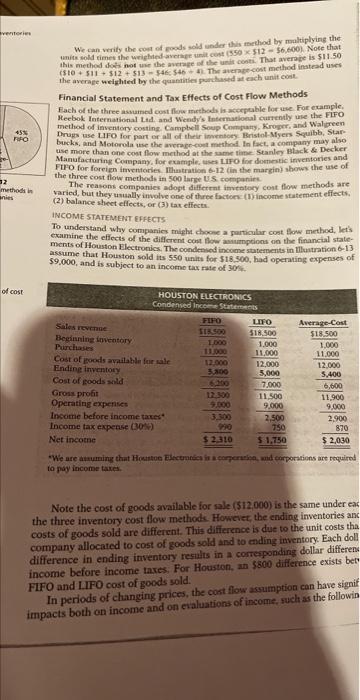

We can vrrily the coet of noods aold under this itsethod by maltiplying the wite sold times the weiplned averape unit cost (350512=56,600). Note that this meched dots not use the average of the unis conti. That averoie is $11.50 ($10+511+$12+$13546.546+4. The averate cost method inatead uses the average weighted by the quantities gorchased at each unit coit. Financial Statement and Tax Effects of Cost Flow Methods Each of the three amumed cost fluw methods is aceepeable tor we. For example: Meebol International Lat, and Wendy's lntemational eurrently use the FIFO method of inventory costing. Campleill Soes Compary, Kroper, and Waljeen Inrups use HIO for part of all of their imentoey. Bristol-Myers Sequibb, Starbucks, and Motorola ise the averape-eont meshos. In fact, a company may also use more than one cost flow method at the same time Stanloy Black \& Decker Manufacturing Coampany, for exampile, uses 1 ifo for dormentic inventories and FITO for foreign inventorles. Ihatration 612 (in the marein) shows the use of the three cost flow methods in 500 larse US. companies. The reasons companies adopt differrmt invetatory cost. flow methods are varied, but they unally involve one of three factoen (1)income statement effects. (2) balance shect elfects, or (3) tax effects. INCOME STAIEMENT EFFECTS To understand why companies might choose a particular cost. Sow method, lets examine the efiects of the diellerent cont flow asurnptions on the financial statements of Houston Electronics. The condensed incoene staternents in Illuatration 6-13 assume that Houston sold its 550 units for $18,500, had operating expenses of $9,000, and is subject to an incomo tas rate of 30 is. to pay income taxtes. Note the cost of goods available for sale (512,000) is the same under eak the three inventory cost flow method. Howevet, the cnding inventories anc costs of goods sold are differcnt. This difference is due to the unit costs tha company alloceted to cost of goods sold and to ending imventory. Each doll difference if cnding itnventofy reciats in 7 correfponding dollar differens income before income laxes, for Hotaston. an 5800 difference exists bet FIF O and I.IFO cost of goodes sold. In periods of changing prices, the cont flots assumption can have signif We can vrrily the coet of noods aold under this itsethod by maltiplying the wite sold times the weiplned averape unit cost (350512=56,600). Note that this meched dots not use the average of the unis conti. That averoie is $11.50 ($10+511+$12+$13546.546+4. The averate cost method inatead uses the average weighted by the quantities gorchased at each unit coit. Financial Statement and Tax Effects of Cost Flow Methods Each of the three amumed cost fluw methods is aceepeable tor we. For example: Meebol International Lat, and Wendy's lntemational eurrently use the FIFO method of inventory costing. Campleill Soes Compary, Kroper, and Waljeen Inrups use HIO for part of all of their imentoey. Bristol-Myers Sequibb, Starbucks, and Motorola ise the averape-eont meshos. In fact, a company may also use more than one cost flow method at the same time Stanloy Black \& Decker Manufacturing Coampany, for exampile, uses 1 ifo for dormentic inventories and FITO for foreign inventorles. Ihatration 612 (in the marein) shows the use of the three cost flow methods in 500 larse US. companies. The reasons companies adopt differrmt invetatory cost. flow methods are varied, but they unally involve one of three factoen (1)income statement effects. (2) balance shect elfects, or (3) tax effects. INCOME STAIEMENT EFFECTS To understand why companies might choose a particular cost. Sow method, lets examine the efiects of the diellerent cont flow asurnptions on the financial statements of Houston Electronics. The condensed incoene staternents in Illuatration 6-13 assume that Houston sold its 550 units for $18,500, had operating expenses of $9,000, and is subject to an incomo tas rate of 30 is. to pay income taxtes. Note the cost of goods available for sale (512,000) is the same under eak the three inventory cost flow method. Howevet, the cnding inventories anc costs of goods sold are differcnt. This difference is due to the unit costs tha company alloceted to cost of goods sold and to ending imventory. Each doll difference if cnding itnventofy reciats in 7 correfponding dollar differens income before income laxes, for Hotaston. an 5800 difference exists bet FIF O and I.IFO cost of goodes sold. In periods of changing prices, the cont flots assumption can have signif