Question

We are using the same numbers that we used for the previous problems. Please use the same file you used for the pay back problems

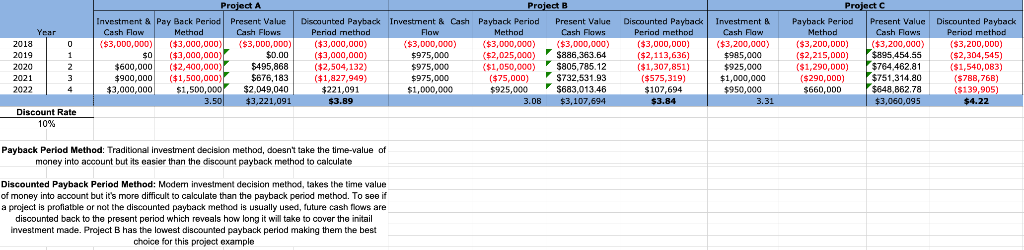

We are using the same numbers that we used for the previous problems. Please use the same file you used for the pay back problems and add a tab marked NPV. This time you will compare the projects using the NPV method. Please use a 10% discount rate.

(Just need this excel file showing "PayBack Period method" and "Discounted Payback Period method" updated with a column for "NPV" at a 10% discount rate)

To get full credit please do the following:

Define the technique.

Discuss the difference between this method and the others we have used so far.

Analyze the numbers in the problem using an excel spreadsheet.

Use a 10% discount rate.

You must use Excel formulas which are on the ribbon in Excel marked Fx to make your calculations whenever possible. Do not write your own formulas unless absolutely necessary.

All information must be in Excel (Word documents will not be read and you will not get credit).

Remember to carry out your answers at least two decimal places.

Add a new tab on your original excel file and submit this project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started