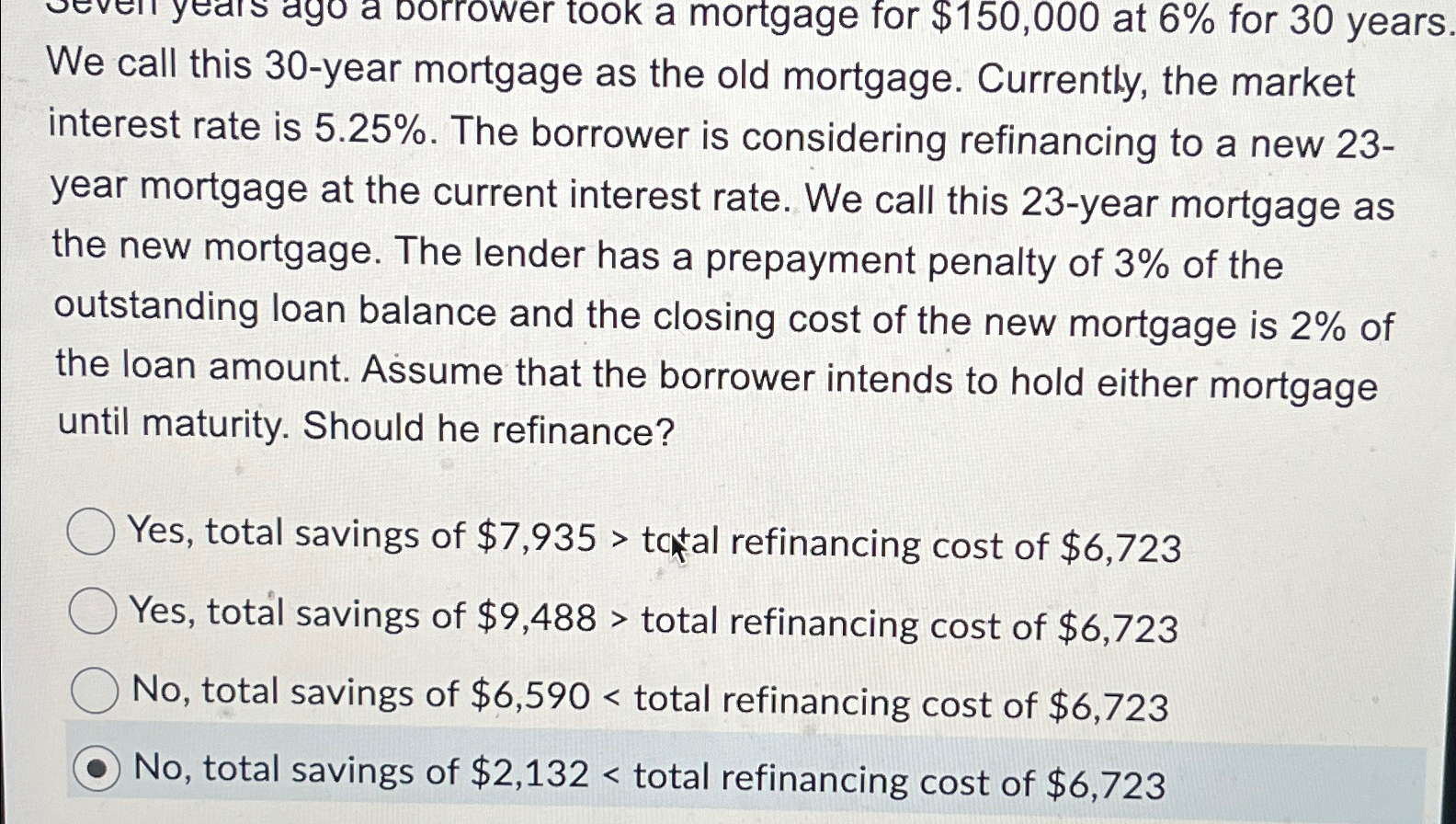

Question: We call this 3 0 - year mortgage as the old mortgage. Currently, the market interest rate is 5 . 2 5 % . The

We call this year mortgage as the old mortgage. Currently, the market interest rate is The borrower is considering refinancing to a new year mortgage at the current interest rate. We call this year mortgage as the new mortgage. The lender has a prepayment penalty of of the outstanding loan balance and the closing cost of the new mortgage is of the loan amount. Assume that the borrower intends to hold either mortgage until maturity. Should he refinance?

Yes, total savings of $ tatal refinancing cost of $

Yes, total savings of $ total refinancing cost of $

No total savings of $ total refinancing cost of $

No total savings of $ total refinancing cost of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock