Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We are online jewelry company, called 99 jewelry. I need to calculate WACC. for rate of equity you can either use ROE for some other

We are online jewelry company, called 99 jewelry. I need to calculate WACC. for rate of equity you can either use ROE for some other similar company or CAPM (as we are not listed in the list pf companies with rate of equity). Here our some of our made up values.

Income statement

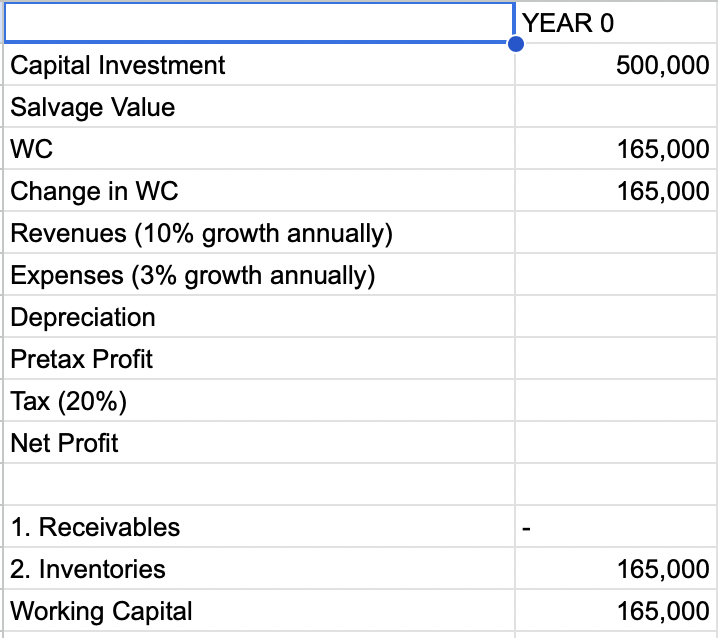

Could you please calculate WACC, Depreciation period, pretax profit, net profit and tax. If you need to make up some other value inorder to show this calculation please do so. The values are in Thai bhat. Please show working as and formulas too.

\begin{tabular}{|l|r|} \hline & YEAR 0 \\ \hline Capital Investment & 500,000 \\ \hline Salvage Value & \\ \hline WC & 165,000 \\ \hline Change in WC & 165,000 \\ \hline Revenues (10\% growth annually) & \\ \hline Expenses (3\% growth annually) & \\ \hline Depreciation & \\ \hline Pretax Profit & \\ \hline Tax (20\%) & \\ \hline Net Profit & \\ \hline & \\ \hline 1. Receivables & \\ \hline 2. Inventories & \\ \hline Working Capital & 165,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline & YEAR 0 \\ \hline Capital Investment & 500,000 \\ \hline Salvage Value & \\ \hline WC & 165,000 \\ \hline Change in WC & 165,000 \\ \hline Revenues (10\% growth annually) & \\ \hline Expenses (3\% growth annually) & \\ \hline Depreciation & \\ \hline Pretax Profit & \\ \hline Tax (20\%) & \\ \hline Net Profit & \\ \hline & \\ \hline 1. Receivables & \\ \hline 2. Inventories & \\ \hline Working Capital & 165,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started