Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We Are Not All Alike Case 14 59 I should have asked about this at the interview. Oh well! I guess it's too late now.

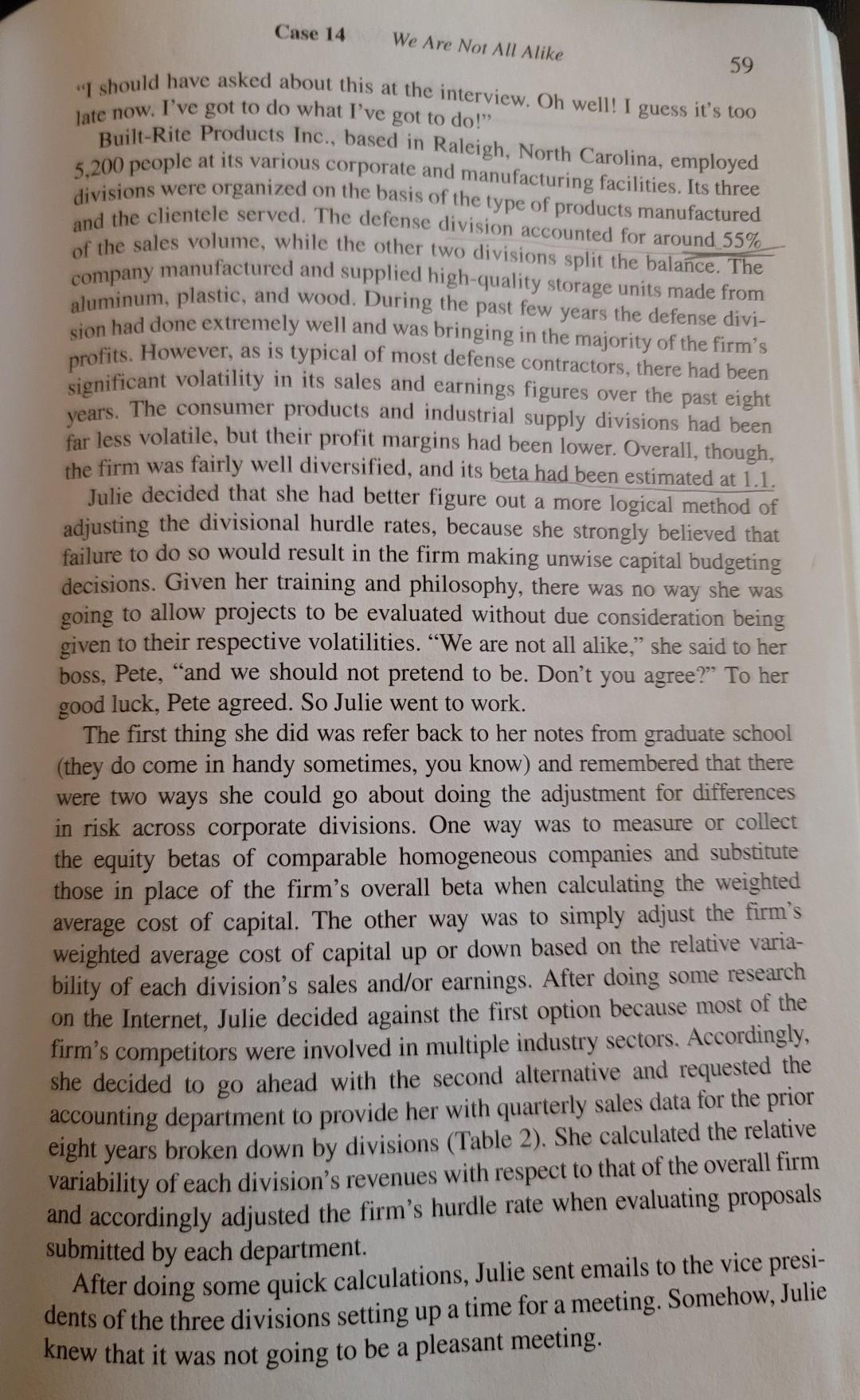

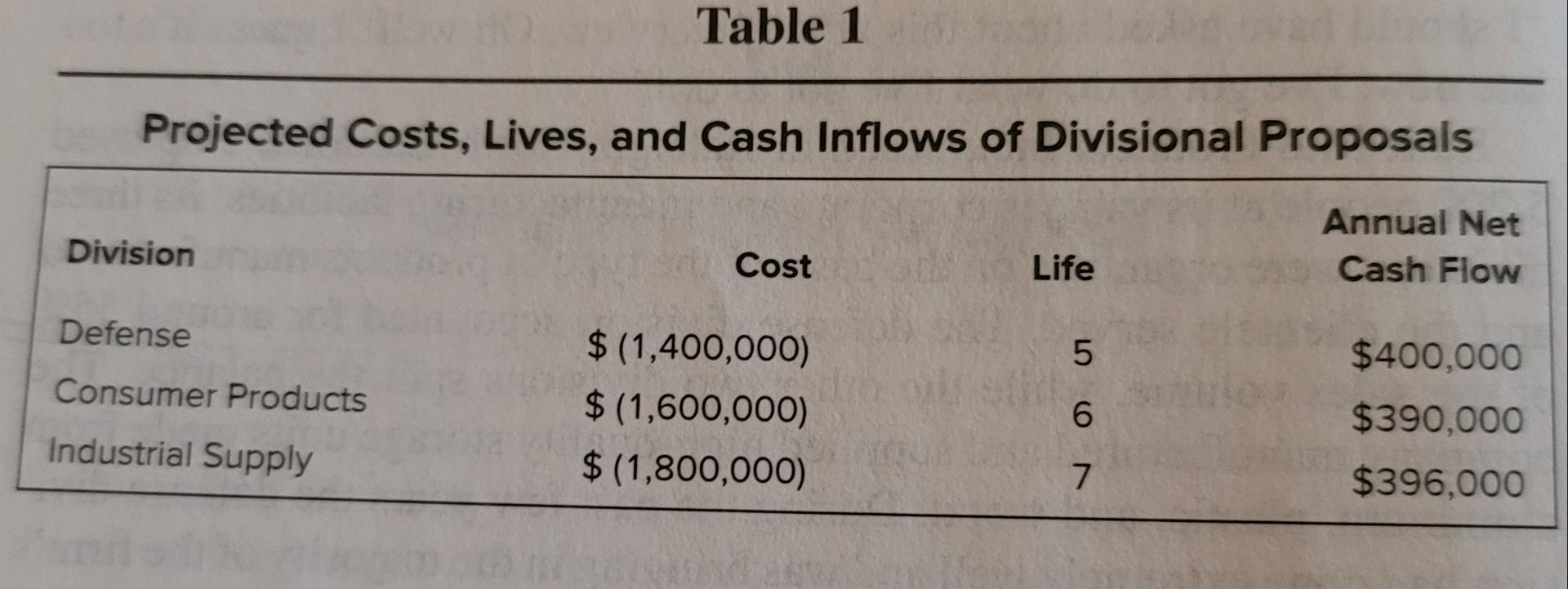

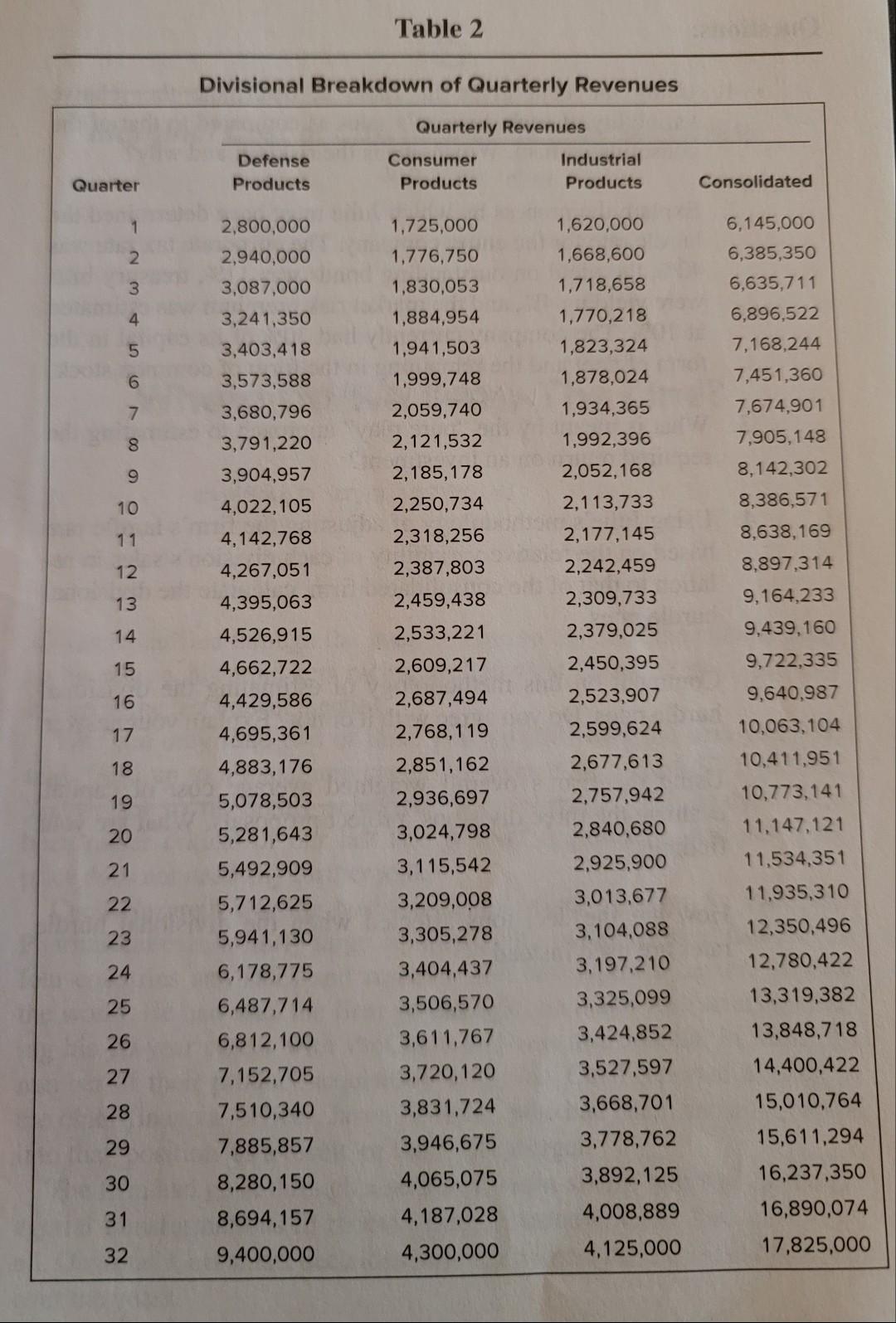

We Are Not All Alike Case 14 59 "I should have asked about this at the interview. Oh well! I guess it's too late now. I've got to do what I've got to do!" divisions were Built-Rite Products Inc., based in Raleigh, North Carolina, employed 5,200 people at its various corporate and manufacturing facilities. Its three organized on the basis of the type of products manufactured and the clientele served. The defense division accounted for around 55% of the sales volume, while the other two divisions split the balance. The company manufactured and supplied high-quality storage units made from aluminum, plastic, and wood. During the past few years the defense divi- sion had done extremely well and was bringing in the majority of the firm's profits. However, as is typical of most defense contractors, there had been significant volatility in its sales and earnings figures over the past eight years . The consumer products and industrial supply divisions had been far less volatile, but their profit margins had been lower. Overall, though, the firm was fairly well diversified, and its beta had been estimated at 1.1. Julie decided that she had better figure out a more logical method of adjusting the divisional hurdle rates, because she strongly believed that failure to do so would result in the firm making unwise capital budgeting decisions. Given her training and philosophy, there was no way she was going to allow projects to be evaluated without due consideration being given to their respective volatilities. We are not all alike," she said to her boss, Pete, "and we should not pretend to be. Don't you agree?" To her good luck, Pete agreed. So Julie went to work. The first thing she did was refer back to her notes from graduate school (they do come in handy sometimes, you know) and remembered that there were two ways she could go about doing the adjustment for differences in risk across corporate divisions. One way was to measure or collect the equity betas of comparable homogeneous companies and substitute those in place of the firm's overall beta when calculating the weighted average cost of capital. The other way was to simply adjust the firm's weighted average cost of capital up or down based on the relative varia- bility of each division's sales and/or earnings. After doing some research on the Internet, Julie decided against the first option because most of the firm's competitors were involved in multiple industry sectors. Accordingly, she decided to go ahead with the second alternative and requested the accounting department to provide her with quarterly sales data for the prior eight years broken down by divisions (Table 2). She calculated the relative variability of each division's revenues with respect to that of the overall firm and accordingly adjusted the firm's hurdle rate when evaluating proposals submitted by each department. After doing some quick calculations, Julie sent emails to the vice presi- dents of the three divisions setting up a time for a meeting. Somehow, Julie knew that it was not going to be a pleasant meeting. Table 1 Projected Costs, Lives, and Cash Inflows of Divisional Proposals Division Annual Net Cash Flow Cost Life Defense Consumer Products $(1,400,000) $(1,600,000) $(1,800,000) 0 07 $400,000 $390,000 $396,000 Industrial Supply 7 Table 2 Divisional Breakdown of Quarterly Revenues Defense Products Quarterly Revenues Consumer Industrial Products Products Quarter Consolidated W N 2,800,000 2,940,000 3,087,000 3,241,350 3,403,418 6,145,000 6,385,350 6,635,711 6,896,522 5 1,725,000 1,776,750 1,830,053 1,884,954 1,941,503 1,999,748 2,059,740 2,121,532 2,185,178 7,168,244 7,451,360 6 1,620,000 1,668,600 1,718,658 1,770,218 1,823,324 1,878,024 1,934,365 1,992,396 2,052,168 2,113,733 2,177,145 2,242,459 7 7,674,901 3,573,588 3,680,796 3,791,220 3,904,957 4,022, 105 8 9 10 11 4,142,768 12 4,267,051 2,250,734 2,318,256 2,387,803 2,459,438 2,533,221 7,905,148 8,142,302 8,386,571 8,638,169 8,897,314 9,164,233 9,439,160 9,722,335 9,640,987 10,063,104 13 4,395,063 2,309,733 14 2,379,025 15 2,609,217 2,450,395 16 2,687,494 2,523,907 17 2,768,119 18 2,851,162 10,411,951 10,773,141 19 11,147,121 20 11,534,351 21 11,935,310 22 23 4,526,915 4,662,722 4,429,586 4,695,361 4,883,176 5,078,503 5,281,643 5,492,909 5,712,625 5,941,130 6,178,775 6,487,714 6,812,100 7,152,705 7,510,340 7,885,857 8,280,150 8,694,157 9,400,000 24 2,599,624 2,677,613 2,757,942 2,840,680 2,925,900 3,013,677 3,104,088 3,197,210 3,325,099 3,424,852 3,527,597 3,668,701 3,778,762 3,892,125 4,008,889 4,125,000 2,936,697 3,024,798 3,115,542 3,209,008 3,305,278 3,404,437 3,506,570 3,611,767 3,720,120 3,831,724 3,946,675 4,065,075 4,187,028 4,300,000 25 26 27 12,350,496 12,780,422 13,319,382 13,848,718 14,400,422 15,010,764 15,611,294 16,237,350 16,890,074 17,825,000 28 29 30 31 32 7. How are the decisions affected when the divisional hurdle rates are used instead? We Are Not All Alike Case 14 59 "I should have asked about this at the interview. Oh well! I guess it's too late now. I've got to do what I've got to do!" divisions were Built-Rite Products Inc., based in Raleigh, North Carolina, employed 5,200 people at its various corporate and manufacturing facilities. Its three organized on the basis of the type of products manufactured and the clientele served. The defense division accounted for around 55% of the sales volume, while the other two divisions split the balance. The company manufactured and supplied high-quality storage units made from aluminum, plastic, and wood. During the past few years the defense divi- sion had done extremely well and was bringing in the majority of the firm's profits. However, as is typical of most defense contractors, there had been significant volatility in its sales and earnings figures over the past eight years . The consumer products and industrial supply divisions had been far less volatile, but their profit margins had been lower. Overall, though, the firm was fairly well diversified, and its beta had been estimated at 1.1. Julie decided that she had better figure out a more logical method of adjusting the divisional hurdle rates, because she strongly believed that failure to do so would result in the firm making unwise capital budgeting decisions. Given her training and philosophy, there was no way she was going to allow projects to be evaluated without due consideration being given to their respective volatilities. We are not all alike," she said to her boss, Pete, "and we should not pretend to be. Don't you agree?" To her good luck, Pete agreed. So Julie went to work. The first thing she did was refer back to her notes from graduate school (they do come in handy sometimes, you know) and remembered that there were two ways she could go about doing the adjustment for differences in risk across corporate divisions. One way was to measure or collect the equity betas of comparable homogeneous companies and substitute those in place of the firm's overall beta when calculating the weighted average cost of capital. The other way was to simply adjust the firm's weighted average cost of capital up or down based on the relative varia- bility of each division's sales and/or earnings. After doing some research on the Internet, Julie decided against the first option because most of the firm's competitors were involved in multiple industry sectors. Accordingly, she decided to go ahead with the second alternative and requested the accounting department to provide her with quarterly sales data for the prior eight years broken down by divisions (Table 2). She calculated the relative variability of each division's revenues with respect to that of the overall firm and accordingly adjusted the firm's hurdle rate when evaluating proposals submitted by each department. After doing some quick calculations, Julie sent emails to the