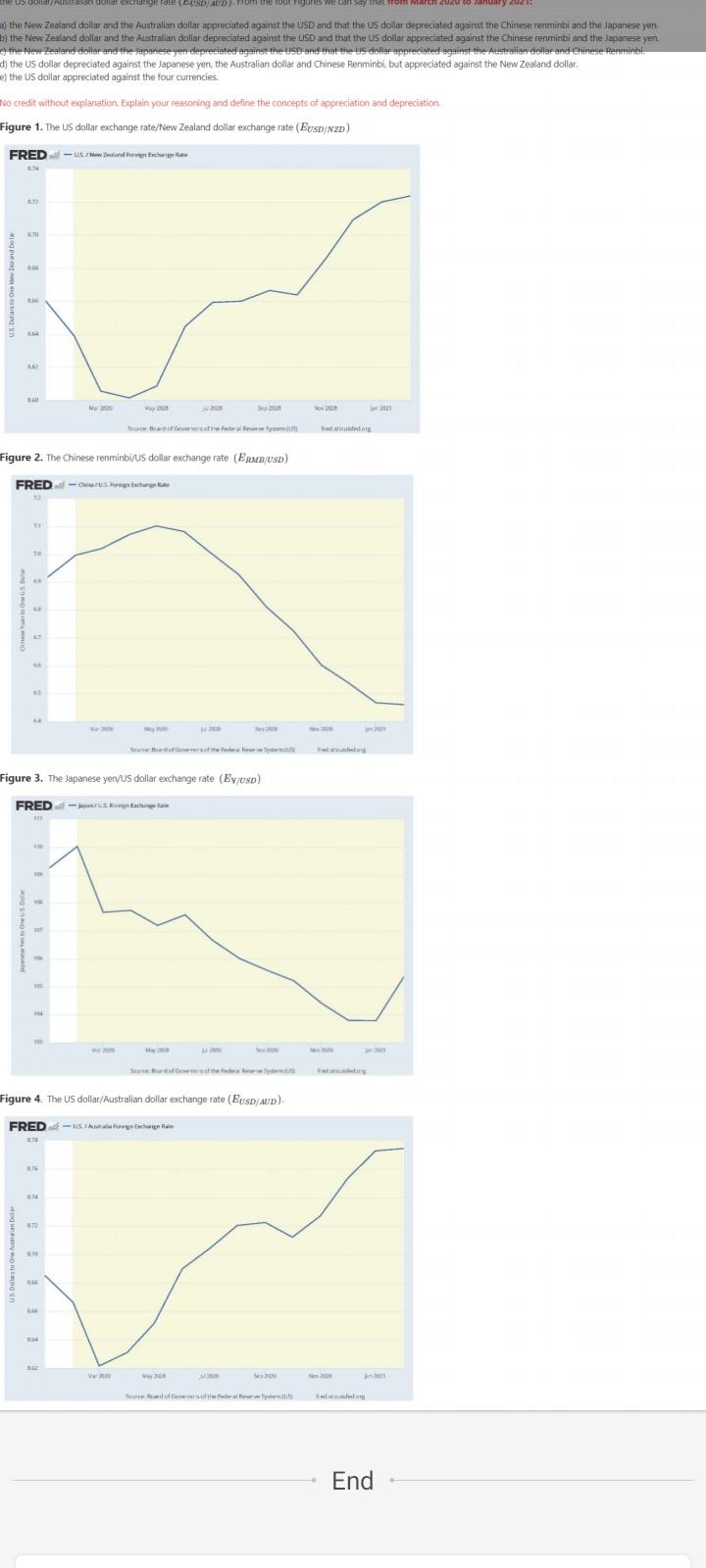

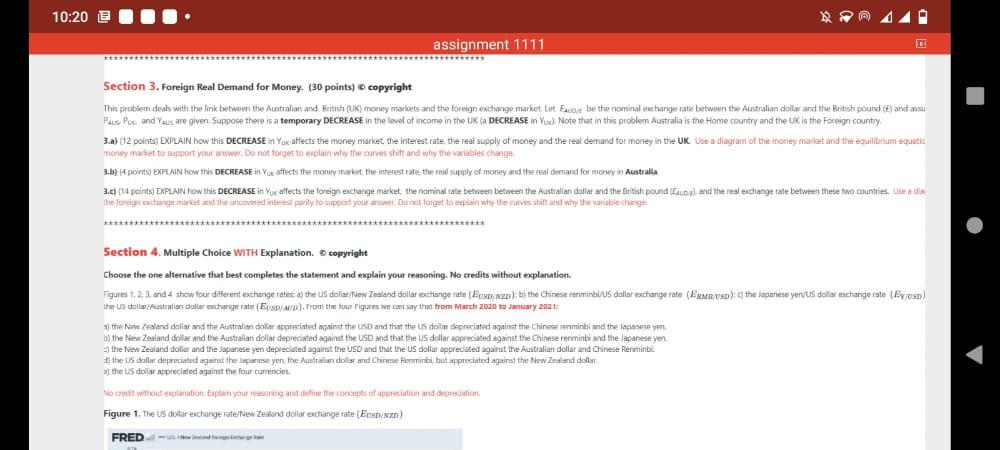

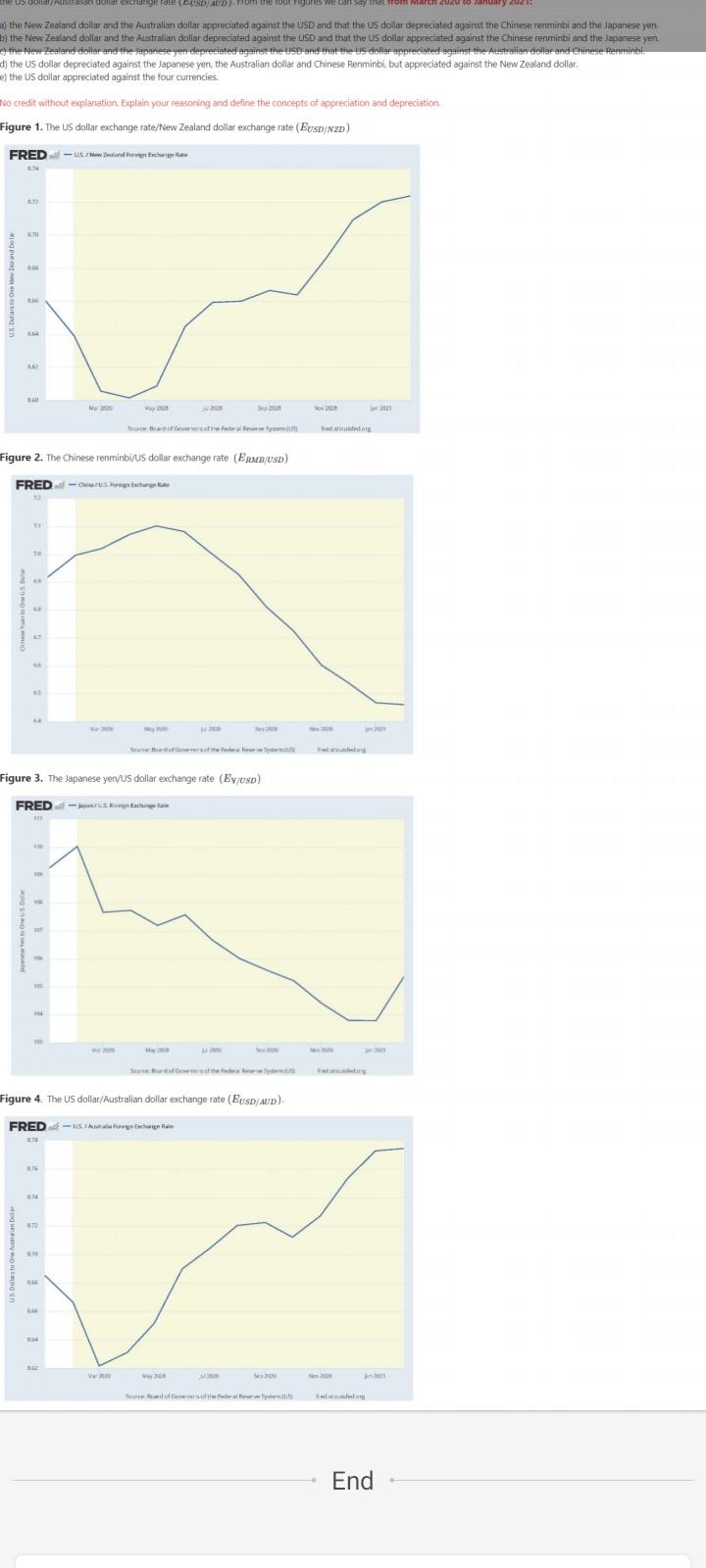

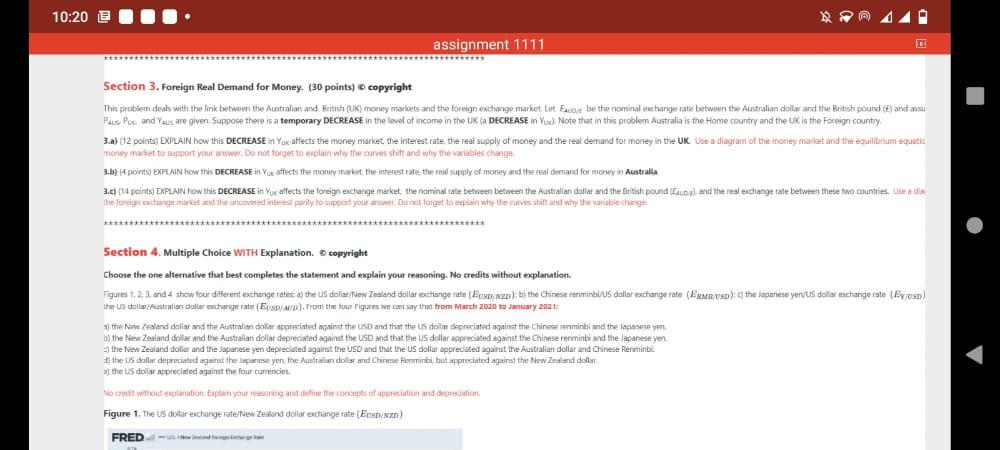

we can say that moment CUE cod/anton exchange rate OSAD). Fromm a) the New Zealand dollar and the Australian dollar appreciated against the USD and that the US dollar depreciated against the Chinese renminbi and the Japanese yen b) the New Zealand dollar and the Australian dollar depreciated against the USD and that the US dollar appreciated against the Chinese renminbi and the Japanese yen. the New Zealand dollar and the Japanese yen depreciated against the US and that the US dollar appreciated against the Australian dollar and Chinese Renminbi dy the US dollar depreciated against the Japanese yen, the Australian dollar and Chinese Renminbi, but appreciated against the New Zealand dollar, e) the US dollar appreciated against the four currencies. No credit without explanation Explain your reasoning and define the concepts of appreciation and depreciation Figure 1. The US dollar exchange rate/New Zealand dollar exchange rate (EUSD NZD) FRED-usw.dar stra Way w Souren Bidor Good Fedewydd Figure 2. The Chinese renminbius dollar exchange rate (ERMBUSD) FRED-Owustrechy + Figure 3. The Japanese yen/US dollar exchange rate (Ev/USD) FRED-Strum Figure 4. The US dollar/Australian dollar exchange rate (EUSD/MID). FRED-USA Foren us Oribes tu Che Multimele V VO html End 10:20 assignment 1111 Section 3. Foreign Real Demand for Money. (30 points) copyright This problem deals with the link between the Australian and British (UK) money markets and the foreign exchange market. Lat Eloy be the nominal change rate between the Australian dollar and the British Pound (E) and assu Paus Pue and You are given. Suppose there is a temporary DECREASE in the level of income in the UK a DECREASE in Y) Note that in this problem Australia is the Home country and the UK is the Foreign country 3.a) (12 points) EXPLAIN how this DECREASE in Yuc affects the money market the interest rate the real Supply of money and the real demand for money in the UK Use a diagram of the money marcat and the equilibrium equatic money market to support your answer. Do not forget to explain why the curves shift and way the variables change 1.b) (4 points) EXPLAIN how this DECREASE in Yux affects the money market the interest rate the real supply of money and the real demand for money in Australia 3.c) (14 points)DXPLAIN how this DECREASE in Yux affects the foreign exchange market the naminal rate between between the Australian dollar and the British pound and the real exchange rate between these two countries. We are the foreign exchange market and the need in parily to support your an. Dorot forget to spin why the cives stift and why the able change ***** Section 4. Multiple Choice WITH Explanation. copyright Choose the one alternative that best completes the statement and explain your reasoning. No credits without explanation Figures 1. 2. 3. and 4 show four different exchange rates the US dollar/ew Zealand dollar exchange rate (Bus), b) the Chinese renminbi US dollar exchange rate (EARD: the Japanese yervus dollar exchange rate (Byrox) the US dollar/Australian dollar exchange rate (ESD). From the lower Figures we can say that from March 2020 to January 2021 by the New Zealand dollar and the Australian dollar depreciated against the USD and that the US dollar appreciated against the Chinese Renminbi and the Japanese yen ( V the New Zealand dollar and the Japanese yen deprecated against the US and that the US dollar appreciated against the Australian dollar and Chinese Renminbi 1) the US dollar depreciated against the passeyen, the Australian dollar and Chinese Renminbi but appreciated against the New Zealand dollar of the US dollar appreciated against the four currencies No credit without explanation Explain your song and define the concepts of appreciation and direction Figure 1. The US dollar exchange rate/New Zealand dollar exchange rate (Eds NZD) FRED we can say that moment CUE cod/anton exchange rate OSAD). Fromm a) the New Zealand dollar and the Australian dollar appreciated against the USD and that the US dollar depreciated against the Chinese renminbi and the Japanese yen b) the New Zealand dollar and the Australian dollar depreciated against the USD and that the US dollar appreciated against the Chinese renminbi and the Japanese yen. the New Zealand dollar and the Japanese yen depreciated against the US and that the US dollar appreciated against the Australian dollar and Chinese Renminbi dy the US dollar depreciated against the Japanese yen, the Australian dollar and Chinese Renminbi, but appreciated against the New Zealand dollar, e) the US dollar appreciated against the four currencies. No credit without explanation Explain your reasoning and define the concepts of appreciation and depreciation Figure 1. The US dollar exchange rate/New Zealand dollar exchange rate (EUSD NZD) FRED-usw.dar stra Way w Souren Bidor Good Fedewydd Figure 2. The Chinese renminbius dollar exchange rate (ERMBUSD) FRED-Owustrechy + Figure 3. The Japanese yen/US dollar exchange rate (Ev/USD) FRED-Strum Figure 4. The US dollar/Australian dollar exchange rate (EUSD/MID). FRED-USA Foren us Oribes tu Che Multimele V VO html End 10:20 assignment 1111 Section 3. Foreign Real Demand for Money. (30 points) copyright This problem deals with the link between the Australian and British (UK) money markets and the foreign exchange market. Lat Eloy be the nominal change rate between the Australian dollar and the British Pound (E) and assu Paus Pue and You are given. Suppose there is a temporary DECREASE in the level of income in the UK a DECREASE in Y) Note that in this problem Australia is the Home country and the UK is the Foreign country 3.a) (12 points) EXPLAIN how this DECREASE in Yuc affects the money market the interest rate the real