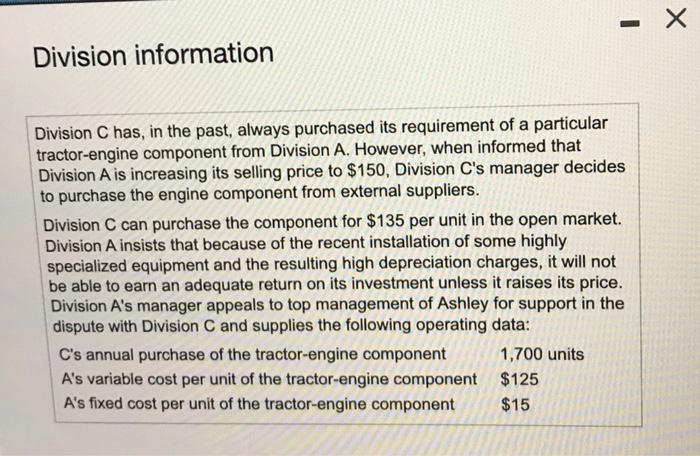

we Ashley Corporation, manulacturer of tractors and ofrer heavy tarm equipment, is organized akong decentralized product ilines, with each manufacturing division operating as a separate profit arte. Each divison manager has been delegated ful outhority on all deciaions imolving the sabe of that ditsion's output both to outsiders and to other divisions of Ashiey. iCick, the icon to viaw the inficernation on the divaiors.) Required 1. Assume that there are no ahernative uses for internal facilines of Division A. Determine Whether the company as a whole wal beneta if Division C purchases the component from oxtemal tuppiers for $135 per unit What ohould the transler price for the component be set at so that division manegers actirg in their own diveions besi interests take actions that are in the test imstest of the company as a whice? 2. Aseutre that internal facites of Division A would not otherwise be idle. By not producing the 1,700 unta for Divisicn C, Divinitn As epuipenent and other facilities would be issed for other poduction oferatons that would rewill in annual cash speratirg swirgs of $22,000. Should Dwison C purchase trom exdernal supplers? Shaw your computations 3. Aswame that there are no ahernative vises for Divisisn A's ittemal facities and that the prce berr outridera drope 515. Stoult Dirision O purchase trom excernal supplers? What should. De tarsier prioe for the corconont be tet at so that divieien manigers acting in their own dvikons beat intarests take actians thol are in fhe best interest of the corroary is a whole? Division information Division C has, in the past, always purchased its requirement of a particular tractor-engine component from Division A. However, when informed that Division A is increasing its selling price to $150, Division C's manager decides to purchase the engine component from external suppliers. Division C can purchase the component for $135 per unit in the open market. Division A insists that because of the recent installation of some highly specialized equipment and the resulting high depreciation charges, it will not be able to earn an adequate return on its investment unless it raises its price. Division A's manager appeals to top management of Ashley for support in the dispute with Division C and supplies the following operating data: C's annual purchase of the tractor-engine component 1,700 units A's variable cost per unit of the tractor-engine component $125 A's fixed cost per unit of the tractor-engine component $15 Division C has, in the past, aleays purchased its requirement of a parficutas trastor-engine component from Dwision A. However, when infoemes that Divaion A is insreasing As seling price to $150, Divivon C s manage seoites to putchase the engine comoonert frem axternal sucpliers. Dvision C can purchase the correonent for 5135 per unh in the open mathat. Divaion A nsists that because of the recerv ratalaton of some highly spedialzes equioment and the resulting tigh degreciation charges, it will rot be dable to sarn an adequale reluth on Ms investrent unless it raisess it poice. Division Als manager appeals to toe management of Ashley for wuppot in the dispule with Division C and supples the following oferating dats. Cis annual purchase of the vactor-engine component 1,700 unts A's veriatle cost per unt of the tractat-engine component $125 As tied cost per unt of the tractof-engine corrporent $15