vice presi- dents of the three divisions setting up a time for a meeting. Somehow, Julie knew that it was not going to be a pleasant meeting. Table 1 Projected Costs, Lives, and Cash Inflows of Divisional Proposals Division Annual Net Cash Flow Cost Life Defense Consumer Products $(1,400,000) $(1,600,000) $(1,800,000) 0 07 $400,000 $390,000 $396,000 Industrial Supply 7 Table 2 Divisional Breakdown of Quarterly Revenues Defense Products Quarterly Revenues Consumer Industrial Products Products Quarter Consolidated W N 2,800,000 2,940,000 3,087,000 3,241,350 3,403,418 6,145,000 6,385,350 6,635,711 6,896,522 5 1,725,000 1,776,750 1,830,053 1,884,954 1,941,503 1,999,748 2,059,740 2,121,532 2,185,178 7,168,244 7,451,360 6 1,620,000 1,668,600 1,718,658 1,770,218 1,823,324 1,878,024 1,934,365 1,992,396 2,052,168 2,113,733 2,177,145 2,242,459 7 7,674,901 3,573,588 3,680,796 3,791,220 3,904,957 4,022, 105 8 9 10 11 4,142,768 12 4,267,051 2,250,734 2,318,256 2,387,803 2,459,438 2,533,221 7,905,148 8,142,302 8,386,571 8,638,169 8,897,314 9,164,233 9,439,160 9,722,335 9,640,987 10,063,104 13 4,395,063 2,309,733 14 2,379,025 15 2,609,217 2,450,395 16 2,687,494 2,523,907 17 2,768,119 18 2,851,162 10,411,951 10,773,141 19 11,147,121 20 11,534,351 21 11,935,310 22 23 4,526,915 4,662,722 4,429,586 4,695,361 4,883,176 5,078,503 5,281,643 5,492,909 5,712,625 5,941,130 6,178,775 6,487,714 6,812,100 7,152,705 7,510,340 7,885,857 8,280,150 8,694,157 9,400,000 24 2,599,624 2,677,613 2,757,942 2,840,680 2,925,900 3,013,677 3,104,088 3,197,210 3,325,099 3,424,852 3,527,597 3,668,701 3,778,762 3,892,125 4,008,889 4,125,000 2,936,697 3,024,798 3,115,542 3,209,008 3,305,278 3,404,437 3,506,570 3,611,767 3,720,120 3,831,724 3,946,675 4,065,075 4,187,028 4,300,000 25 26 27 12,350,496 12,780,422 13,319,382 13,848,718 14,400,422 15,010,764 15,611,294 16,237,350 16,890,074 17,825,000 28 29 30 31 32 7. How are the decisions affected when the divisional hurdle rates are used instead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started