Supply of money and the real demand for money in the UK Use a diagram of the money marcat and the equilibrium equatic money market to support your answer. Do not forget to explain why the curves shift and way the variables change 1.b) (4 points) EXPLAIN how this DECREASE in Yux affects the money market the interest rate the real supply of money and the real demand for money in Australia 3.c) (14 points)DXPLAIN how this DECREASE in Yux affects the foreign exchange market the naminal rate between between the Australian dollar and the British pound and the real exchange rate between these two countries. We are the foreign exchange market and the need in parily to support your an. Dorot forget to spin why the cives stift and why the able change ***** Section 4. Multiple Choice WITH Explanation. copyright Choose the one alternative that best completes the statement and explain your reasoning. No credits without explanation Figures 1. 2. 3. and 4 show four different exchange rates the US dollar/ew Zealand dollar exchange rate (Bus), b) the Chinese renminbi US dollar exchange rate (EARD: the Japanese yervus dollar exchange rate (Byrox) the US dollar/Australian dollar exchange rate (ESD). From the lower Figures we can say that from March 2020 to January 2021 by the New Zealand dollar and the Australian dollar depreciated against the USD and that the US dollar appreciated against the Chinese Renminbi and the Japanese yen ( V the New Zealand dollar and the Japanese yen deprecated against the US and that the US dollar appreciated against the Australian dollar and Chinese Renminbi 1) the US dollar depreciated against the passeyen, the Australian dollar and Chinese Renminbi but appreciated against the New Zealand dollar of the US dollar appreciated against the four currencies No credit without explanation Explain your song and define the concepts of appreciation and direction Figure 1. The US dollar exchange rate/New Zealand dollar exchange rate (Eds NZD) FRED