Answered step by step

Verified Expert Solution

Question

1 Approved Answer

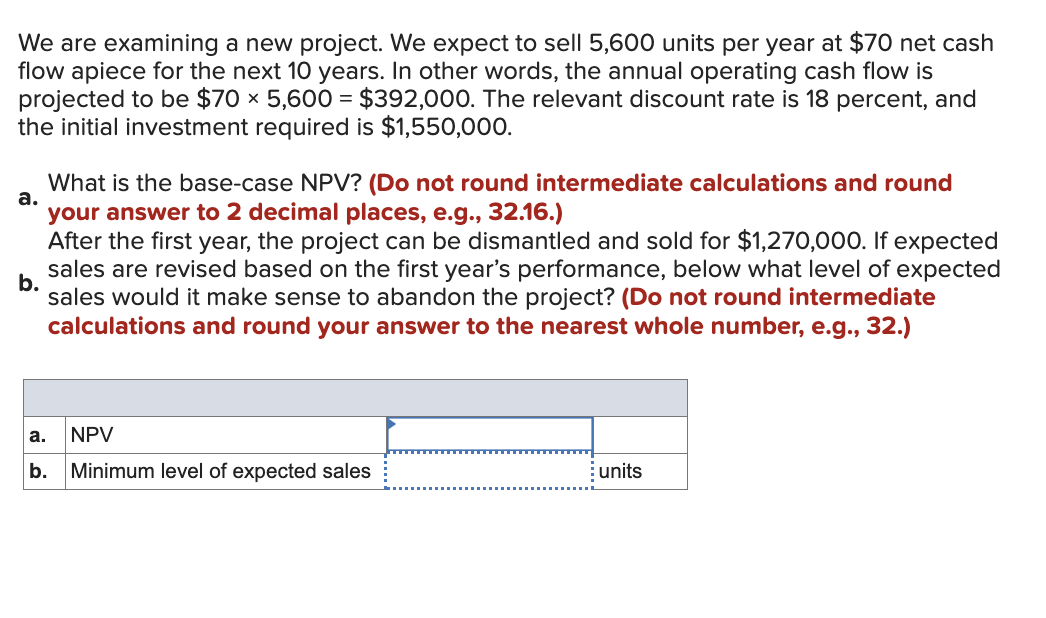

We are examining a new project. We expect to sell 5 , 6 0 0 units per year at $ 7 0 net cash flow

We are examining a new project. We expect to sell units per year at $ net cash

flow apiece for the next years. In other words, the annual operating cash flow is

projected to be $$ The relevant discount rate is percent, and

the initial investment required is $

a

What is the basecase NPVDo not round intermediate calculations and round

your answer to decimal places, eg

After the first year, the project can be dismantled and sold for $ If expected

b

sales are revised based on the first year's performance, below what level of expected

sales would it make sense to abandon the project? Do not round intermediate

calculations and round your answer to the nearest whole number, eg

a NPV

b Minimum level of expected sales

units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started