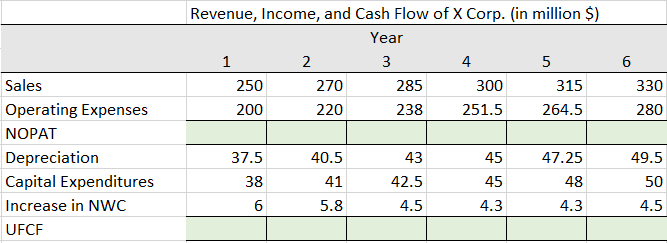

We are at the beginning of year 1 and we're looking at the forecasted sales, profits, and cash flows of X corporation from year 1

We are at the beginning of year 1 and we're looking at the forecasted sales, profits, and cash flows of X corporation from year 1 to year 6. At the beginning of year 1, the market value of X corp. debt = $400 million, and the outstanding shares are 600 thousand. The estimated WACC = 4% and the corporate tax = 40%

1. Calculate the NOPAT and the UFCF (unlevered free cash flow) for each year

2. Calculate the present value of the UFCF in each year

3. Estimations show that from year 7 to forever, the corporation's invested capital will grow at 1% per year, and the ROIC will grow at 6% per year. Based on this, what is the continuing enterprise value of the company evaluated at the end of year 6?

4. Based on the discounted cash flow method, calculate the stock price per share at the beginning of year 1

5. Calculate the invested capital at the end of each year from year 0 to year 6

6. Calculate the present value of MVA at the end of year 6 evaluated at the beginning of year 1

7. Using the EVA approach, what is the stock price per share at the beginning of year 1?

Revenue, Income, and Cash Flow of X Corp. (in million $) Year 1 2 3 4. 5 250 270 285 300 315 200 220 238 251.5 264.5 6 330 280 Sales Operating Expenses NOPAT Depreciation Capital Expenditures Increase in NWC UFCF 37.5 43 45 40.5 41 5.8 42.5 38 6 45 47.25 48 4.3 49.5 50 4.5 4.5 4.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started